Individual Income Taxes

43rd Edition

ISBN: 9780357109731

Author: Hoffman

Publisher: CENGAGE LEARNING - CONSIGNMENT

expand_more

expand_more

format_list_bulleted

Question

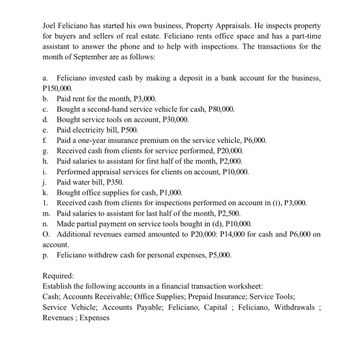

Transcribed Image Text:Joel Feliciano has started his own business, Property Appraisals. He inspects property

for buyers and sellers of real estate. Feliciano rents office space and has a part-time

assistant to answer the phone and to help with inspections. The transactions for the

month of September are as follows:

a.

Feliciano invested cash by making a deposit in a bank account for the business,

P150,000.

b.

Paid rent for the month, P3,000.

C. Bought a second-hand service vehicle for cash, P80,000.

d. Bought service tools on account, P30,000.

e.

Paid electricity bill, P500.

f.

g.

h.

i.

j.

Paid a one-year insurance premium on the service vehicle, P6,000.

Received cash from clients for service performed, P20,000.

Paid salaries to assistant for first half of the month, P2,000.

Performed appraisal services for clients on account, P10,000.

Paid water bill, P350.

k. Bought office supplies for cash, P1,000.

1.

Received cash from clients for inspections performed on account in (i), P3,000.

m. Paid salaries to assistant for last half of the month, P2,500.

n. Made partial payment on service tools bought in (d), P10,000.

O. Additional revenues earned amounted to P20,000: P14,000 for cash and P6,000 on

account.

p.

Feliciano withdrew cash for personal expenses, P5,000.

Required:

Establish the following accounts in a financial transaction worksheet:

Cash; Accounts Receivable; Office Supplies; Prepaid Insurance; Service Tools;

Service Vehicle; Accounts Payable; Feliciano, Capital; Feliciano, Withdrawals ;

Revenues; Expenses

SAVE

AI-Generated Solution

info

AI-generated content may present inaccurate or offensive content that does not represent bartleby’s views.

Unlock instant AI solutions

Tap the button

to generate a solution

to generate a solution

Click the button to generate

a solution

a solution

Knowledge Booster

Similar questions

- Blue Company, an architectural firm, has a bookkeeper who maintains a cash receipts and disbursements journal. At the end of the year (2019), the company hires you to convert the cash receipts and disbursements into accrual basis revenues and expenses. The total cash receipts are summarized as follows. The accounts receivable from customers at the end of the year are 120,000. You note that the accounts receivable at the beginning of the year were 190,000. The cash sales included 30,000 of prepayments for services to be provided over the period January 1, 2019, through December 31, 2021. a. Compute the companys accrual basis gross income for 2019. b. Would you recommend that Blue use the cash method or the accrual method? Why? c. The company does not maintain an allowance for uncollectible accounts. Would you recommend that such an allowance be established for tax purposes? Explain.arrow_forwardRay, the owner of a small company, asked Holmes, CPA, to conduct an audit of the company’s records. Ray told Holmes that the audit must be completed in time to submit audited financial statements to a bank as part of a loan application. Holmes immediately accepted the engagement and agreed to provide an auditor’s report within three weeks. Ray agreed to pay Holmes a fixed fee plus a bonus if the loan was granted. Holmes hired two accounting students to conduct the audit and spent several hours telling them exactly what to do. Holmes told the students not to spend time reviewing the controls but to concentrate on proving the mathematical accuracy of the ledger accounts and to summarize the data in the accounting records that support Ray’s financial statements. The students followed Holmes’ instructions and after two weeks gave Holmes the financial statements, which did not include footnotes because the company did not have any unusual transactions. Holmes reviewed the statements and prepared an unqualified auditor’s report. The report, however, did not refer to GAAP or to the year-to-year application of such principles. Briefly describe each of the ten standards included in the PCAOB guidance and indicate how the action(s) of Holmes resulted in a failure to comply with each standard.arrow_forwardJournalize the following: 1. On the books & records of Company A: On May 2nd, Company A received $100 of interest income from the bank earned in April. If the books are on an accrual basis, record the entry in April and in May when cash was received April May 2. On the books & records of Company A: In January, Company A purchased Investment in XYZ for $100. Payment was made in cash. In March, Company A sold Investment in XYZ for $150. Payment was received in cash. 3. On the books & records of Company A: On April 1st, Company A paid $1,200 for insurance expense that covers the year 4/1/17-3/31/18. Record 4/1/17 entry for payment of $1,200 Record 4/30/17 journal entry 4. There are 2 parallel funds, Fund A and Fund B. Together, the funds will make an investment of $100k, with a 65/35 split. The investment will be paid in cash, however, Fund B does not currently have any cash so Fund…arrow_forward

- You habe a business where you babysit for people in your local area.Some of your customers pay you mimmediately after you finish a job.Some customers ask you to send them a bill.It is now the 30th June and you have collected $3,600 from cash-paying customers.Your remaining customers owe you $5,200. How much service revenue would you have under accrual accounting?arrow_forwardBev Wynn, vice president of operations for Dillon County Bank, has instructed the bank’s computer programmer to use a 365-day year to compute interest on depository accounts (liabilities). Bev also instructed the programmer to use a 360-day year to compute interest on loans (assets).Discuss whether Bev is behaving in a professional manner.arrow_forwardJohn Grey owns Grey's Snow Plowing. In October, Grey's collects $12,000 cash for 6 commercial accounts for which he will provide snowplowing for the entire season. To record this transaction, Grey will enter which of the following entries? (Check all that apply.) Debit to Unearned Plowing Revenue Debit to Plowing Revenue Credit to Cash Credit to Unearned Plowing Revenue Debit to Cash Check all that apply. Credit to Plowing Revenuearrow_forward

- Lizzie Gunderson is trying to establish a credit history and has a Visa charge card. She received a September 3 statement that shows a balance of $254.80 from the previous month. The statement shows the following transactions: payment on September 12 of $50, charge on September 15 of $35.18, charge on September 20 of $120, and a final charge on October 2 of $14.60. Calculate the average daily balance for September.arrow_forwardBev Wynn, Vice President of operations for Dillon County Bank, has instructed the banks computer programmer to use a 365-day year to compute interest on depository accounts (liabilities). Bev also instructed the programmer to use a 360-day year to contour interest on loans (assets). Is bev behaving in a professional manner?arrow_forwardHelen Parish started a design company on January 1, Year 1. On April 1, Year 1, Parish borrowed cash from a local bank by issuing a one-year $41,600 face value note with annual interest based on an 11 percent discount. During Year 1, Parish provided services for $34,850 cash. Required Answer the following questions. (Hint: Record the events in T-accounts prior to answering the questions.) What is the amount of total liabilities on the December 31, Year 1, balance sheet? What is the amount of net income on the Year 1 income statement? What is the amount of cash flow from operating activities on the Year 1 statement of cash flows? Provide the general journal entries necessary to record issuing the note on April 1, Year 1; recognizing accrued interest on December 31, Year 1; and repaying the loan on March 31, Year 2.arrow_forward

- Precilla, vice-president of operations for Sturgis National Bank, has instructed the bank's computer programmer to use a 365-day year to compute interest on depositoryaccounts (payables). Precilla also instructed the programmer to use a 360-day year to compute interest on loans (receivables). Discuss whether Precilla is behavingin a professional manner.arrow_forwardPlease help mearrow_forwardHi, I need help assembling the following journal entries. Thank you.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Individual Income TaxesAccountingISBN:9780357109731Author:HoffmanPublisher:CENGAGE LEARNING - CONSIGNMENT

Individual Income TaxesAccountingISBN:9780357109731Author:HoffmanPublisher:CENGAGE LEARNING - CONSIGNMENT Auditing: A Risk Based-Approach to Conducting a Q...AccountingISBN:9781305080577Author:Karla M Johnstone, Audrey A. Gramling, Larry E. RittenbergPublisher:South-Western College Pub

Auditing: A Risk Based-Approach to Conducting a Q...AccountingISBN:9781305080577Author:Karla M Johnstone, Audrey A. Gramling, Larry E. RittenbergPublisher:South-Western College Pub

Individual Income Taxes

Accounting

ISBN:9780357109731

Author:Hoffman

Publisher:CENGAGE LEARNING - CONSIGNMENT

Auditing: A Risk Based-Approach to Conducting a Q...

Accounting

ISBN:9781305080577

Author:Karla M Johnstone, Audrey A. Gramling, Larry E. Rittenberg

Publisher:South-Western College Pub