Cornerstones of Financial Accounting

4th Edition

ISBN: 9781337690881

Author: Jay Rich, Jeff Jones

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Question

How much was the 2014 net income?

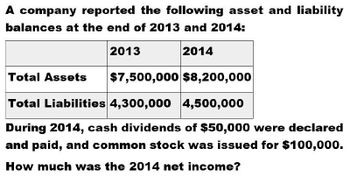

Transcribed Image Text:A company reported the following asset and liability

balances at the end of 2013 and 2014:

2013

2014

Total Assets

$7,500,000 $8,200,000

Total Liabilities 4,300,000 4,500,000

During 2014, cash dividends of $50,000 were declared

and paid, and common stock was issued for $100,000.

How much was the 2014 net income?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- The 2017 annual report of Tootsie Roll Industries contains the following information. (in millions) December 31, 2017 0000 December 31, 2016 Total assets $930.9 $920.1 Total liabilities 197.1 208.6 Net sales 515.7 517.4 Net income 80.7 67.2 Instructions Compute the following ratios for Tootsie Roll for 2017. a. Asset turnover. b. Return on assets. c. Profit margin on sales. d. How can the asset turnover be used to compute the return on assets?arrow_forwardAssume Nordstrom Inc. reports net income of $667 million for its fiscal year ended January 2016. At the beginning of that fiscal year, Nordstrom had $9,467 million in total assets. By fiscal year ended January 2016, total assets had decreased to $7,920 million. What is Nordstrom's ROA?arrow_forwardČardinal Industries had the following operating results for 2018: Sales = $34,621; Cost of goods sold Dividends paid = $2,023. At the beginning of the year, net fixed assets were $19,970, current assets were $7,075, and current liabilities were $4,01O. At the end of the year, net fixed assets were $24,529, current assets were $8,702, and current liabilities were $4,700. The tax rate for 2018 was 25 percent. $24,359; Depreciation expense = $6,027; Interest expense $2,725; %3D a. What is net income for 2018? (Do not round intermediate calculations.) b. What is the operating cash flow for 2018? (Do not round intermediate calculations.) c. What is the cash flow from assets for 2018? (Do not round intermediate calculations. A negative answer should be indicated by a minus sign.) d- If no new debt was issued during the year, what is the cash flow to creditors? (Do not 1. round intermediate calculations.) d- If no new debt was issued during the year, what is the cash flow to stockholders? (Do…arrow_forward

- Financial information for Powell Panther Corporation is shown below: Powell Panther Corporation: Income Statements for Year Ending December 31 (Millions of Dollars) 2018 2017 Sales $ 1,800.0 $ 1,500.0 Operating costs excluding depreciation and amortization 1,395.0 1,275.0 EBITDA $ 405.0 $ 225.0 Depreciation and amortization 43.0 39.0 Earnings before interest and taxes (EBIT) $ 362.0 $ 186.0 Interest 40.0 33.0 Earnings before taxes (EBT) $ 322.0 $ 153.0 Taxes (40%) 128.8 61.2 Net income $ 193.2 $ 91.8 Common dividends $ 174.0 $ 73.0 Powell Panther Corporation: Balance Sheets as of December 31 (Millions of Dollars) 2018 2017 Assets Cash and equivalents $ 23.0 $ 18.0 Accounts receivable 248.0 225.0 Inventories 396.0 360.0 Total current assets $ 667.0 $ 603.0 Net plant and equipment 429.0 390.0 Total assets $ 1,096.0 $ 993.0 Liabilities and Equity Accounts…arrow_forwardThe comparative statement of financial position for Cullumber Corporation shows the following noncash current asset and liability accounts at March 31: 2018 2017 Accounts receivable $61,000 $43,000 Inventory 70,000 64,000 Accounts payable 35,000 43,000 Dividends payable 1,400 2,300 Cullumber’s income statement reported the following selected information for the year ended March 31, 2018: net income was $280,000, depreciation expense was $60,000, and a loss on the disposal of land was $18,000. Cullumber uses a perpetual inventory system. Calculate net cash provided (used) by operating activities using the indirect method. (Show amounts that decrease cash flow with either a - sign e.g. -15,000 or in parenthesis e.g. (15,000).) CULLUMBER CORPORATIONStatement of Cash Flows (Partial)-Indirect Method Operating activities…arrow_forwardThe 2017 Annual Report of Tootsie Roll Industries contains the following information. (in millions) December 31, 2017 December 31, 2016 Total assets $930.9 $920.1 Total liabilities 197.1 208.6 Net sales 515.7 517.4 Net income 80.7 67.2 Compute the following ratios for Tootsie Roll for 2017. (a) Asset turnover (Round answer to 3 decimal places, e.g. 0.851 times.) enter the asset turnover rounded to 4 decimal places times (b) Return on assets (Round answer to 2 decimal places, e.g. 4.87%.) enter the return on assets in percentages rounded to 2 decimal places % (c) Profit margin on sales (Round answer to 2 decimal places, e.g. 4.87%.) enter the profit margin on sales in percentages rounded to 3 decimal places %arrow_forward

- What is the 2017 profit margin on this accounting question?arrow_forwardDetermine Profit Margin,Asset Turnover,Earnings Per Share,Price-Earning Ratios, Pay out ratio and Debt to asset ratio for 2016 and 2017 and explain briefly whether or not the company experiences improvement in the financial positon and operating for the period from 2016 to 2017.arrow_forwardPohio Corp. reported total assets of $500000, $400000, $370000 in the year 2016, 2015 and 2014 respectively. If 2015 is the base year, what is the percentage change for 2016? 45% 25% 35% 15%arrow_forward

- Calculate the following ratios: return on equity, return on assets (levered), return on sales (levered), asset turnover, and financial leverage.arrow_forwardThe following information was available for the year ended December 31, 2016: Sales $ 460,000 Net income 66,140 Average total assets 760,000 Average total stockholders' equity 365,000 Dividends per share 1.33 Earnings per share 3.00 Market price per share at year-end 27.60 a. Calculate margin, turnover, and ROI for the year ended December 31, 2016. (Round your intermediate calculations and final answers to 2 decimal places.) b. Calculate ROE for the year ended December 31, 2016. (Round your answer to 2 decimal places.) c. Calculate the price/earnings ratio for 2016. (Round your answer to 2 decimal places.) d. Calculate the dividend payout ratio for 2016. (Round your answer to 2 decimal places.) e. Calculate the dividend yield for 2016. (Round your answer to 2 decimal places.)arrow_forwardWhat is Nordstrom's return on assets for this accounting question?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:9781337514835

Author:MOYER

Publisher:CENGAGE LEARNING - CONSIGNMENT

Financial Accounting

Accounting

ISBN:9781305088436

Author:Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:Cengage Learning