Principles of Accounting Volume 2

19th Edition

ISBN: 9781947172609

Author: OpenStax

Publisher: OpenStax College

expand_more

expand_more

format_list_bulleted

Question

thumb_up100%

Provide correct answer

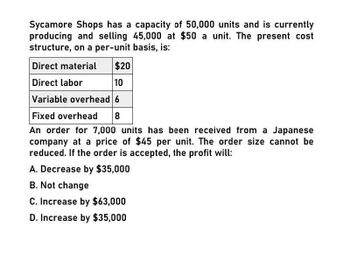

Transcribed Image Text:Sycamore Shops has a capacity of 50,000 units and is currently

producing and selling 45,000 at $50 a unit. The present cost

structure, on a per-unit basis, is:

Direct material

Direct labor

$20

10

Variable overhead 6

Fixed overhead

8

An order for 7,000 units has been received from a Japanese

company at a price of $45 per unit. The order size cannot be

reduced. If the order is accepted, the profit will:

A. Decrease by $35,000

B. Not change

C. Increase by $63,000

D. Increase by $35,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Gent Designs requires three units of part A for every unit of Al that it produces. Currently, part A is made by Gent, with these per-unit costs in a month when 4.000 units were produced: Variable manufacturing overhead is applied at $1.00 per unit. The other $0.30 of overhead consists of allocated fixed costs. Gent will need 6,000 units of part A for the next years production. Cory Corporation has offered to supply 6,000 units of part A at a price of $7.00 per unit. It Gent accepts the offer, all of the variable costs and $1,200 of the fixed costs will be avoided. Should Gent Designs accept the offer from Cory Corporation?arrow_forwardMarks Co. has a capacity of 100,000 units. They are currently producing and selling 90,000 units at $50 per unit. The cost of a unit at the present production level is as follows: Direct materials Direct labor Variable overhead Fixed overhead Per unit $19 11 6 9 $45 An order for 10,000 units has just been received from a foreign company at a price of $42 per unit. Freight costs of $2 per unit would be required. (A) Should Marks accept the order? Why or why not? (B) Assume the order was for 12,000 units. Should Marks accept the order? Why or why not?arrow_forwardGadubhaiarrow_forward

- Mohave Corporation is considering outsourcing production of the umbrella tote bag included with some of its products. The company has received a bid from a supplier in Vietnam to produce 8,700 units per year for $10.00 each. Mohave the following information about the cost of producing tote bags: Direct materials Direct labor Variable manufacturing overhead Fixed manufacturing overhead Total cost per unit $ 6.00 2.00 1.00 1.50 $10.50 Mohave determined all variable costs could be eliminated by outsourcing the tote bags, while 70 percent of the fixed overhead cost is unavoidable. At this time, Mohave has no specific use in mind for the space currently dedicated to producing the tote bags. Required: 1. Compute the difference in cost between making and buying the umbrella tote bag. 2. Based strictly on the incremental analysis, should Mohave buy the tote bags or continue to make them? 3-a. Suppose the space Mohave currently uses to make the bags could be utilized by a new product line that…arrow_forwardA customer has asked Lalka Corporation to supply 4,500 units of product H60, with some modifications, for $42.70 each. The normal selling price of this product is $49.35 each. The normal unit product cost of product H60 is computed as follows: Direct materials Direct labor Variable manufacturing overhead Fixed manufacturing overhead Unit product cost $ 16.20 2.80 10.00 9,40 $ 38.40 Direct labor is a variable cost. The special order would have no effect on the company's total fixed manufacturing overhead costs. The customer would like some modifications made to product H60 that would increase the variable costs by $5.30 per unit and that would require a one-time investment of $24,750 in special molds that would have no salvage value. This special order would have no effect on the company's other sales. The company has ample spare capacity for producing the special order. Required: Determine the financial advantage or disadvantage of accepting the special order.arrow_forwardMohave Corporation is considering outsourcing production of the umbrella tote bag included with some of its products. The company has received a bid from a supplier in Vietnam to produce 8,100 units per year for $8.50 each. Mohave the following information about the cost of producing tote bags: Direct materials Direct labor Variable manufacturing overhead Fixed manufacturing overhead Total cost per unit $ 4.00 2.00 1.00 2.00 $9.00 Mohave determined all variable costs could be eliminated by outsourcing the tote bags, while 60 percent of the fixed overhead cost is unavoidable. At this time, Mohave has no specific use in mind for the space currently dedicated to producing the tote bags. Required: 1. Compute the difference in cost between making and buying the umbrella tote bag. 2. Based strictly on the incremental analysis, should Mohave buy the tote bags or continue to make them? 3-a. Suppose the space Mohave currently uses to make the bags could be utilized by a new product line that…arrow_forward

- Wehrs Corporation has received a request for a special order of 8,300 units of product K19 for $45.20 each. The normal selling price of this product is $50.30 each, but the units would need to be modified slightly for the customer. The normal unit product cost of product K19 is computed as follows: Direct materials $ 16.00 Direct labor 5.30 Variable manufacturing overhead 2.50 Fixed manufacturing overhead 5.40 Unit product cost $ 29.20 Direct labor is a variable cost. The special order would have no effect on the company's total fixed manufacturing overhead costs. The customer would like some modifications made to product K19 that would increase the variable costs by $4.90 per unit and that would require a one-time investment of $44,700 in special molds that would have no salvage value. This special order would have no effect on the company's other sales. The company has ample spare capacity for producing the special order. Required: Determine the…arrow_forwardGadubhaiarrow_forwardEdalyn Corporation has received a request for a special order of 8,400 units of product Amity for $45.30 each. The normal selling price of this product is $50.40 each, but the units would need to be modified slightly for the customer. The normal unit product cost of product Amity is computed as follows: Direct materials Direct labor Variable manufacturing overhead Fixed manufacturing overhead Unit product cost es $16.10 5.40 2.60 5.50 $29.60 Direct labor is a variable cost. The special order would have no effect on the company's total fixed manufacturing overhead costs. The customer would like some modifications made to product Amity that would increase the variable costs by $5.00 per unit and that would require a one-time investment of $44,800 in special molds that would have no salvage value. This special order would have no effect on the company's other sales. The company has ample spare capacity for producing the special order. Required: Determine the effect on the company's total…arrow_forward

- Wehrs Corporation has received a request for a special order of 9,800 units of product K19 for $47.50 each. The normal selling price of this product is $52.60 each, but the units would need to be modified slightly for the customer. The normal unit product cost of product K19 is computed as follows: Direct materials Direct labor Variable manufacturing overhead Fixed manufacturing overhead Unit product.cost $ 18.30 7.60 4.80 7.70 $ 38.40 Direct labor is a varlable cost. The special order would have no effect on the company's total fixed manufacturing overhead costs. The customer would like some modifications made to product K19 that would increase the variable costs by $7.20 per unit and that would require a one-time investment of $47,000 in special molds that would have no salvage value. This special order would have no effect on the company's other sales. The company has ample spare capacity for producing the special order. Required: Determine the effect on the company's total net…arrow_forwardABC company is currently producting 20,000 units at $16 per unit. An outside supplier has offered to sell ABC company 20,000 units at $14 per unit. The production costs are: Direct Materials $2/ unit Direct Labor $4/ unit Variable overhead $5/ unit Fixed overhead (40% avoidable) $5/ unit Should ABC make or buy the component?arrow_forwardAlpha currently makes a subassembly for its main product. The costs per unit are as follows: Direct materials $ 45.00 Direct labor 35.00 Variable overhead Fixed overhead 30.00 Total $143.00 33.00 Vendor has contacted Alpha with an offer to sell 5,000 of the subassemblies for $135.00 each. Alpha will eliminate $85,000 of fixed overhead if it accepts the proposal. 25) Which option, make or buy, gives Alpha the higher operating income? By how much?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

- Principles of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Principles of Accounting Volume 2

Accounting

ISBN:9781947172609

Author:OpenStax

Publisher:OpenStax College