Century 21 Accounting General Journal

11th Edition

ISBN: 9781337680059

Author: Gilbertson

Publisher: Cengage

expand_more

expand_more

format_list_bulleted

Question

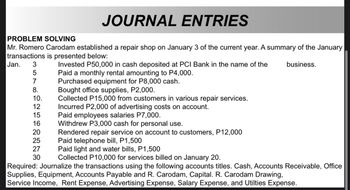

Transcribed Image Text:PROBLEM SOLVING

JOURNAL ENTRIES

Mr. Romero Carodam established a repair shop on January 3 of the current year. A summary of the January

transactions is presented below:

Jan. 3

5

7

8.

10.

12

15

16

NNNNO

20

25

27

30

Invested P50,000 in cash deposited at PCI Bank in the name of the

Paid a monthly rental amounting to P4,000.

Purchased equipment for P8,000 cash.

Bought office supplies, P2,000.

Collected P15,000 from customers in various repair services.

Incurred P2,000 of advertising costs on account.

Paid employees salaries P7,000.

Withdrew P3,000 cash for personal use.

Rendered repair service on account to customers, P12,000

Paid telephone bill, P1,500

Paid light and water bills, P1,500

Collected P10,000 for services billed on January 20.

business.

Required: Journalize the transactions using the following accounts titles. Cash, Accounts Receivable, Office

Supplies, Equipment, Accounts Payable and R. Carodam, Capital. R. Carodam Drawing,

Service Income, Rent Expense, Advertising Expense, Salary Expense, and Utilties Expense.

SAVE

AI-Generated Solution

info

AI-generated content may present inaccurate or offensive content that does not represent bartleby’s views.

Unlock instant AI solutions

Tap the button

to generate a solution

to generate a solution

Click the button to generate

a solution

a solution

Knowledge Booster

Similar questions

- Can you show me what the general ledgers would look like. I have them done just want to double check my workarrow_forwardCreate journal entries for sage 50. ? 1.The owner Jasmine, had the bank transfer (by the bank memo) $20000 from the personal savings account to the business bank account to start the business. 2. Negotiated a 5-year bank loan of $40000 at an annual interest rate of 9.50% with Loyal Bank. The money was deposited in the bank account today. 3.Received invoice 402 for $1200 plus HST from Captain Insurance, for a one-year business Insurance Policy, commencing Aug 1, 2018. Issued cheque #1001 to pay this invoice.arrow_forwardPlease provide journal entries for the following: 1. Deposited P900,000 in the bank and contributed a systems library valued at P390,000 to start a business.2. Paid office rent for the month, P36,000.3. Acquired computer equipment for cash, P700,000.4. Purchased computer supplies on credit, P60,000.5. Received payment from a client for programing done, P280,000.6. Billed a client on completion of a programming project, P71,000.7. Paid salaries, P80,000.8. Received a partial payment from the client billed, P61,000.9. Withdrew P25,000 for personal expenses.10. Made partial payment on the supplies purchased, P30,000arrow_forward

- Home Office put up a branch with initial investment of cash 400,000; and equipment180,000, and furniture & fixtures, 100,000, both to be booked in the branch. Requirements:a. Prepare the journal entries for both the Home Office and Branch books based on theabove transactions.arrow_forwardWould you provide me with an answer to this question please?arrow_forwardhi how do we record this in MYOB. Please help me Transactions from early January 2021 2 Obtained a loan of $14,000 from Uncle Oliver (a family relative of Beatrice Reed) at a simple interest rate of 10% per year, Cheque No. 145, ID #CR000001. The principal and interest on the loan are payable in six months time. 3 Received Cheque No. 227 from Pikea for the full amount outstanding on their account, ID #CR000002. 4 Issued Cheque No. 4098 for $10,065 to Mega Tech in payment of Purchase #303 (Supplier Inv#230). 4 Purchased 9 units MePod multimedia players from Pony at $979 each (includes 10% GST), Purchase #306, Supplier Inv#328. Issued Cheque No. 4099 for $3,900 to this supplier for this particular invoice at the time of the purchase. 4 Issued Cheque No. 4100 for $1,320 (includes 10% GST) to Discount Office Supplies for the cash purchase of office supplies. 6 Sold the following items on credit to Jerry Technology, Invoice #3284: 3 units BG90 plasma televisions for…arrow_forward

- need help with full working and steps thanks answer in text Listed below are selected transactions of Solution Department Store for the current year ending December 31. a. On December 5, the store received $500 from the Jackson Players as a deposit to be returned after certain furniture to be used in stage production was returned on January 15. b. During December, cash sales totaled $798,000, which includes the 5% sales tax that must be remitted to the state by the fifteenth day of the following month. c. On December 10, the store purchased for cash three delivery trucks for $120,000. The trucks were purchased in a state that applies a 5% sales tax. d. The store determined it will cost $100,000 to restore the area (considered a land improvement) surrounding one of its store parking lots, when the store is closed in 2 years. Solution’s estimates the fair value of the obligation at December 31 is $84,000. Required: Prepare all the journal entries necessary to record the…arrow_forwardQuestion: How would I record these in MYOB account right v19. can you please provide step by step instructions. Thanks It is now 7 January 2024 You find a note on your desk from Alonso instructing you to record a list of transactions that occurred during the first week of January as follows: Transactions from early January 2024 2 3 Obtained a loan of $16,000 from Uncle Sebastian (a family relative of Alonso Cohen) at a simple interest rate of 12% per year, Cheque No. 188, ID #CR000001. The principal and interest on the loan are payable in six months time. Issued Cheque No. 4005 for $9,328 to Big Telco in payment of Purchase #326 (Supplier Inv#253). 3 Received Cheque No. 249 from Hypertronics for the full amount outstanding on their account, ID #CR000002. 3 Issued Cheque No. 4006 for $1,980 (includes 10% GST) to Discount Office Supplies for the cash purchase of office supplies. 4 5 Purchased 7 units Tony ZIO MLP projectors from Pear Technology at $1,342 each (includes 10% GST), Purchase…arrow_forwardRecord each transaction in a journal entry. Explanations are not required.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

- Century 21 Accounting Multicolumn JournalAccountingISBN:9781337679503Author:GilbertsonPublisher:Cengage

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,Principles of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,Principles of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:9781337679503

Author:Gilbertson

Publisher:Cengage

College Accounting, Chapters 1-27

Accounting

ISBN:9781337794756

Author:HEINTZ, James A.

Publisher:Cengage Learning,

Principles of Accounting Volume 1

Accounting

ISBN:9781947172685

Author:OpenStax

Publisher:OpenStax College

Cornerstones of Financial Accounting

Accounting

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Cengage Learning