Intermediate Financial Management (MindTap Course List)

13th Edition

ISBN: 9781337395083

Author: Eugene F. Brigham, Phillip R. Daves

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Question

thumb_up100%

Give correct roe for this accounting question

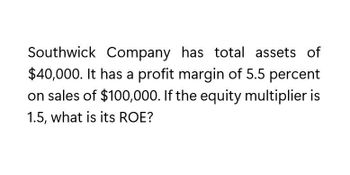

Transcribed Image Text:Southwick Company has total assets of

$40,000. It has a profit margin of 5.5 percent

on sales of $100,000. If the equity multiplier is

1.5, what is its ROE?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- ROE Needham Pharmaceuticals has a profit margin of 3.5% and an equity multiplier of 1.5. Its sales are $100 million and it has total assets of $60 million. What is its Return on Equity (ROE)? Round your answer to two decimal places.arrow_forwardIf Rooters, Inc., has an equity multiplier of 1.90, total asset turnover of 1.20, and a profit margin of 8 percent, what is its ROE?arrow_forwardIf Roten Rooters, Inc., has an equity multiplier of 1.27, total asset turnover of 1.20, and a profit margin of 3.5 percent, what is its ROE?arrow_forward

- Gardial & Son has an ROA of 11%, a 4% profit margin, and a return on equity equal to 20%. What is the company's total assets turnover? What is the firm's equity multiplier? Do not round intermediate calculations. Round your answers to two decimal places.arrow_forwardNeedham Pharmaceuticals has a profit margin of 3% and an equity multiplier of 1.8. Its sales are $130 million and it has total assets of $50 million. What is its return on equity (ROE)? Do not round intermediate calculations. Round your answer to two decimal placesarrow_forwardGardial & Son has an ROA of 12%, a 4% profit margin, and a return on equity equal to 11%. What is the company's total assets turnover? Round your answer to two decimal places. What is the firm's equity multiplier? Round your answer to two decimal places.arrow_forward

- What is the return on equity ??arrow_forwardGeneral Electric has a ROA of 11%, a 3.5% profit margin, and a ROE of 14.5%. What is its totalassets turnover? What is its equity multiplier?arrow_forwardA firm has a profit margin of 7% and an equity multiplier of 1.3. Its sales are $130 million, and it has total assets of $78 million. What is its ROE? Do not round intermediate calculations. Round your answer to twoarrow_forward

- Gardial & Son has an ROA of 9%, a 4% profit margin, and a return on equity equal to 20%. What is the company's total assets turnover? What is the firm's equity multiplier? Do not round intermediate calculations. Round your answers to two decimal places. Total assets turnover: Equity multiplier:arrow_forwardHenderson's Hardware has an ROA of 15%, a 4.5% profit margin, and an ROE of 25%. What is its total assets turnover? Do not round intermediate calculations. Round your answer to two decimal places. What is its equity multiplier? Do not round intermediate calculations. Round your answer to two decimal places.arrow_forwardNeed helparrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

Intermediate Financial Management (MindTap Course...

Finance

ISBN:9781337395083

Author:Eugene F. Brigham, Phillip R. Daves

Publisher:Cengage Learning