Intermediate Financial Management (MindTap Course List)

13th Edition

ISBN: 9781337395083

Author: Eugene F. Brigham, Phillip R. Daves

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Question

What is the dollar amount of taxes paid?

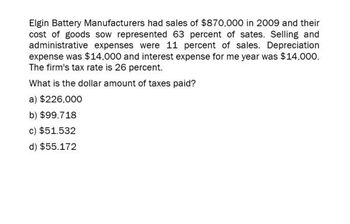

Transcribed Image Text:Elgin Battery Manufacturers had sales of $870,000 in 2009 and their

cost of goods sow represented 63 percent of sates. Selling and

administrative expenses were 11 percent of sales. Depreciation

expense was $14,000 and interest expense for me year was $14,000.

The firm's tax rate is 26 percent.

What is the dollar amount of taxes paid?

a) $226,000

b) $99.718

c) $51.532

d) $55.172

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- The Berndt Corporation expects to have sales of 12 million. Costs other than depreciation are expected to be 75% of sales, and depreciation is expected to be 1.5 million. All sales revenues will be collected in cash, and costs other than depreciation must be paid for during the year. Berndts federal-plus-state tax rate is 40%. Berndt has no debt. a. Set up an income statement. What is Berndts expected net income? Its expected net cash flow? b. Suppose Congress changed the tax laws so that Berndts depreciation expenses doubled. No changes in operations occurred. What would happen to reported profit and to net cash flow? c. Now suppose that Congress changed the tax laws such that, instead of doubling Berndts depreciation, it was reduced by 50%. How would profit and net cash flow be affected? d. If this were your company, would you prefer Congress to cause your depreciation expense to be doubled or halved? Why?arrow_forwardWhat is the dollar amount of taxes paid on these financial accounting question?arrow_forwardWant Answerarrow_forward

- Ans.arrow_forwardFusion Energy Co’s earnings before interest and taxes (EBIT) was $275 million. Assuming Fusion Energy’s tax rate is 25%, what is their net operating profit after taxes (NOPAT) for 2015 expressed in millions of dollarsarrow_forwardDuval Manufacturing recently reported the following information:Net income $600,000ROA 8%Interest expense $225,000Duval’s tax rate is 35%. What is its basic earning power (BEP)?arrow_forward

- Please answer this question correctly. Thank you.arrow_forwardXYZ Corp. had the following data for 2012, in millions: Net income = $500; EBIT = $700; Depreciation & Amortization = $100; and Gross fixed assets = $2,000. Information for 2013 is as follows: Net income = $625; EBIT = $925; Depreciation & Amortization = $110; and Gross fixed assets = $2,280. Assume the tax rate is 40% and the company invested $160 in NOWC in 2013. How much free cash flow did the firm generate during 2013?arrow_forwardA company's tax rate is 33% and its interest expense is $18,500. In addition, its cost of goods sold is 61% of sales and its depreciation and amortization expenses are $35,800. What must the company's revenue be for it to have earnings of $150,000? 1) $603,238 2) $641,914 3) $681,271 4) $713,284 5) $703,211arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

Intermediate Financial Management (MindTap Course...

Finance

ISBN:9781337395083

Author:Eugene F. Brigham, Phillip R. Daves

Publisher:Cengage Learning