FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

thumb_up100%

Find out general account answer.

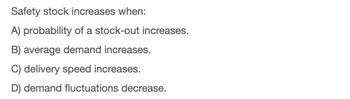

Transcribed Image Text:Safety stock increases when:

A) probability of a stock-out increases.

B) average demand increases.

C) delivery speed increases.

D) demand fluctuations decrease.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Which of the following will (holding everything else constant) cause the price earnings (P/E) ratio of a stock to decrease: The required return increases The risk-free rate decreases The stock's beta decreases The required return decreasesarrow_forwardA “random walk” occurs when:a. Stock price changes are random but predictable.b. Stock prices respond slowly to both new and old information.c. Future price changes are uncorrelated with past price changes.d. Past information is useful in predicting future prices.arrow_forwardAssume that the risk-free rate remains constant, but the market risk premium declines. Which of the following is most likely to occur? a. The required return on a stock with beta = 1.0 will not change. b. The required return on a stock with beta > 1.0 will increase. c. The return on "the market" will increase. d. The return on "the market" will remain constant. e. The required return on a stock with a positive beta < 1.0 will decline.arrow_forward

- Suppose you find that prices of stocks before large dividend increases show on average consistently positive abnormal returns. Is this a violation of the EMH?arrow_forwardOver time, the unexpected return on a company's stock is expected to equal Multiple Choice the company's average rate of return. the average return on the overall market. zero, the risk-free rate. the market risk premium.arrow_forwardA stock that has a negative beta tends to a. move up when the market as a whole moves down. b. move down when the market as a whole moves down. c. be volatile compared to the market as a whole. d. be stable compared to the market as a whole.arrow_forward

- If the intrinsic value of a stock is below the current market price, over time we can expect buy orders to exceed sell orders, causing the price to rise buy and sell orders to be evenly matched, keeping the price at its current level sell orders to exceed buy orders, causing the price to rise sell orders to exceed buy orders, causing the price to fall buy orders to exceed sell orders, causing the price to fallarrow_forwardIf a stock's expected return plots on or above the SML, then the stock's return is SML, the stock's return is to compensate the investor for risk. cent to compensate the investor for risk. If a stock's expected return plots below the The SML line can change due to expected Inflation and risk aversion. If inflation changes, then the SML plotted on a graph will shift up or down parallel to the old SML. If risk aversion changes, then the SML plotted on a graph will rotate up or down becoming more or less steep if investors become more or less risk averse. A firm can influence market risk (hence its beta coefficient) through changes in the composition of its assets and through changes in the amount of debt it uses. Quantitative Problem: You are given the following information for Wine and Cork Enterprises (WCE): Tar 4%; 10 % ; RPM 6%, and beta - 1.1 What is WCE's required rate of return? Do not round intermediate calculations. Round your answer to two decimal places. -75 % If inflation…arrow_forward1. Suppose stock A has a higher volatility than stock B. According to CAPM, which one is expected to deliver a higher return? A. A B. B C. The information provided is insufficient D. None of above is correctarrow_forward

- What does beta represent? Multiple Choice Beta is a measure of covariance standardized by the variance of the market. This adjusts the risk of the firm to be relative to the risk of the market. Beta is the extra income earned on an investment that cannot be explained by systematic risk or unsystematic risk. Beta is related to the return on risk-free assets. Beta is always positive or O, it cannot be negative because stock prices cannot be negative.arrow_forward1.Which of the following is assumed by the Black-Scholes-Merton model? A.The return from the stock in a short period of time is lognormal B.The stock price at a future time is lognormal C.The stock price at a future time is normal D.None of the abovearrow_forwardEvaluate the following statement: If the financial market is frictionless and complete, the asset with higher expected return also exhibits higher return volatility (i.e., standard deviation of returns).arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education