Principles of Accounting Volume 1

19th Edition

ISBN: 9781947172685

Author: OpenStax

Publisher: OpenStax College

expand_more

expand_more

format_list_bulleted

Question

Please provide answer this general accounting question

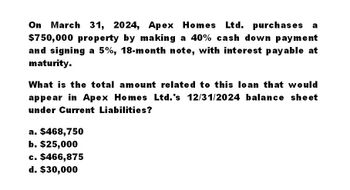

Transcribed Image Text:On March 31, 2024, Apex Homes Ltd. purchases a

$750,000 property by making a 40% cash down payment

and signing a 5%, 18-month note, with interest payable at

maturity.

What is the total amount related to this loan that would

appear in Apex Homes Ltd.'s 12/31/2024 balance sheet

under Current Liabilities?

a. $468,750

b. $25,000

c. $466,875

d. $30,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- On January 1, 2019, Park Company accepted a 36,000, non-interest-bearing, 3-year note from a major customer in exchange for used equipment. The equipment had originally cost Park 200,000 and had a book value of 20,000 on the date of the sale. At the 12% imputed interest rate for this type of loan, the present value of the note is 25,500 on January 1, 2019. Park uses the effective interest rate. What is the carrying value of the note receivable on Parks December 31, 2019, balance sheet? a. 28,560 b. 29,000 c. 32,500 d. 36,000arrow_forwardHamlet Corporation purchases computer equipment at a price of 100,000 on January 1, 2019, paying 40,000 down and agreeing to pay the balance in three 20.000 annual instalments beginning December 31, 2019. It is not possible to value either the equipment or the 60,000 note directly; how-ever, Hamlet's incremental borrowing rate is 12%. Required: 1. Prepare a schedule to compute the interest expense and discount amortization on the note. 2. Prepare all the journal entries for Hamlet to record the issuance of the note, each annual interest expense, and the three annual installment payments.arrow_forwardAll In Digital Bank granted a loan to a client on January 1, 2022. The interest on the loan is 10% payable annually starting December 31, 2022. The loan matures in three years on December 31, 2024. Pertinent information on the loan is provided below: Principal amount, P 1,000,000 Origination fee received from the borrower, P 55,200 Direct origination cost paid, P 30,770 Indirect origination cost paid, P 5,000 After considering the origination fee received from the borrower and the direct origination cost incurred, the effective rate on the loan is 11%. What is the carrying value of the loan receivable on December 31, 2023 in Megabank's accounting books?arrow_forward

- Need helparrow_forwardPlease help mearrow_forwardNational Bank granted a loan to borrower on January 1, 2021. The interest on the loan is 10% payable annually starting December 31, 2021. The loan matures in thee years on December 21, 2023. Principal amount 4,000,000Origination fee charges against the borrower 342,100Direct Origination Cost incurred 150,000 What is the carrying amount of the loan receivable on January 1, 2021? a. 4,000,000b. 3,807,900c. 4,150,000d. 3,657,900arrow_forward

- B. MATATAG Bank loaned P5,000,000 to a borrower on January 1, 2019. The term of the loan require principal payments of P1,000,000 each year for 5 years plus interest at 8%. The first principal and interest payment is due on January 1, 2020. The borrower made the required payments during 2020 and 2021. However, during 2021 the borrower began to experience financial difficulties, requiring the bank to reassess the collectability of the loan. On December 31, 2021, the bank has determined that the remaining principal payment will be collected as originally scheduled but the collection of the interest is unlikely. The bank did not accrue the interest on December 31, 2021. Present value of 1 at 8% 0.926 For one period For two periods For three periods 0.857 0.794 1. What is the impairment loss for 2021? а. 423,000 b. 217,000 c. 222,000 d. 0 2. What is the interest income for 2022? a. 126,160 b. 142,640 c. 240,000 d. 0 3. What is the carrying amount of the loan receivable on December 31,…arrow_forwardHow do I do this?arrow_forwardOn January 1, 2020, a bank have issued a 5-year term loan to a businessman. The following details of the loan are provided as follows: Principal: Interest rate per annum: Repayment structure: 5,000,000.00 16% Quarterly Instruction: Prepare the amortization table below. Q2 Q3 Q4 2024 Q1 Q2 Q3 Q4 Year Quarter Payment Beginning Balance 2020 Q1 Q2 Q3 Q4 2021 Q1 Q2 Q3 Q4 2022 Q1 Q2 Q3 Q4 2023 Q1 Interest Principal Balance 5,000,000.00arrow_forward

- please help me to solve this problemarrow_forwardCrane Company issues a 12%, 5-year mortgage note on January 1, 2025, to obtain financing for new equipment. Land is used as collateral for the note. The terms provide for semiannual installment payments of $47,300. Click here to view the factor table What are the cash proceeds received from the issuance of the note? (For calculation purposes, use 5 decimal places as displayed in the factor table provided. Round answer to 2 decimal places, e.g. 25.25.) Crane Company should receive $arrow_forwardCarla Vista Co. issues a 10%, 7-year mortgage note on January 1, 2022, to obtain financing for new equipment. Land is used as collateral for the note. The terms provide for semiannual installment payments of $50,000. Click here to view the factor table. (For calculation purposes, use 5 decimal places as displayed in the factor table provided.) What are the cash proceeds received from the issuance of the note? (Round answer to 2 decimal places, e.g. 25.25.) Carla Vista Co. should receive $ Carla Vista Co. issues a 10%, 7-year mortgage note on January 1, 2022, to obtain financing for new equipment. Land is used as collateral for the note. The terms provide for semiannual installment payments of $50,000. Click here to view the factor table. 3 (For calculation purposes, use 5 decimal places as displayed in the factor table provided.) What are the cash proceeds received from the issuance of the note? (Round answer to 2 decimal places, e.g. 25.25.) Carla Vista Co. should receive $arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

- Principles of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:9781947172685

Author:OpenStax

Publisher:OpenStax College

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:Cengage Learning