Managerial Accounting

15th Edition

ISBN: 9781337912020

Author: Carl Warren, Ph.d. Cma William B. Tayler

Publisher: South-Western College Pub

expand_more

expand_more

format_list_bulleted

Question

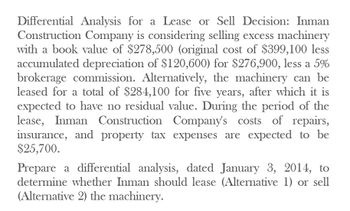

Transcribed Image Text:Differential Analysis for a Lease or Sell Decision: Inman

Construction Company is considering selling excess machinery

with a book value of $278,500 (original cost of $399,100 less

accumulated depreciation of $120,600) for $276,900, less a 5%

brokerage commission. Alternatively, the machinery can be

leased for a total of $284,100 for five years, after which it is

expected to have no residual value. During the period of the

lease, Inman Construction Company's costs of repairs,

insurance, and property tax expenses are expected to be

$25,700.

Prepare a differential analysis, dated January 3, 2014, to

determine whether Inman should lease (Alternative 1) or sell

(Alternative 2) the machinery.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- PROVIDE Answer with calculation and explanationarrow_forwardAnswerarrow_forward1. Differential Analysis for a Lease-or-Sell Decision Inman Construction Company is considering selling excess machinery with a book value of $279,300 (original cost of $399,200 less accumulated depreciation of $119,900) for $276,600, less a 5% brokerage commission. Alternatively, the machinery can be leased to another company for a total of $283,600 for five years, after which it is expected to have no residual value. During the period of the lease, Inman Construction Company's costs of repairs, insurance, and property tax expenses are expected to be $25,100. 2. Differential Analysis for a Discontinued Product A condensed income statement by product line for Crown Beverage Inc. indicated the following for King Cola for the past year: Sales $234,500 Cost of goods sold 112,000 Gross profit $122,500 Operating expenses 143,000 Loss from operations $(20,500) It is estimated that 16% of the cost of goods sold represents fixed factory overhead costs and that 18% of the…arrow_forward

- Want such correct optionarrow_forwardDifferential Analysis for a Lease-or-Sell Decision Sure-Bilt Construction Company is considering selling excess machinery with a book value of $280,600 (original cost of $398,600 less accumulated depreciation of $118,000) for $277,700, less a 5% brokerage commission. Alternatively, the machinery can be leased to another company for a total of $286,000 for five years, after which it is expected to have no residual value. During the period of the lease, Sure-Bilt Construction Company's costs of repairs, insurance, and property tax expenses are expected to be $26,500. Question Content Area a. Prepare a differential analysis, dated May 25 to determine whether Sure-Bilt should lease (Alternative 1) or sell (Alternative 2) the machinery. For those boxes in which you must enter subtracted or negative numbers use a minus sign. Differential AnalysisLease Machinery (Alt. 1) or Sell Machinery (Alt. 2)May 25 Lease Machinery(Alternative 1) Sell Machinery(Alternative 2) Differential…arrow_forwardDifferential Analysis for a Lease-or-Sell Decision Sure-Bilt Construction Company is considering selling excess machinery with a book value of $283,000 (original cost of $401,300 less accumulated depreciation of $118,300) for $276,900, less a 5% brokerage commission. Alternatively, the machinery can be leased to another company for a total of $285,900 for five years, after which it is expected to have no residual value. During the period of the lease, Sure-Bilt Construction Company's costs of repairs, insurance, and property tax expenses are expected to be $26,300. a. Prepare a differential analysis, dated May 25 to determine whether Sure-Bilt should lease (Alternative 1) or sell (Alternative 2) the machinery. For those boxes in which you must enter subtracted or negative numbers use a minus sign. Differential Analysis Lease Machinery (Alt. 1) or Sell Machinery (Alt. 2) May 25 Differential Effect on Income (Alternative 2) Lease Machinery Sell Machinery (Alternative 1) (Alternative 2)…arrow_forward

- Differential Analysis for a Lease-or-Sell Decision Sure-Bilt Construction Company is considering selling excess machinery with a book value of $281,400 (original cost of $400,900 less accumulated depreciation of $119,500) for $275,200, less a 5% brokerage commission. Alternatively, the machinery can be leased to another company for a total of $286,100 for five years, after which it is expected to have no residual value. During the period of the lease, Sure-Bilt Construction Company's costs of repairs, insurance, and property tax expenses are expected to be $26,400. a. Prepare a differential analysis, dated May 25 to determine whether Sure-Bilt should lease (Alternative 1) or sell (Alternative 2) the machinery. For those boxes in which you must enter subtracted or negative numbers use a minus sign. Differential Analysis Lease Machinery (Alt. 1) or Sell Machinery (Alt. 2) May 25 Lease Machinery(Alternative 1) Sell Machinery(Alternative 2) Differential Effects(Alternative…arrow_forwardDiff Analysis & Product Pricing:arrow_forwardDifferential Analysis for a Lease-or-Sell Decision Inman Construction Company is considering selling excess machinery with a book value of $280,200 (original cost of $398,800 less accumulated depreciation of $118,600) for $274,600, less a 5% brokerage commission. Alternatively, the machinery can be leased to another company for a total of $285,500 for five years, after which it is expected to have no residual value. During the period of the lea Inman Construction Company's costs of repairs, insurance, and property tax expenses are expected to be $24,800. a. Prepare a differential analysis, dated May 25 to determine whether Inman should lease (Alternative 1) or sell (Alternative 2) the machinery. For those boxes in which you must enter subtracted or negative numbers use a minus sign. Revenues Costs Differential Analysis Lease Machinery (Alt. 1) or Sell Machinery (Alt. 2) May 25 Income (Loss) Lease Machinery Sell Machinery (Alternative 1) (Alternative 2) EU Differential Effect on Income…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial Accounting

Accounting

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:South-Western College Pub