Essentials of Business Analytics (MindTap Course List)

2nd Edition

ISBN: 9781305627734

Author: Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. Anderson

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Question

thumb_up100%

Need help with the Financial Accounting Question

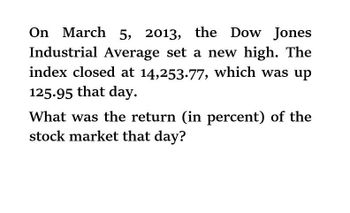

Transcribed Image Text:On March 5, 2013, the Dow Jones

Industrial Average set a new high. The

index closed at 14,253.77, which was up

125.95 that day.

What was the return (in percent) of the

stock market that day?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- On March 9, 2009, the Dow Jones Industrial Average reached a new low. The index closed at 6,547.05, which was down 79.89 that day. What was the return (in percent) of the stock market that day? (Negative answer should be indicated by a minus sign. Round your answer to 2 decimal places.) Return of stock market %arrow_forwardYesterday, the S&P 500 rose by .48%. However, 1,704 issues on the NYSE declined in price while 1,367 advanced. Why might a technical analyst be concerned even though the market index rose on this day?arrow_forwardA stock has an abnormal return of -0,8% per month. What is the annualized abnormal return? The answer should be given in decimal form with three decimals (e.g., if the correct answer is 2.4% write 0.024)arrow_forward

- 6-14. (Expected return, standard deviation, and capital asset pricing model) The following LO5 are the end-of-month prices for both the Standard & Poor's 500 Index and Nike's common stock. a. Using the data here, calculate the holding-period returns for each of the months. NIKE S&P 500 INDEX 2017 January $52.90 $2,279 February 57.16 2,364 March 55.73 2,363 April 55.41 2,384 May 52.99 2,412 June 59.00 2,423 July 59.05 2,470 August 52.81 2,472 September 51.85 2,519 October 54.99 2,575 November 60.42 2,648 December 62.55 2,674 2018 January 68.22 2,824 b. Calculate the average monthly return and the standard deviation for both the S&P 500 and Nike. 222 PART 2 • The Valuation of Financial Assets c. Develop a graph that shows the relationship between the Nike stock returns and the S&P 500 Index. (Show the Nike returns on the vertical axis and the S&P 500 Index returns on the horizontal axis as done in Figure 6-5.) d. From your graph, describe the nature of the relationship between Nike stock…arrow_forwardA company expects EPS to be $2.52 next year. The industry average P/E ratio is 23.99 and Enterprise multiple is 7.57. The EBITDA for the company is $22.97 million. What is an estimate of the stock price using the method of comparables for P/E multiples? Round your answer to two (2) decimal places.arrow_forwardFrom the data below for the Dow Jones Industrial Average, calculate the three-day simple moving average. Fill in the “Buy/Sell Signal” column for this trading indicator. Then, calculate the three-day exponential moving average and fill in the “Buy/ Sell Signal” column for this trading indicator. Assume that the current closing price will receive 4/5 of the weight in the exponential moving average. Finally, fill in the “Signal Comparison” column. On which days do the signals disagree? (Leave no cells blank - be certain to enter "0" wherever required. Do not round intermediate calculations. Round your answers to 2 decimal places.) Date Adj Close 3-Day Simple Moving Average Buy/Sell Signal 3-Day Exponential Moving Average Buy/Sell Signal Signal Comparison 3/25/2019 25,516.99 3/26/2019 25,657.89 3/27/2019 25,625.75 3/28/2019 25,717.62 3/29/2019 25,928.84 4/1/2019 26,258.58 4/2/2019 26,179.29…arrow_forward

- Using the data shown in the table below that contains historical monthly prices and dividends (paid at the end of themonth) for Ford Motor Company stock (Ticker: F) from August 1994 to August 1998, compute the: a. Average monthly return over this period is --%. (Round to two decimal places.) b. Monthly volatility (or standard deviation) over this period. (Round to two decimal places.)c. compute 95% confidence interval of the estimate of the average monthly return. Date Stock Price Dividend Return 1+RtAug-94 $29.250 $0.000 Sep-94 $27.750 $0.000 -5.13% 0.949Oct-94 $29.500 $0.260 7.24% 1.072Nov-94 $27.125 $0.000 -8.05% 0.919Dec-94 $27.875 $0.000 2.76% 1.028Jan-95 $25.250 $0.260 -8.48% 0.915Feb-95 $26.125 $0.000 3.47% 1.035Mar-95 $26.875 $0.000 2.87% 1.029Apr-95 $27.125 $0.310 2.08% 1.021May-95 $29.250 $0.000 7.83% 1.078Jun-95 $29.750 $0.000…arrow_forwardHere are alphas and betas for Company X and Company Y for the 60 months ending April 2019. Alpha is expressed as a percent per month. A month later, the market is up by 5%, X is up by 6% and Y is up by 3%. (3a) What is the abnormal rate of return for X and Y? ] Alpha Beta X 0.57 1.08 Y 0.46 0.65 The table below shows a condensed income statement and balance sheet for a plant. Income Statement Assets at 31 December 2018 Revenue 56.66 Net working capital 7.08 Raw materials cost 18.72 Operating cost 21.09 Depreciation Investment plant & equipment 69.33 4.50 Less accumulated depreciation Net plant & equipment 21.01 Pretax income 12.35 48.32 Tax at 35% 4.32 Net income 8.03 Total assets 55.40 (3b) Calculate the plant's EVA. Assume the cost of capital is 9%. (3c) Assume now that the plant could be sold to another company for $95 million. How should this fact change your calculation of EVA? Explain your answerarrow_forwardThe following spreadsheet contains monthly returns for Cola Co. and Gas Co. for 2013. Using these data, estimate the average monthly return and the volatility for each stock. (Click on the following icon in order to copy its contents into a spreadsheet.) Month January February March April May June July August September October November The average monthly return for Cola Co. is%. (Round to two decimal places.) Cola Co. -7.10% -2.10% -3.80% -4.10% 1.50% 1.20% -21.10% - 14.50% - 28.80% 22.90% -13.40% Gas Co. -8.10% -2.00% -2.60% -5.00% -4.70% -3.20% 6.70% -8.50% - 12.60% 16.50% -6.10%arrow_forward

- The following spreadsheet contains monthly returns for Cola Co. and Gas Co. for 2013. Using these data, estimate the average monthly return and the volatility for each stock. (Click on the following icon in order to copy its contents into a spreadsheet.) Month January February March April May June July August September October November December The average monthly return for Cola Co. is%. (Round to two decimal places.) Cola Co. - 6.80% 7.40% -2.10% 4.30% 11.30% 1.40% 4.10% - 0.60% 0.80% 1.90% 0.70% - 2.90% Gas Co. - 3.00% - 7.70% 0.20% 3.10% - 1.00% 0.00% 4.80% - 3.80% - 5.80% 1.20% - 2.30% 4.70%arrow_forwardThe following are the calendar year rates of return for a S&P 500 ETF (Ticker: IVV) between 2013 and 2017. Year IVV 2013 29.60% 2014 11.39% 2015 -0.73% 2016 9.54% 2017 19.42% What is the geometric mean rate of return? Round to the nearest 0.01, in percentage terms.arrow_forwardConsider the following information on large-company stocks for a period of years. Large-company stocks Inflation Arithmetic Mean 15.3% 3.5 a. What was the arithmetic average annual return on large-company stocks in nominal terms? (Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16.) b. What was the arithmetic average annual return on large-company stocks in real terms? (Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16.) Answer is complete but not entirely correct. a. Nominal return 15.30 % b. Real return 11.80 %arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials of Business Analytics (MindTap Course ...StatisticsISBN:9781305627734Author:Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. AndersonPublisher:Cengage Learning

Essentials of Business Analytics (MindTap Course ...StatisticsISBN:9781305627734Author:Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. AndersonPublisher:Cengage Learning

Essentials of Business Analytics (MindTap Course ...

Statistics

ISBN:9781305627734

Author:Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. Anderson

Publisher:Cengage Learning