Managerial Accounting: The Cornerstone of Business Decision-Making

7th Edition

ISBN: 9781337115773

Author: Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Question

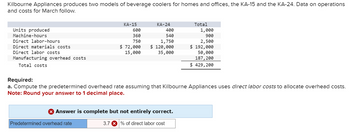

Kilbourne Appliances produces two models of beverage coolers for homes and offices, the KA-15 and the KA-24. Data on operations and costs for March follow.

KA-15 KA-24 Total

Units produced 600 400 1,000

Machine-hours 360 540 900

Direct labor-hours 750 1,750 2,500

Direct materials costs $ 72,000 $ 120,000 $ 192,000

Direct labor costs 15,000 35,000 50,000

Manufacturing

Total costs $ 429,200

Required:

a. Compute the predetermined overhead rate assuming that Kilbourne Appliances uses direct labor costs to allocate overhead costs.

Note: Round your answer to 1 decimal place.

Transcribed Image Text:Kilbourne Appliances produces two models of beverage coolers for homes and offices, the KA-15 and the KA-24. Data on operations

and costs for March follow.

Units produced

Machine-hours

Direct labor-hours

Direct materials costs

Direct labor costs

Manufacturing overhead costs

Total costs

KA-15

KA-24

Total

600

400

360

750

$ 72,000

540

1,750

$ 120,000

1,000

900

2,500

$ 192,000

15,000

35,000

50,000

187,200

$ 429,200

Required:

a. Compute the predetermined overhead rate assuming that Kilbourne Appliances uses direct labor costs to allocate overhead costs.

Note: Round your answer to 1 decimal place.

> Answer is complete but not entirely correct.

Predetermined overhead rate

3.7 % of direct labor cost

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Plata Company has identified the following overhead activities, costs, and activity drivers for the coming year: Plata produces two models of microwave ovens with the following activity demands: The companys normal activity is 21,000 machine hours. Calculate the total overhead cost that would be assigned to Model X using an activity-based costing system: a. 230,000 b. 240,000 c. 280,000 d. 190,000arrow_forwardWrappers Tape makes two products: Simple and Removable. It estimates it will produce 369,991 units of Simple and 146,100 of Removable, and the overhead for each of its cost pools is as follows: It has also estimated the activities for each cost driver as follows: Â How much is the overhead allocated to each unit of Simple and Removable?arrow_forwardCaseys Kitchens makes two types of food smokers: Gas and Electric. The company expects to manufacture 20,000 units of Gas smokers, which have a per-unit direct material cost of $15 and a per-unit direct labor cost of $25. k also expects to manufacture 50,000 units of Electric smokers, which have a per-unit material cost of $20 and a per-unit direct labor cost of $45. Historically, it has used the traditional allocation method and applied overhead at a rate of $125 per machine hour. It was determined that there were three cost pools, and the overhead for each cost pool is as follows: The cost driver for each cost pool and its expected activity is as follows: A. What is the per-unit cost for each product under the traditional allocation method? B. What is the per-unit cost for each product under ABC costing? C. Compared to ABC costing, was each products overhead under- or over applied? D. How much was overhead under- or over applied for each product?arrow_forward

- Steeler Towel Company estimates its overhead to be $250,000. It expects to have 100,000 direct labor hours costing $2,500,000 in labor and utilizing 12,500 machine hours. Calculate the predetermined overhead rate using: A. Direct labor hours B. Direct labor dollars C. Machine hoursarrow_forwardMedical Tape makes two products: Generic and Label. It estimates it will produce 423,694 units of Generic and 652,200 of Label, and the overhead for each of its cost pools is as follows: It has also estimated the activities for each cost driver as follows: How much is the overhead allocated to each unit of Generic and Label?arrow_forwardPetrillo Company produces engine parts for large motors. The company uses a standard cost system for production costing and control. The standard cost sheet for one of its higher volume products (a valve) is as follows: During the year, Petrillo had the following activity related to valve production: a. Production of valves totaled 20,600 units. b. A total of 135,400 pounds of direct materials was purchased at 5.36 per pound. c. There were 10,000 pounds of direct materials in beginning inventory (carried at 5.40 per pound). There was no ending inventory. d. The company used 36,500 direct labor hours at a total cost of 656,270. e. Actual fixed overhead totaled 110,000. f. Actual variable overhead totaled 168,000. Petrillo produces all of its valves in a single plant. Normal activity is 20,000 units per year. Standard overhead rates are computed based on normal activity measured in standard direct labor hours. Required: 1. Compute the direct materials price and usage variances. 2. Compute the direct labor rate and efficiency variances. 3. Compute overhead variances using a two-variance analysis. 4. Compute overhead variances using a four-variance analysis. 5. Assume that the purchasing agent for the valve plant purchased a lower-quality direct material from a new supplier. Would you recommend that the company continue to use this cheaper direct material? If so, what standards would likely need revision to reflect this decision? Assume that the end products quality is not significantly affected. 6. Prepare all possible journal entries (assuming a four-variance analysis of overhead variances).arrow_forward

- The following product Costs are available for Haworth Company on the production of chairs: direct materials, $15,500; direct labor, $22.000; manufacturing overhead, $16.500; selling expenses, $6,900; and administrative expenses, $15,200. What are the prime costs? What are the conversion costs? What is the total product cost? What is the total period cost? If 7,750 equivalent units are produced, what is the equivalent material cost per unit? If 22,000 equivalent units are produced, what is the equivalent conversion cost per unit?arrow_forwardKilbourne Appliances produces two models of beverage coolers for homes and offices, the KA-15 and the KA-24. Data on operations and costs for March follow. Units produced Machine-hours Direct labor-hours Direct materials costs Direct labor costs Manufacturing overhead costs Total costs Required: KA-15 a. Predetermined overhead rate b. Predetermined overhead rate 672 360 750 $ 74,400 15,000 KA-24 448 540 1,750 $ 126,000 35,000 Total a. Compute the predetermined overhead rate assuming that Kilbourne Appliances uses direct labor-hours to allocate overhead costs. Note: Round your answer to 2 decimal places. b. Compute the predetermined overhead rate assuming that Kilbourne Appliances uses machine-hours to allocate overhead costs. per direct labor-hour per machine-hour 1,120 900 2,500 $ 200,400 50,000 198,000 $ 448,400arrow_forwardKilbourne Appliances produces two models of beverage coolers for homes and offices, the KA-15 and the KA-24. Data on operations and costs for March follow. Units produced Machine-hours Direct labor-hours Direct materials costs Direct labor costs Manufacturing overhead costs. Total costs KA-15 a. Predetermined overhead rate Predetermined overhead rate 612 360 750 $ 72,400 15,000 KA-24 408 540 1,750 $ 121,000 35,000 Required: a. Compute the predetermined overhead rate assuming that Kilbourne Appliances uses direct labor-hours to allocate overhead costs. Note: Round your answer to 2 decimal places. b. Compute the predetermined overhead rate assuming that Kilbourne Appliances uses machine-hours to allocate overhead costs. Total 1,020 900 2,500 $ 193,400 50,000 189,000 $ 432,400 per direct labor-hour per machine-hourarrow_forward

- Dengerarrow_forwardKilbourne Appliances produces two models of beverage coolers for homes and offices, the KA-15 and the KA-24. Data on operations and costs for March follow. Units produced Machine-hours Direct labor-hours Direct materials costs Direct labor costs Manufacturing overhead costs Total costs Required A Required B Required C Product costs per unit KA-15 Required: a. Compute the individual product costs per unit assuming that Kilbourne Appliances uses the number of units to allocate overhead to the products. b. Compute the individual product costs per unit assuming that Kilbourne Appliances uses direct labor cost. c. Compute the individual product costs per unit assuming that Kilbourne Appliances uses direct material costs to allocate overhead to the products. KA-15 600 360 750 $ 82,000 16,500 KA-24 KA-24 400 540 1,750 $ 130,000 38,500 Compute the individual product costs per unit assuming that Kilbourne Appliances uses the number of units to allocate overhead to the products. Note: Do not…arrow_forwardTiger Furnishings produces two models of cabinets for home theater components, the Basic and the Dominator. Data on operations and costs for March follow: Basic Dominator Total Units produced 1,050 450 1,500 Machine-hours 3,800 1,800 5,600 Direct labor-hours 3,600 1,500 5,100 Direct materials costs $ 11,400 $ 3,400 $ 14,800 Direct labor costs $ 73,800 $39,800 $ 113,600 Manufacturing overhead costs $ 181,764 Total costs $ 310,164 Required: Compute the predetermined overhead rate assuming that Tiger Furnishings uses direct labor costs to allocate overhead costs. (Round your answer to 2 decimal places.)arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Managerial Accounting: The Cornerstone of Busines...

Accounting

ISBN:9781337115773

Author:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...

Accounting

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:9781947172609

Author:OpenStax

Publisher:OpenStax College