Financial Accounting

15th Edition

ISBN: 9781337272124

Author: Carl Warren, James M. Reeve, Jonathan Duchac

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Question

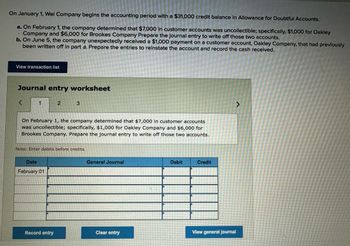

Transcribed Image Text:On January 1, Wel Company begins the accounting period with a $31,000 credit balance in Allowance for Doubtful Accounts.

a. On February 1, the company determined that $7,000 in customer accounts was uncollectible; specifically, $1,000 for Oakley

Company and $6,000 for Brookes Company Prepare the journal entry to write off those two accounts.

'

b. On June 5, the company unexpectedly received a $1,000 payment on a customer account, Oakley Company, that had previously

been written off in part a. Prepare the entries to reinstate the account and record the cash received.

View transaction list

Journal entry worksheet

<

2

3

On February 1, the company determined that $7,000 in customer accounts

was uncollectible; specifically, $1,000 for Oakley Company and $6,000 for

Brookes Company. Prepare the journal entry to write off those two accounts.

Note: Enter debits before credits.

Date

February 01

General Journal

Debit

Credit

>

Record entry

Clear entry

View general journal

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps with 1 images

Knowledge Booster

Similar questions

- Casebolt Company wrote off the following accounts receivable as uncollectible for the first year of its operations ending December 31: a. Journalize the write-offs under the direct write-off method. b. Journalize the write-offs under the allowance method. Also, journalize the adjusting entry for uncollectible accounts. The company recorded 5,250,000 of credit sales during the year. Based on past history and industry averages, % of credit sales are expected to be uncollectible. c. How much higher (lower) would Casebolt Companys net income have been under the direct write-off method than under the allowance method?arrow_forwardOn March 24, MS Companys Accounts Receivable consisted of the following customer balances: S. Burton 310 A. Tangier 240 J. Holmes 504 F. Fullman 110 P. Molty 90 During the following week, MS made a sale of 104 to Molty and collected cash on account of 207 from Burton and 360 from Holmes. Prepare a schedule of accounts receivable for MS at March 31, 20--.arrow_forwardOn June 30, Oscar Inc.s bookkeeper is preparing to close the books for the month. The accounts receivable control total shows a balance of $2,820.76, but the accounts receivable subsidiary ledger shows total account balances of $2,220.76. The accounts receivable subsidiary ledger is shown here. Can you help find the mistake?arrow_forward

- On June 30, Isner Inc.s bookkeeper is preparing to close the books for the month. The accounts receivable control total shows a balance of $550, but the accounts receivable subsidiary ledger shows total account balances of $850. The accounts receivable subsidiary ledger is shown here. Can you help find the mistake?arrow_forwardOn December 1 of the current year, Jordan Inc. assigns 125,000 of its accounts receivable to McLaughlin Company for cash. McLaughlin Company charges a 750 service fee, advances 85% of Jordans accounts receivable, and charges an annual interest rate of 9% on any outstanding loan balance. Prepare the related journal entries for Jordan. Refer to RE6-10. On December 31, Jordan Inc. received 50,000 on assigned accounts. Prepare Jordans journal entries to record the cash receipt and the payment to McLaughlin.arrow_forwardAt the end of 20-3, Martel Co. had 410,000 in Accounts Receivable and a credit balance of 300 in Allowance for Doubtful Accounts. Martel has now been in business for three years and wants to base its estimate of uncollectible accounts on its own experience. Assume that Martel Co.s adjusting entry for uncollectible accounts on December 31, 20-2, was a debit to Bad Debt Expense and a credit to Allowance for Doubtful Accounts of 25,000. (a) Estimate Martels uncollectible accounts percentage based on its actual bad debt experience during the past two years. (b) Prepare the adjusting entry on December 31, 20-3, for Martel Co.s uncollectible accounts.arrow_forward

- Waddell Industries has a past history of uncollectible accounts, as follows. Estimate the allowance for doubtful accounts, based on the aging of receivables schedule you completed in Exercise 9-8. The accounts receivable clerk for Waddell Industries prepared the following partially completed aging of receivables schedule as of the end of business on August 31: The following accounts were unintentionally omitted from the aging schedule and not included in the preceding subtotals: a. Determine the number of days past due for each of the preceding accounts as of August 31. b. Complete the aging of receivables schedule by adding the omitted accounts to the bottom of the schedule and updating the totals.arrow_forwardOn January 1, Wei company begins the accounting period with a $31,000 credit balance in Allowance for Doubtful Accounts. a. On February 1, the company determined that $7,000 in customer accounts was uncollectible; specifically, $1,000 for Oakley Co. and $6,000 for Brookes Co. Prepare the journal entry to write off those two accounts. b. On June 5, the company unexpectedly received a $1,000 payment on a customer account, Oakley Company, that had previously been written off in part a. Prepare the entries to reinstate the account and record the cash received.arrow_forwardOn January 1, Wei company begins the accounting period with a $46,000 credit balance in Allowance for Doubtful Accounts. a. On February 1, the company determined that $10,000 in customer accounts was uncollectible; specifically, $2,500 for Oakley Co. and $7,500 for Brookes Co. Prepare the journal entry to write off those two accounts. b. On June 5, the company unexpectedly received a $2,500 payment on a customer account, Oakley Company, that had previously been written off in part a. Prepare the entries to reinstate the account and record the cash received. View transaction list Journal entry worksheet 1 2 On February 1, the company determined that $10,000 in customer accounts was uncollectible; specifically, $2,500 for Oakley Co. and $7,500 for Brookes Co. Prepare the journal entry to write off those two accounts. Date Feb 01 3 Note: Enter debits before credits. Record entry General Journal Clear entry Debit Credit View general journalarrow_forward

- On January 1, Wei Company begins the accounting period with a $34,000 credit balance in Allowance for Doubtful Accounts. a. On February 1, the company determined that $7,600 in customer accounts was uncollectible; specifically, $1,300 for Oakley Company and $6,300 for Brookes Company Prepare the journal entry to write off those two accounts. b. On June 5, the company unexpectedly received a $1,300 payment on a customer account, Oakley Company, that had previously been written off in part a. Prepare the entries to reinstate the account and record the cash received. View transaction list Journal entry worksheet 1 2 On February 1, the company determined that $7,600 in customer accounts was uncollectible; specifically, $1,300 for Oakley Company and $6,300 for Brookes Company. Prepare the journal entry to write off those two accounts. Date February 01 3 Note: Enter debits before credits. Record entry General Journal Clear entry Debit Credit View general journalarrow_forwardOn January 1, Wei Company begins the accounting period with a $42,000 credit balance in Allowance for Doubtful Accounts. a. On February 1, the company determined that $9,200 in customer accounts was uncollectible; specifically, $2,100 for Oakley Company and $7,100 for Brookes Company Prepare the journal entry to write off those two accounts. b. On June 5, the company unexpectedly received a $2,100 payment on a customer account, Oakley Company, that had previously been written off in part a. Prepare the entries to reinstate the account and record the cash received. View transaction list Journal entry worksheet 1 2 3 > On February 1, the company determined that $9,200 in customer accounts was uncollectible; specifically, $2,100 for Oakley Company and $7,100 for Brookes Company. Prepare the journal entry to write off those two accounts. Note: Enter debits before credits. Date General Journal Debit Credit February 01arrow_forwardOn January 1, Wet Company begins the accounting period with a $35,000 credit balance in Allowance for Doubtful Accounts a. On February 1, the company determined that $7.800 in customer accounts was uncollectible specifically $1,400 for Oakley Company and $6,400 for Brookes Company Prepare the journal entry to write off those two accounts b. On June 5, the company unexpectedly received a $1.400 payment on a customer account. Oakley Company, that had previously been written off in part a. Prepare the entries to reinstate the account and record the cash received View transaction list Journal entry worksheet < 1 2 3 On February 1, the company determined that $7,800 in customer accounts was uncollectible; specifically, $1,400 for Oakley Company and $0.400 for Brookes Company. Prepare the journal entry to write off these two accounts. Note: Enter debits before credits. Date February 01 General Journal Debit Credil Record entry Clear entry View general journalarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,Principles of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,Principles of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial Accounting

Accounting

ISBN:9781337272124

Author:Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:9781337794756

Author:HEINTZ, James A.

Publisher:Cengage Learning,

Principles of Accounting Volume 1

Accounting

ISBN:9781947172685

Author:OpenStax

Publisher:OpenStax College

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:Cengage Learning

Financial Accounting

Accounting

ISBN:9781305088436

Author:Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:Cengage Learning