Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

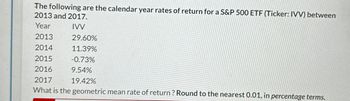

Transcribed Image Text:The following are the calendar year rates of return for a S&P 500 ETF (Ticker: IVV) between

2013 and 2017.

Year

IVV

2013

29.60%

2014

11.39%

2015

-0.73%

2016

9.54%

2017

19.42%

What is the geometric mean rate of return? Round to the nearest 0.01, in percentage terms.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- The following regression model was estimated to forecast the value of the Malaysian ringgit (MYR): MYR Fao+a+INC+a₂INF+U where MYR is the quarterly change in the ringgit, INF is the previous quarterly percentage change in the inflation differential, and INC is the predious quarterly percentage change in the income growth differential. Regression results indicato coeficients ao-0.004; a₁-0.6; and az -0.5. The most recent quarterly percentage change in the income differential is -1%, while the most recent quarterly percentage change in the inflation differential is -7%. Using this information, the forecast for the percentage change in the ringgit is % (1 decimal place please; note % is already given, so if you find an answer of .055, you will need to enter 5.5 for the correct answer because .055-5.5%)arrow_forwardSuppose that the average income in 1954 was 1,050£. Suppose further that the CPI in 1954 was 35.3, and that the CPI in 2021 is 1,021.5. What is the 2020 value of the 1954 average income?arrow_forwardYou had the following rates of return for on your portfolio for the last four years: 2019: -10.1%2020: 15.4%2021: 7.3%2022: 12.8%Calculate the geometric average return on your portfolio. Enter your answer as a decimal, rounded to four decimal places.arrow_forward

- If the average range of the market’s return (as measured by the S&P 500) is +/- 9% for a given period, and X-Co’s Beta is 1.4, what is its expected range for that period?arrow_forwardCurrently, a firm has an EPS of $2.13 and a benchmark PE of 18.64. Earnings are expected to grow by 3.8 percent annually. What is the estimated current stock price?arrow_forwardThe Beta coefficients of TSLA and JPM are 1.99 and 1.18 respectively. What does Beta measure and how is it interpreted? Explain the beta values of TSLA and JPM by providing a calculated example of how they relate to market returns.arrow_forward

- What is the volatility of a certain stock index from 2019 to 2022? The return for each year is given by: 4,30%, 10,75%, 2,05%, and 12,70%. Calculate the average return over the four-year period. Then, determine the volatility (standard deviation) of the stock index returns.arrow_forwardCalculate the 1. payback period, 2. the net present value to the nearest whole dollar (for example 4500), 3. the internal rate of return to the nearest whole percentage (for example 12), and 4. the modified internal rate of return (to the nearest whole percent, for example 12) Period OH 0 1 2 3 4 5 CF -100,000 25000 50000 50000 3000 1000 WACC 0.125 2 A N A/arrow_forwardAn analyst produces the following series of annual dividend forecasts for company D: Expected dividend (end of) year t+1 = 10 euros; Expected dividend (end of) year t+2 = 20 euros; Expected dividend (end of) year t+3 = 10 euros. The analyst further expects that company D dividend will grow indefinitely at a rate of 2 percent after year t+3. Company D cost of equity equals 10 percent. Under these assumptions, calculate the analysts estimate of company D equity value at the end of year t.arrow_forward

- If the value of sustainable investing is $158.7 and the discount rate is 5.8% while the value of non-sustainable investing is $22.81 and the expected value of the company is $27.14. What is the assumed probability of being sustainable given a 5 year horizon? (Answer in percent to 2 decimals)arrow_forwardWhat was the compound average annual return of a stock that earned -16.8%, -4.8%, 1%, and 13.1% per year? Answer in percent and round to one decimal place.arrow_forwardTen annual returns are listed below. -19.9%, 16.6%, 18%, -50 %, 43.3%, 1.2%, -16.5 %, 45.6%, 45.2%, a. What is the arithmetic average return over the 10-year period? b. What is the geometric average return over the 10-year period? c. If you invested $100 at the beginning of the period, how much would you have at the end?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education