EBK CONTEMPORARY FINANCIAL MANAGEMENT

14th Edition

ISBN: 9781337514835

Author: MOYER

Publisher: CENGAGE LEARNING - CONSIGNMENT

expand_more

expand_more

format_list_bulleted

Question

ROE ? Accounting

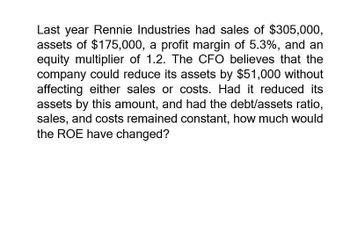

Transcribed Image Text:Last year Rennie Industries had sales of $305,000,

assets of $175,000, a profit margin of 5.3%, and an

equity multiplier of 1.2. The CFO believes that the

company could reduce its assets by $51,000 without

affecting either sales or costs. Had it reduced its

assets by this amount, and had the debt/assets ratio,

sales, and costs remained constant, how much would

the ROE have changed?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Last year Rennie Industries had sales of $255,000, assets of $175,000 (which equals total invested capital), a profit margin of 5.3%, and an equity multiplier of 1.2. The CFO believes that the company could reduce its assets by $51,000 without affecting either sales or costs. The firm finances using only debt and common equity. Had it reduced its assets by this amount, and had the debt/total invested capital ratio, sales, and costs remained constant, how much would the ROE have changed? Do not round your intermediate calculations. 4.23% 3.35% 3.39% 3.81% 4.69%arrow_forwardAirport Motors, Inc. has $2,305,800 in current assets and $854,000 in current liabilities. The managers want to increase the firm’s inventory, which will be financed using short-term debt. How much can the firm increase its inventory without its current ratio falling below a 2.1, (assuming all other current assets and current liabilities remain constant)?arrow_forwardAirspot Motors, Inc. has $2,343,600 in current assets and $868,000 in current liabilities. The company's managers want to increase the firm's inventory, which will be financed using short-term debt. How much can the firm increase its inventory without its current ratio falling below 2.1 (assuming all other current assets and current liabilities remain constant)?arrow_forward

- Last year Mason Inc. had a total assets turnover of 1.33 and an equity multiplier of 1.75. Its sales were $215,000 and its net income was $10,549. The CFO believes that the company could have operated more efficiently, lowered its costs, and increased its net income by $5,250 without changing its sales, assets, or capital structure. Had it cut costs and increased its net income in this amount, by how much would the ROE have changed? Select the correct answer. a. 6.74% b. 6.21% c. 7.27% d. 7.80% e. 5.68%arrow_forwardBartlett's Pears has a profit margin of 8.20 percent on sales of $24,300,000. If the firm has a debt of $10,400,000 and total assets of $21,000,000, what is the firm's ROA? Solve this problemarrow_forwardLance Motors has current assets of $1.2 million. The company’s current ratio is 1.2, its quick ratio is 0.7, and its inventory turnover ratio is 4. The company would like to increase its inventory turnover ratio to the industry average, which is 5, without reducing its sales. Any reductions in inventory will be used to reduce the company’s current liabilities. What will be the company’s current ratio, assuming that it is successful in improving its inventory turnover ratio to 5?arrow_forward

- Rangoon Corp's sales last year were $400,000, and its year-end total assets were $300,000. The average firm in the industry has a total assets turnover ratio (TATO) of 2.5. The new CFO believes the firm has excess assets that can be sold so as to bring the TATO down to the industry average without affecting sales. By how much must the assets be reduced to bring the TATO to the industry average?arrow_forwardSpot Company’s balance sheet consists of the following: $790 million and $230 million. Its current after-tax cost of debt is 4% and its cost of equity is 8%. You have been analyzing various market factors and have estimated that the market value of its debt is currently $760 million and the market value of the equity is $690 million. Furthermore, you believe that given current market conditions and the existence of flotation costs, the marginal after-tax cost of debt would be 70 basis points higher than the existing after-tax cost of debt and the marginal cost of equity would be 130 basis points higher. What is the difference in the company's Weighted Average Cost of Capital (WACC) based on the market-based data and the book-value data? Subtract the book value WACC from the market value WACC and present your answer in percentage terms, rounded to decimal places (e.g., 1.23%].Round your answer to 2 decimal places. Please show all work including how to set up in excel. Note:- Do not…arrow_forwardNonearrow_forward

- Get Answerarrow_forwardLast year, a company had $355,000 in assets, $26,275 of net income, and a debt-to-total-assets ratio of 44%. Now suppose the newly hired CFO convinces the president to increase the debt ratio to 58%. Sales and total assets will not be affected, but interest expenses would increase. However, the CFO believes that better cost controls would be sufficient to offset the higher interest expense and therefore keep net income unchanged. What was the original return on equity (ROE) for this company?arrow_forwardWie Corp's sales last year were $260,000, and its year-end total assets were $360,000. The average firm in the industry has a total assets turnover ratio (TATO) of 2.4. The firm's new CFO believes the firm has excess assets that can be sold to bring the TATO down to the industry average without affecting sales. By how much must the assets be reduced to bring the TATO to the industry average, holding sales constant? Do not round your intermediate calculations.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:9781337514835

Author:MOYER

Publisher:CENGAGE LEARNING - CONSIGNMENT