FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

nik

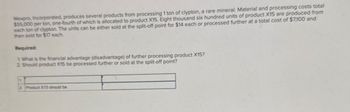

Transcribed Image Text:Wexpro, Incorporated, produces several products from processing 1 ton of clypton, a rare mineral. Material and processing costs total

$55,000 per ton, one-fourth of which is allocated to product X15. Eight thousand six hundred units of product X15 are produced from

each ton of clypton. The units can be either sold at the split-off point for $14 each or processed further at a total cost of $7,100 and

then sold for $17 each.

Required:

1. What is the financial advantage (disadvantage) of further processing product X15?

2. Should product X15 be processed further or sold at the split-off point?

2. Product X15 should be

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Wexpro, Incorporated, produces several products from processing 1 ton of clypton, a rare mineral. Material and processing costs total $53,000 per ton, one-fourth of which is allocated to product X15. Eight thousand three hundred units of product X15 are produced from each ton of clypton. The units can either be sold at the split-off point for $10 each, or processed further at a total cost of $7,100 and then sold for $13 each. Required: 1. What is the financial advantage (disadvantage) of further processing product X15? 2. Should product X15 be processed further or sold at the split-off point? 1. 2. Product X15 should bearrow_forwardWexpro, Incorporated, produces several products from processing 1 ton of clypton, a rare mineral. Material and processing costs total $63,000 per ton, one-fourth of which is allocated to product X15. Six thousand eight hundred units of product X15 are produced from each ton of clypton. The units can be either sold at the split-off point for $16 each or processed further at a total cost of $6,100 and then sold for $21 each. Required: 1. What is the financial advantage (disadvantage) of further processing product X15? 2. Should product X15 be processed further or sold at the split-off point? 1. 2. Product X15 should bearrow_forwardAlpesharrow_forward

- Wexpro, Incorporated, produces several products from processing 1 ton of clypton, a rare mineral. Material and processing costs total $60,000 per ton, one-fourth of which is allocated to product X15. Seven thousand units of product X15 are produced from each ton of clypton. The units can either be sold at the split-off point for $9 each, or processed further at a total cost of $9,500 and then sold for $12 each. Required: 1. What is the financial advantage (disadvantage) of further processing product X15? 2. Should product X15 be processed further or sold at the split-off point? 1. 2. Answer is complete but not entirely correct. Financial advantage Product X15 should be 48,000 Processed furtherarrow_forwardWexpro, Incorporated, produces several products from processing 1 ton of clypton, a rare mineral. Material and processing costs total $60,000 per ton, one-fourth of which is allocated to product X15. Seven thousand units of product X15 are produced from each ton of clypton. The units can either be sold at the split-off point for $9 each, or processed further at a total cost of $9,500 and then sold for $12 each. Required: 1. What is the financial advantage (disadvantage) of further processing product X15? 2. Should product X15 be processed further or sold at the split-off point? 1. 2. Product X15 should bearrow_forwardAlpesharrow_forward

- 2arrow_forwardBetram Chemicals Company processes a number of chemical compounds used in producing industrial cleaning products. One compound is decomposed into two chemicals: anderine and dofinol. The cost of processing one batch of compound is $73,000, and the result is 5,900 gallons of anderine and 8,200 gallons of dofinol. Betram Chemicals can sell the anderine at split-off for $12.00 per gallon and the dofinol for $6.30 per gallon. Alternatively, the anderine can be processed further at a cost of $7.90 per gallon (of anderine) into cermine. It takes 4 gallons of anderine for every gallon of cermine. A gallon of cermine sells for $65.arrow_forwardH1arrow_forward

- Carina Company produces sanitation products after processing specialized chemicals; Thefollowing relates to its activities: 1 Kilogram of chemicals purchased for $2000 and with an additional $1000 isprocessed into 400 grams of Crystals and 80 litres of a Cleaning agent. At split-off, agram of Crystal can be sold for $1 and the Cleaning agent can be sold for $4 per litre. At an additional cost of $400, Carina can process the 400 grams of Crystal into 500 grams of Detergent that can be sold for $2 per gram. The 80 litres of Cleaning agent is packaged at an additional cost of $300 and made into 200 packs of Softener that can be sold for $2 per pack. Required: 1. Allocate the joint cost to the Detergent and the Softener using the following: a. Sales value at split-off method b. NRV method 2. Should Carina have processed each of the products further? What effect does the allocationmethod have on this decision? Make full references to Question 1 when possiblearrow_forwardBetram Chemicals Company processes a number of chemical compounds used in producing industrial cleaning products. One compound is decomposed into two chemicals: anderine and dofinol. The cost of processing one batch of compound is $74,000, and the result is 6,000 gallons of anderine and 8,000 gallons of dofinol. Betram Chemicals can sell the anderine at split-off for $11 per gallon and the dofinol for $6.75 per gallon. Alternatively, the anderine can be processed further at a cost of $8 per gallon (of anderine) into cermine. It takes 3 gallons of anderine for every gallon of cermine. A gallon of cermine sells for $60. Required: 1. Which alternative is more cost effective and by how much? Process it further by $fill in the blank 2 2. What if the production of anderine into cermine required additional purchasing and quality inspection activity? Every 500 gallons of anderine that undergo further processing require 20 more purchase orders at $10 each and 15 more quality inspection hours at…arrow_forwardCarina Company produces sanitation products after processing specialized chemicals; Thefollowing relates to its activities: 1 Kilogram of chemicals purchased for $2000 and with an additional $1000 isprocessed into 400 grams of Crystals and 80 litres of a Cleaning agent. At split-off, agram of Crystal can be sold for $1 and the Cleaning agent can be sold for $4 per litre.2. At an additional cost of $400, Carina can process the 400 grams of Crystal into 500grams of Detergent that can be sold for $2 per gram. The 80 litres of Cleaning agent ispackaged at an additional cost of $300 and made into 200 packs of Softener that canbe sold for $2 per pack.Required:1. Allocate the joint cost to the Detergent and the Softener using the following:a. Sales value at split-off method b. NRV method 2. Should Carina have processed each of the products further? What effect does the allocationmethod have on this decision?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education