Cornerstones of Financial Accounting

4th Edition

ISBN: 9781337690881

Author: Jay Rich, Jeff Jones

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Question

What is the amount of gross margin for this merchandise?

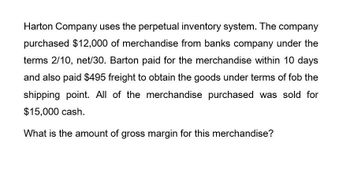

Transcribed Image Text:Harton Company uses the perpetual inventory system. The company

purchased $12,000 of merchandise from banks company under the

terms 2/10, net/30. Barton paid for the merchandise within 10 days

and also paid $495 freight to obtain the goods under terms of fob the

shipping point. All of the merchandise purchased was sold for

$15,000 cash.

What is the amount of gross margin for this merchandise?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Analyzing the Accounts Casey Company uses a perpetual inventory system and engaged in the following transactions: a. Made credit sales of $825,000. The cost of the merchandise sold was $560,000. b. Collected accounts receivable in the amount of $752,600. c. Purchased goods on credit in the amount of $574,300. d. Paid accounts payable in the amount of $536,200. Required: Prepare the journal entries necessary to record the transactions. Indicate whether each transaction increased cash, decreased cash, or had no effect on cash.arrow_forwardPrepare journal entries for the following sales and cash receipts transactions. (a) Merchandise is sold on account for 300 plus 3% sales tax, with 2/10, n/30 cash discount terms. (b) Part of the merchandise sold in transaction (a) for 70 plus sales tax is returned for credit. (c) The balance on account for the merchandise sold in transaction (a) is paid in cash within the discount period.arrow_forwardBallard Company uses the perpetual inventory system. The company purchased $8,700 of merchandise from Andes Company under the terms 4/10, net/30. Ballard paid for the merchandise within 10 days and also paid $320 freight to obtain the goods under terms FOB shipping point. All of the merchandise purchased was sold for $16,400 cash. What is the amount of gross margin for this merchandise?arrow_forward

- Hinds Company sold merchandise to Peter Company on account for $146,000 with credit terms of ?/10, n/30. The cost of the merchandise sold was $86,140. During the discount period, Peter Company returned $6,000 of merchandise and paid its account in full (minus the discount) by remitting $137,200 in cash. Both companies use a perpetual inventory system.Prepare the journal entries that Hinds Company made to record: (Credit account titles are automatically indented when the amount is entered. Do not indent manually. Record journal entries in the order presented in the problem.)(1) the sale of merchandise.(2) the return of merchandise.(3) the collection on account. Transaction Account Titles and Explanation Debit Credit 1. (To record credit sale.) (To record cost of good sold.) 2. (To record returned goods.)…arrow_forwardCumberland Co. sells $2,000 of merchandise to Hancock Co. for cash. Cumberland paid $1,250 for the merchandise. Under a perpetual inventory system, which of the following is the correct journal entry(ies)? a.debit Cash, $2,000; credit Merchandise Inventory, $2,000 b.debit Accounts Receivable, $2,000; credit Sales, $2,000; and debit Cost of Merchandise Sold, $1,250; credit Merchandise Inventory, $1,250 c.debit Cash, $1,250; credit Sales, $1,250 d.debit Cash, $2,000; credit Sales, $2,000; and debit Cost of Merchandise Sold, $1,250; credit Merchandise Inventory, $1,250arrow_forwardBell Corporation sold merchandise on account with a list price of $18,000 and a cost of $10,000. Payment terms were 1/10, n/30. Bell shipped the goods FOB destination and paid $600 in freight costs. Prior to payment of the invoice, the customer returned merchandise with a list price of $1,800 and a $1,000 cost. The customer paid the amount due within the discount period. What is Bell Corporation's net sales amount as a result of these transactions?arrow_forward

- GW sold merchandise to Mulligans for $10,000, offering term of 1/15, n/30. mulligans paid for the merchandise within the discount period. both companies use perpetual inventory system. I need a. Prepare the journal entries in the accounting records of GW to accounts for this sale and the subsequent collection. Assume the original cost of merchandise to GW had been $6,500 b. Prepare jurnal entire in the accounting records of mulligans accounts for the purchase and subsequent paymen.t Mulligans records purchase merchandise at net cost. c. Assume that, because of a change in personnel, Mulligans failed to pay for this mechandise within the discount period. prepare journal entry in the accounting records of Mulligans to record payment after the discount period.arrow_forwardsarrow_forwardAvila Co. sold $10,000 of merchandise to Beasley Corp. on account with terms of 1/10, n/30. The merchandise cost Avila $8,200. What is the entry to record the sale on Avila's books? Debit Accounts Receivable for $10,000; Credit Sales for $10,000; Debit Cost of Goods Sold for $8,200; Credit Inventory for $8,200 Debit Accounts Receivable for $10,000; Credit Inventory for $8,200; Credit Sales for $1,800 Debit Sales for $10,000; Credit Accounts Receivable for $10,000; Debit Inventory for $8,200; Credit Cost of Goods Sold for $8,200 Debit Sales for $9,900; Credit Accounts Receivable for $9,900; Debit Cost of Goods Sold for $8,200; Credit Inventory for $8,200arrow_forward

- Sampson Co. sold merchandise to Batson Co. on account, $46,000, terms 2/15, net 45. The cost of the merchandise sold is $38,500. Batson Co. paid the invoice within the discount period. Prepare the entries that both Sampson and Batson would record for the above. Assume both Sampson and Batson use a perpetual inventory system.arrow_forwardCumberland Co. sells $998 of inventory to Hancock Co. for cash. Cumberland paid $624 for the merchandise. Under a perpetual inventory system, which of the following journal entry(ies) would be recorded? Oa. debit Cash, $998; credit Merchandise Inventory, $624 Ob. debit Accounts Receivable, $998; credit Sales, $998; and debit Cost of Merchandise Sold, $624; credit Merchandise Inventory, $624 Oc. debit Cash, $998; credit Sales, $998; and debit Cost of Merchandise Sold, $624; credit Merchandise Inventory, $624 Od. debit Cash, $624; credit Sales, $624arrow_forwardArcher Co. completed the following transactions and uses a perpetual inventory system. Aug. 4 Sold $3,700 of merchandise on credit (that had cost $2,000) to McKenzie Carpenter, terms n∕10. 10 Sold $5,200 of merchandise (that had cost $2,800) to customers who used their Commerce Bank credit cards. Commerce charges a 3% fee. 11 Sold $1,250 of merchandise (that had cost $900) to customers who used their Goldman cards. Goldman charges a 2% fee. 14 Received Carpenter’s check in full payment for the August 4 purchase. 15 Sold $3,250 of merchandise (that had cost $1,758) to customers who used their Goldman cards. Goldman charges a 2% fee. 22 Wrote off the account of Craw Co. against the Allowance for Doubtful Accounts. The $498 balance in Craw Co.’s account was from a credit sale last year. Required Prepare journal entries to record the preceding transactions and events.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,

Cornerstones of Financial Accounting

Accounting

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:9781337794756

Author:HEINTZ, James A.

Publisher:Cengage Learning,