EBK CONTEMPORARY FINANCIAL MANAGEMENT

14th Edition

ISBN: 9781337514835

Author: MOYER

Publisher: CENGAGE LEARNING - CONSIGNMENT

expand_more

expand_more

format_list_bulleted

Question

Please give me answer general accounting question

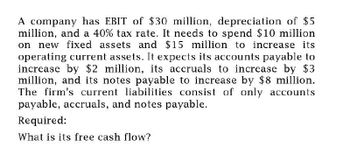

Transcribed Image Text:A company has EBIT of $30 million, depreciation of $5

million, and a 40% tax rate. It needs to spend $10 million

on new fixed assets and $15 million to increase its

operating current assets. It expects its accounts payable to

increase by $2 million, its accruals to increase by $3

million, and its notes payable to increase by $8 million.

The firm's current liabilities consist of only accounts

payable, accruals, and notes payable.

Required:

What is its free cash flow?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- A company has EBIT of $30 million, depreciation of $5 million, and a 40% tax rate. It needsto spend $10 million on new fixed assets and $15 million to increase its operating currentassets. It expects its accounts payable to increase by $2 million, its accruals to increase by$3 million, and its notes payable to increase by $8 million. The firm’s current liabilities consistof only accounts payable, accruals, and notes payable. What is its free cash flow?arrow_forwardWhat is its free cash flow?arrow_forwardHappy Time Inc. is expected to generate the following cash flows for the next year, as shown in the table below. Happy Time now only has one outstanding debt with a face value of $110 million to be repaid in the next year. The current market value for the debt is $67 million. The tax rate is zero. If you invest in the corporate debt of Happy Time Inc. today, what is your expected percentage return on this investment? Cash flow in the next year Economy Probability Amount Boom 0.3 Normal 0.4 Recession 0.3 O 36.87% O -26.37% 64.8% O-16.63% $110 million $101 million $61 millionarrow_forward

- Milton Industries expects free cash flows of $14 million each year. Milton's corporate tax rate is 21%, and its unlevered cost of capital is 14%. Milton also has outstanding debt of $25.57 million, and it expects to maintain this level of debt permanently. a. What is the value of Milton Industries without leverage? b. What is the value of Milton Industries with leverage? a. What is the value of Milton Industries without leverage? The value of Milton Industries without leverage is $ million. (Round to two decimal places.) b. What is the value of Milton Industries with leverage? The value of Milton Industries with leverage is $ million. (Round to two decimal places.)arrow_forwardMilton Industries expects free cash flow of $12 million each year. The corporate tax rate is 22 %, and its unlevered cost of equity is 12%. The firm also has outstanding debt of $40 million and it expects to maintain this amount permanently. What is the value of Milton Industries with leverage? a) 85, 973,333 b) 88, 573, 333 c) 89,646, 444 d) 90, 125, 564 What is the value of equity of Milton Industries with leverage? a) 76, 573, 333 b) 73,973,333 c) 77,646,444 d) 78, 125, 564arrow_forwardMarpor Industries has no debt and expects to generate free cash flows of $16.82 million each year. Marpor believes that if it permanently increases its level of debt to $35.60 million, the risk of financial distress may cause it to lose some customers and receive less favourable terms from its suppliers. As a result, Marpor's expected free cash flows with debt will be only $15.32 million per year. Suppose Marpor's tax rate is 25%, the risk-free rate is 6%, the expected return of the market is 12%, and the beta of Marpor's free cash flows is 1.10 (with or without leverage). a. Estimate Marpor's value without leverage. b. Estimate Marpor's value with the new leverage.arrow_forward

- Tool Manufacturing has an expected EBIT of $ 69,000 in perpetuity and a tax rate of 23 percent. The firm has $200,000 in outstanding debt at an interest rate of 4.5 percent, and its unlevered cost of capital is 10.4 percent. What is the value of the firm according to M&M Proposition I with taxes?arrow_forwardVijayarrow_forwardKohwe Corporation plans to finance a new investment with leverage. Kohwe Corporation plans to borrow $49.3 million to finance the new investment. The firm will pay interest only on this loan each year, and it will maintain an outstanding balance of $49.3 million on the loan. After making the investment, Kohwe expects to earn free cash flows of $10.7 million each year. However, due to reduced sales and other financial distress costs, Kohwe's expected free cash flows will decline to $9.7 million per year. Kohwe currently has 4.6 million shares outstanding, and it has no other assets or opportunities. Assume that the appropriate discount rate for Kohwe's future free cash flows is 7.9% and Kohwe's corporate tax rate is 40%. What is Kohwe's share price today given the financial distress costs of leverage? The price per share is $23.01 per share. (Round to the nearest cent.) Carrow_forward

- Nonearrow_forwardsarrow_forwardPeterson Packaging Corp. has $9 billion in total assets. The company's basic earning power (BEP) ratio is 9 percent, and its times interest earned ratio is 3.0. Peterson's depreciation and amortization expense totals $1 billion. It has $0.6 billion in lease payments and $0.3 billion must go towards principal payments on outstanding loans and long-term debt. What is Peterson's EBITDA coverage ratio?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:9781337514835

Author:MOYER

Publisher:CENGAGE LEARNING - CONSIGNMENT

Intermediate Financial Management (MindTap Course...

Finance

ISBN:9781337395083

Author:Eugene F. Brigham, Phillip R. Daves

Publisher:Cengage Learning