FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

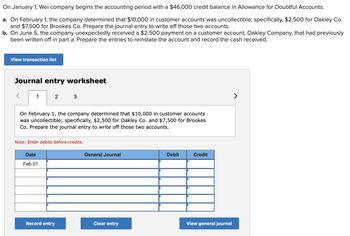

Transcribed Image Text:On January 1, Wei company begins the accounting period with a $46,000 credit balance in Allowance for Doubtful Accounts.

a. On February 1, the company determined that $10,000 in customer accounts was uncollectible; specifically, $2,500 for Oakley Co.

and $7,500 for Brookes Co. Prepare the journal entry to write off those two accounts.

b. On June 5, the company unexpectedly received a $2,500 payment on a customer account, Oakley Company, that had previously

been written off in part a. Prepare the entries to reinstate the account and record the cash received.

View transaction list

Journal entry worksheet

1

2

On February 1, the company determined that $10,000 in customer accounts

was uncollectible; specifically, $2,500 for Oakley Co. and $7,500 for Brookes

Co. Prepare the journal entry to write off those two accounts.

Date

Feb 01

3

Note: Enter debits before credits.

Record entry

General Journal

Clear entry

Debit

Credit

View general journal

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Note:- Do not provide handwritten solution. Maintain accuracy and quality in your answer. Take care of plagiarism. Answer completely. You will get up vote for sure.arrow_forwardOn December 31, Year 1, the Loudoun Corporation estimated that 3% of its credit sales of $112.500 would be uncollectible. Loudoun uses the allowance method. On February 15, Year 2, one of Loudoun's customers failed to pay his $1,050 account and the account was written off. On April 4, Year 2, this customer paid Loudoun the $1,050. Which of the following correctly states the effect of Loudoun's recording the restablishment of the receivable on April 4, Year 2? Cash 蛋蛋蛋白 NA a. b. NA C. NA d. NA Assets Multiple Choice + Net Realizable Value - 1,050 (1,050) (1,050) (1,050) 1,050 (1,050) Option A Option Balance Sheet Option C Liabilities + Accounts Payable + NA + NA (1,050) 1,050 + Stockholders' Equity Retained earnings NA (1,050) NA NA Common Stock NA NA NA (1,050) Revenue NA (1,050) NA NA Income Statement Expenses NA NA NA 1,050. = Net Income NA (1,050) NA (1,050) Statement of Cash Flows NA NA NA NAarrow_forwardPrior to recording the following, Elite Electronics, Incorporated, had a credit balance of $2,200 in its Allowance for Doubtful Accounts. Required: Prepare journal entries for each transaction. (If no entry is required for a transaction/event, select "No Journal Entry Required" in the first account field.) On August 31, a customer balance for $320 from a prior year was determined to be uncollectible and was written off. On December 15, the customer balance for $320 written off on August 31 was collected in full.arrow_forward

- The following information applies to the questions displayed below.] On December 31, Jarden Company's Allowance for Doubtful Accounts has an unadjusted credit balance of $ 14,500. Jarden prepares a schedule of its December 31 accounts receivable by age. Accounts Receivable Age of Accounts Receivable Expected Percent Uncollectible $ 830,000 Not yet due 1.25 % 254,000 1 to 30 days past due 2.00 86,000 31 to 60 days past due 6.50 38,000 61 to 90 days past due 32.75 12,000 Over 90 days past due 68.00 2. Prepare the adjusting entry to record bad debts expense at December 31. Record the estimated ba debts. Required information 1 Record the estimated bad debts. Note: Enter debits before credits. Date December 31 General Journal Debit Credit Record entry Clear entry View general journalarrow_forwardPrior to recording the following, Elite Electronics, Inc., had a credit balance of $2,200 in its Allowance for Doubtful Accounts a. On August 31, a customer balance for $320 from a prior year was determined to be uncollectible and was written off. b. On December 15, the customer balance for $320 written off on August 31 was collected in full. Required: For each transaction listed above, indicate the amount and direction (+for increase, - for decrease) of effects on the financial statement accounts and on the overall accounting equation. Hint: On December 15th, first reinstate the Accounts receivable and then record the collection of cash. (Enter any decreases to Assets, Liabilities, or Stockholders Equity with a minus sign.) Assets Liabilities Stockholders' Equity b(2)arrow_forwardRecRoom Equipment Company received an $8,000, six-month, 6 percent note to settle an $8,000unpaid balance owed by a customer. Prepare journal entries to record the following transactionsfor RecRoom. Rather than use letters to reference each transaction, use the date of the transaction.a. The note is accepted by RecRoom on November 1, causing the company to increase its NotesReceivable and decrease its Accounts Receivable.b. RecRoom adjusts its records for interest earned to its December 31 year-end.c. RecRoom receives the interest on the note’s maturity date.d. RecRoom receives the principal on the note’s maturity date.arrow_forward

- Harrow_forwardQuantum Solutions Company, a computer consulting firm, has decided to write off the $33,550 balance of an account owed by a customer, Alliance Inc. Required: On March 1, journalize the entry to record the write-off, assuming that (a) the direct write-off method is used and (b) the allowance method is used. Refer to the Chart of Accounts for exact wording of account titles. CHART OF ACCOUNTS Quantum Solutions Company General Ledger ASSETS 110 Cash 111 Petty Cash 121 Accounts Receivable-Alliance Inc. 129 Allowance for Doubtful Accounts 131 Interest Receivable 132 Notes Receivable 141 Merchandise Inventory 145 Office Supplies 146 Store Supplies 151 Prepaid Insurance 181 Land 191 Store Equipment 192 Accumulated Depreciation-Store Equipment 193 Office Equipment 194 Accumulated Depreciation-Office Equipment LIABILITIES 210 Accounts Payable 211 Salaries Payable 213 Sales Tax Payable 214 Interest Payable 215…arrow_forward! Required information [The following information applies to the questions displayed below.] On December 31, Jarden Company's Allowance for Doubtful Accounts has an unadjusted credit balance of $16,000. Jarden prepares a schedule of its December 31 accounts receivable by age. Accounts Receivable $ 820,000 Age of Accounts Receivable Not yet due Expected Percent Uncollectible 1.30% 328,000 1 to 30 days past due 2.05 65,600 31 to 60 days past due 6.55 32,800 13,120 61 to 90 days past due Over 90 days past due 33.00 69.00 2. Prepare the adjusting entry to record bad debts expense at December 31. Note: Round percentage answers to nearest whole percent. Do not round intermediate calculations.arrow_forward

- Abbott Company uses the allowance method of accounting for uncollectible receivables. Abbott estimates that 1% of credit sales will be uncollectible. On January 1, Ailowance for Doubtful Accounts had a credit balance of $3,000. During the year, Abbott wrote off accounts receivable totaling $2,500 and made credit sales of $106,000. There were no sales returns during the year. After the adjusting entry, the December 31 balance in Bad Debt Expense will be Ca. $1.060 Ob. $1.500 Oc. $4.060 Od. $1.560arrow_forwardOn January 1, Wei Company begins the accounting period with a $42,000 credit balance in Allowance for Doubtful Accounts. a. On February 1, the company determined that $9,200 in customer accounts was uncollectible; specifically, $2,100 for Oakley Company and $7,100 for Brookes Company Prepare the journal entry to write off those two accounts. b. On June 5, the company unexpectedly received a $2,100 payment on a customer account, Oakley Company, that had previously been written off in part a. Prepare the entries to reinstate the account and record the cash received. View transaction list Journal entry worksheet 1 2 3 > On February 1, the company determined that $9,200 in customer accounts was uncollectible; specifically, $2,100 for Oakley Company and $7,100 for Brookes Company. Prepare the journal entry to write off those two accounts. Note: Enter debits before credits. Date General Journal Debit Credit February 01arrow_forwardOn December 31, 20X1, the company reported a debit balance of $100,000 in accounts receivable and a credit balance of $1,500 in the allowance for doubtful accounts. December 31 is the company’s reporting date. During 20X2, the company had the following transactions: The company made a credit sale of $400,000. The company wrote off the uncollectible accounts for $14,000. The company collected the receivable of $6,000 that had been written off previously. Prepare journal entries to record the above three transactions. Assume that 1% of the company’s accounts receivable cannot be collected, prepare journal entry to record bad debt expense at the end of 20X2.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education