Corporate Fin Focused Approach

5th Edition

ISBN: 9781285660516

Author: EHRHARDT

Publisher: Cengage

expand_more

expand_more

format_list_bulleted

Question

None

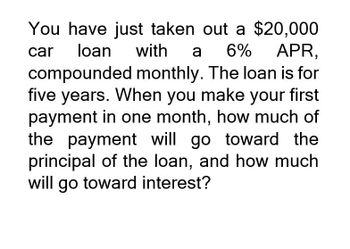

Transcribed Image Text:You have just taken out a $20,000

with a 6% APR,

car loan

compounded monthly. The loan is for

five years. When you make your first

payment in one month, how much of

the payment will go toward the

principal of the loan, and how much

will go toward interest?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Give correct answerarrow_forwardNeed help pleasearrow_forwardYou have just taken out a $15,000 car loan with a 7% APR, compounded monthly. The loan is for 5 years. When you make your first payment in one month, how much of the payment will go toward the principal of the loan and how much will go toward interest? The amount of your first payment that will go toward the interest of the loan is The amount of your first payment that will go toward the principal of the loan isarrow_forward

- You have just taken out a $23,000 car loan with a 7% APR, compounded monthly. The loan is for five years. When you make your first payment in one month, how much of the payment will go toward the principal of the loan and how much will go toward interest?arrow_forwardNeed helparrow_forwardYou have just taken out a $23,000 car loan with a 7% APR, compounded monthly. The loan is for five years. When you make your first payment in one month, how much of the payment will go toward the principal of the loan and how much will go toward interest? (Note: Be careful not to round any intermediate steps less than six decimal places.) When you make your first payment, $ will go toward the principal of the loan and will go toward the interest. (Round to the nearest cent.)arrow_forward

- Suppose that you take out an unsubsidized Stafford loan on September 1 before your junior year for $45004500 and plan to begin paying it back on December 1 after graduation and grace period 27 months later. The interest rate is 6.8%. How much of what you will owe will be interest?$Round your answer to the nearest cent.arrow_forwardYou take out a 14-year personal loan for $13000 at rate of 8.1% which compounds 4 times per year. After 1 years, you refinance the loan and get a 13-year loan at a rate of 6.48%. a) When you first get the loan, how much is your payment? $ 390.24 Correct b) Make a spreadsheet for your loan balance, interest, and payments. After 1 years of paying, how much do you owe? $ c) Adjust your spreadsheet for the new interest rate starting when you refinance in year 1. What is your new payment? $arrow_forwardNeed help with this accounting questionarrow_forward

- Solve this questionarrow_forwardYou need to borrow $80,000 to purchase a car. You qualify for a 7-year car loan that requires you to make constantly monthly payments with the first payment one month from today. If the quoted interest rate with monthly compounding is 2.28%, what is the monthly payment that must be made?arrow_forwardAssume you graduate from college with $31,000 in student loans. If your interest rate is fixed at 4.90% APR with monthly compounding and you repay the loans over a 10-year period, what will be your monthly payment?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you