Principles of Accounting Volume 1

19th Edition

ISBN: 9781947172685

Author: OpenStax

Publisher: OpenStax College

expand_more

expand_more

format_list_bulleted

Textbook Question

Chapter 7, Problem 1PB

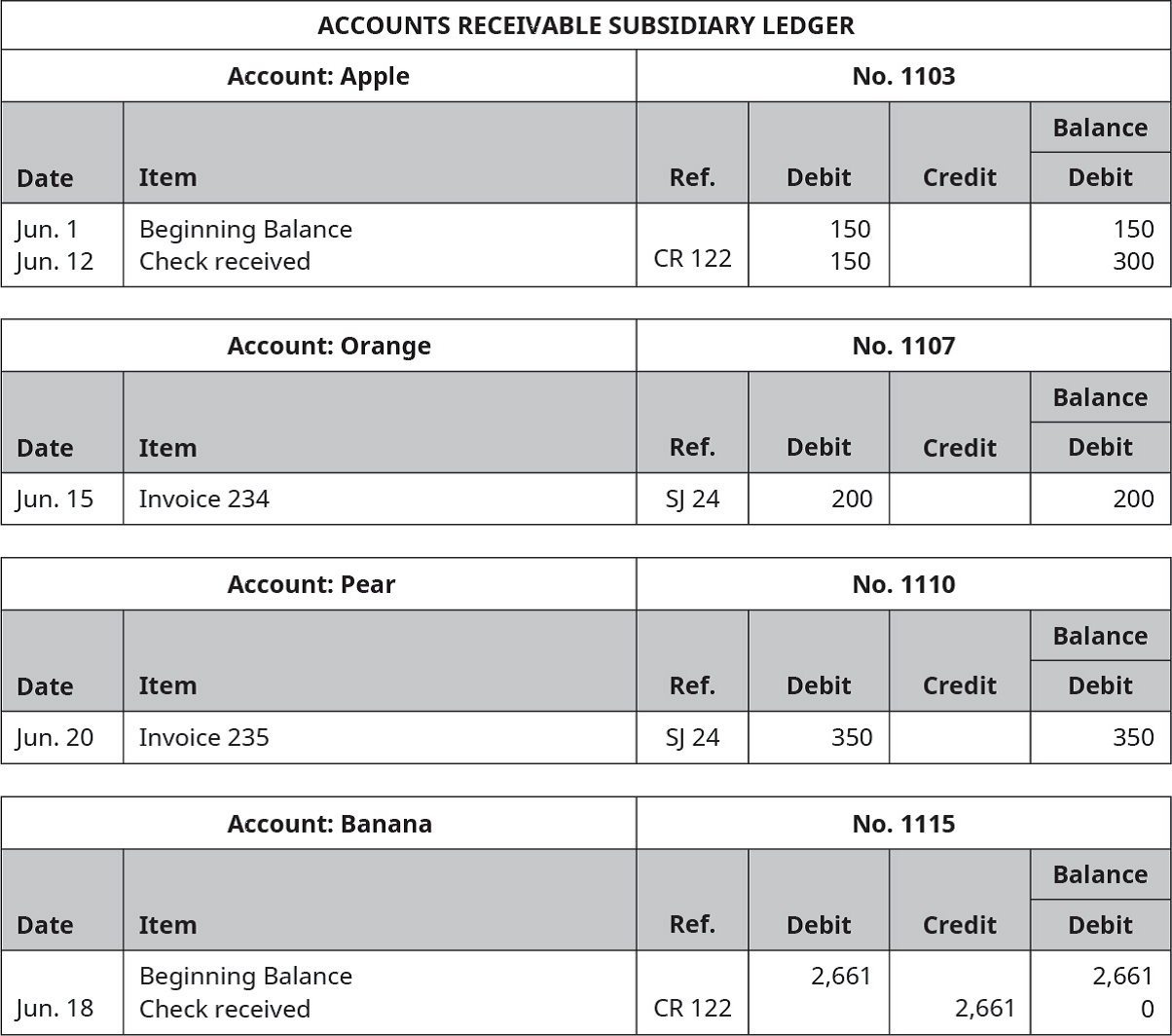

On June 30, Isner Inc.’s bookkeeper is preparing to close the books for the month. The

Expert Solution & Answer

Trending nowThis is a popular solution!

Students have asked these similar questions

Recently, Abercrombie & Fitch has been implementing a turnaround strategy since its sales had been falling for the past few years (11% decrease in 2014, 8% in 2015, and just 3% in 2016.) One part of Abercrombie's new strategy has been to abandon its logo-adorned merchandise, replacing it with a subtler look. Abercrombie wrote down $20.6 million of inventory, including logo-adorned merchandise, during the year ending January 30, 2016. Some of this inventory dated back to late 2013. The write-down was net of the amount it would be able to recover selling the inventory at a discount. The write-down is significant; Abercrombie's reported net income after this write-down was $35.6 million. Interestingly, Abercrombie excluded the inventory write-down from its non-GAAP income measures presented to investors; GAAP earnings were also included in the same report. Question: What impact would the write-down of inventory have had on Abercrombie's expenses, Gross margin, and Net income?

Recently, Abercrombie & Fitch has been implementing a turnaround strategy since its sales had been falling for the past few years (11% decrease in 2014, 8% in 2015, and just 3% in 2016.) One part of Abercrombie's new strategy has been to abandon its logo-adorned merchandise, replacing it with a subtler look. Abercrombie wrote down $20.6 million of inventory, including logo-adorned merchandise, during the year ending January 30, 2016. Some of this inventory dated back to late 2013. The write-down was net of the amount it would be able to recover selling the inventory at a discount. The write-down is significant; Abercrombie's reported net income after this write-down was $35.6 million. Interestingly, Abercrombie excluded the inventory write-down from its non-GAAP income measures presented to investors; GAAP earnings were also included in the same report. Question: What impact would the write-down of inventory have had on Abercrombie's assets, Liabilities, and Equity?

Need answer general Accounting

Chapter 7 Solutions

Principles of Accounting Volume 1

Ch. 7 - So far, computer systems cannot yet ________. A....Ch. 7 - Any device used to provide the results of...Ch. 7 - Source documents ________. A. are input devices B....Ch. 7 - All of the following can provide source data...Ch. 7 - A document that asks you to return an identifying...Ch. 7 - Which of the following is false about accounting...Ch. 7 - An unhappy customer just returned $50 of the items...Ch. 7 - A customer just charged $150 of merchandise on the...Ch. 7 - A customer just charged $150 of merchandise using...Ch. 7 - The company just took a physical count of...

Ch. 7 - Your company paid rent of $1,000 for the month...Ch. 7 - On January 1, Incredible Infants sold goods to...Ch. 7 - Received a check for $72 from a customer, Mr....Ch. 7 - You returned damaged goods you had previously...Ch. 7 - Sold goods for $650 cash. Which journal would the...Ch. 7 - Sandren Co. purchased inventory on credit from...Ch. 7 - Sold goods for $650, credit terms net 30 days....Ch. 7 - You returned damaged goods to C.C. Rogers Inc. and...Ch. 7 - The sum of all the accounts in the accounts...Ch. 7 - AB Inc. purchased inventory on account from YZ...Ch. 7 - You just posted a debit to ABC Co. in the accounts...Ch. 7 - You just posted a credit to Stars Inc. in the...Ch. 7 - You just posted a debit to Cash in the general...Ch. 7 - You just posted a credit to Accounts Receivable....Ch. 7 - You just posted a credit to Sales and a debit to...Ch. 7 - An enterprise resource planning (ERP) system...Ch. 7 - Which of the following is not a way to prevent...Ch. 7 - Big data is mined ________. A. to find business...Ch. 7 - Artificial intelligence refers to ________. A....Ch. 7 - Blockchain is a technology that ________. A. is in...Ch. 7 - Which of the following is not true about...Ch. 7 - Why does a student need to understand how to use a...Ch. 7 - Provide an example of how paper-based accounting...Ch. 7 - Why are scanners better than keyboards?Ch. 7 - Why are there so many different accounting...Ch. 7 - Which area of accounting needs a computerized...Ch. 7 - The American Institute of Certified Public...Ch. 7 - Which special journals also require an entry to a...Ch. 7 - What is a schedule of accounts receivable?Ch. 7 - How often do we post the cash column in the cash...Ch. 7 - The schedule of accounts payable should equal...Ch. 7 - Which amounts do we post daily and which do we...Ch. 7 - Why are special journals used?Ch. 7 - Name the four main special journals.Ch. 7 - A journal entry that requires a debit to Accounts...Ch. 7 - The purchase of equipment for cash would be...Ch. 7 - Can a sales journal be used to record sales on...Ch. 7 - When should entries from the sales journal be...Ch. 7 - We record a sale on account that involves sales...Ch. 7 - We record purchases of inventory for cash in which...Ch. 7 - Should the purchases journal have a column that is...Ch. 7 - Forensic means suitable for use in a court of law....Ch. 7 - For each of the following, indicate if the...Ch. 7 - All of the following information pertains to...Ch. 7 - Match the special journal you would use to record...Ch. 7 - For each of the transactions, state which special...Ch. 7 - Catherines Cookies has a beginning balance in the...Ch. 7 - Record the following transactions in the sales...Ch. 7 - Record the following transactions in the cash...Ch. 7 - Maddie Inc. has the following transactions for its...Ch. 7 - For each of the following, indicate if the...Ch. 7 - The following information pertains to Crossroads...Ch. 7 - Match the special journal you would use to record...Ch. 7 - For each of the following transactions, state...Ch. 7 - Catherines Cookies has a beginning balance in the...Ch. 7 - Record the following transactions in the purchases...Ch. 7 - Record the following transactions in the cash...Ch. 7 - Piedmont Inc. has the following transactions for...Ch. 7 - On June 30, Oscar Inc.s bookkeeper is preparing to...Ch. 7 - Evie Inc. has the following transactions during...Ch. 7 - Use the journals and ledgers that follow. Total...Ch. 7 - Brown Inc. records purchases in a purchases...Ch. 7 - On June 30, Isner Inc.s bookkeeper is preparing to...Ch. 7 - Use the journals and ledgers that follows. Total...Ch. 7 - Why must the Accounts Receivable account in the...Ch. 7 - Why would a company use a subsidiary ledger for...Ch. 7 - If a customer owed your company $100 on the first...

Additional Business Textbook Solutions

Find more solutions based on key concepts

E2-13 Identifying increases and decreases in accounts and normal balances

Learning Objective 2

Insert the mis...

Horngren's Accounting (12th Edition)

Determine the FW of the following engineering project when the MARR is 15% per year. Is the project acceptable?...

Engineering Economy (17th Edition)

What is a beta? How is it used to calculate r, the investor’s required rate of return?

Foundations Of Finance

Quick ratio and current ratio (Learning Objective 7) 1520 min. Consider the following data COMPANY A B C D Cash...

Financial Accounting, Student Value Edition (5th Edition)

The weaknesses of payback period method of calculation. Introduction: Every investment requires a time period t...

Gitman: Principl Manageri Finance_15 (15th Edition) (What's New in Finance)

What is the relationship between management by exception and variance analysis?

Horngren's Cost Accounting: A Managerial Emphasis (16th Edition)

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

- Principles of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning  College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College PubCentury 21 Accounting Multicolumn JournalAccountingISBN:9781337679503Author:GilbertsonPublisher:Cengage

College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College PubCentury 21 Accounting Multicolumn JournalAccountingISBN:9781337679503Author:GilbertsonPublisher:Cengage Survey of Accounting (Accounting I)AccountingISBN:9781305961883Author:Carl WarrenPublisher:Cengage Learning

Survey of Accounting (Accounting I)AccountingISBN:9781305961883Author:Carl WarrenPublisher:Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:9781947172685

Author:OpenStax

Publisher:OpenStax College

Financial Accounting

Accounting

ISBN:9781337272124

Author:Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:Cengage Learning

Financial Accounting

Accounting

ISBN:9781305088436

Author:Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:Cengage Learning

College Accounting (Book Only): A Career Approach

Accounting

ISBN:9781337280570

Author:Scott, Cathy J.

Publisher:South-Western College Pub

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:9781337679503

Author:Gilbertson

Publisher:Cengage

Survey of Accounting (Accounting I)

Accounting

ISBN:9781305961883

Author:Carl Warren

Publisher:Cengage Learning

Accounting Changes and Error Analysis: Intermediate Accounting Chapter 22; Author: Finally Learn;https://www.youtube.com/watch?v=c2uQdN53MV4;License: Standard Youtube License