Intermediate Financial Management (MindTap Course List)

13th Edition

ISBN: 9781337395083

Author: Eugene F. Brigham, Phillip R. Daves

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Question

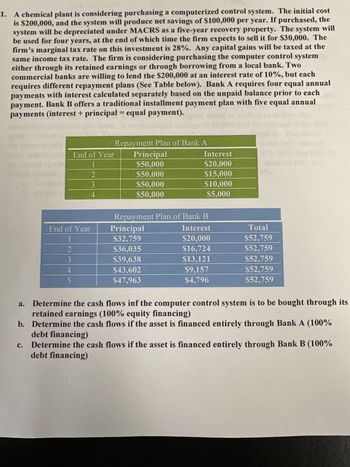

Transcribed Image Text:1. A chemical plant is considering purchasing a computerized control system. The initial cost

is $200,000, and the system will produce net savings of $100,000 per year. If purchased, the

system will be depreciated under MACRS as a five-year recovery property. The system will

be used for four years, at the end of which time the firm expects to sell it for $30,000. The

firm's marginal tax rate on this investment is 28%. Any capital gains will be taxed at the

same income tax rate. The firm is considering purchasing the computer control system

either through its retained earnings or through borrowing from a local bank. Two

commercial banks are willing to lend the $200,000 at an interest rate of 10%, but each

requires different repayment plans (See Table below). Bank A requires four equal annual

payments with interest calculated separately based on the unpaid balance prior to each

payment. Bank B offers a traditional installment payment plan with five equal annual

payments (interest + principal = equal payment).

End of Year

1

234

Repayment Plan of Bank A

Principal

$50,000

$50,000

$50,000

$50,000

Interest

$20,000

$15,000

$10,000

$5,000

Repayment Plan of Bank B

End of Year

Principal

Interest

Total

$32,759

$20,000

$52,759

4

2345

$36,035

$16,724

$52,759

$39,638

$13,121

$52,759

$43,602

$9,157

$52,759

$47,963

$4,796

$52,759

a.

Determine the cash flows inf the computer control system is to be bought through its

retained earnings (100% equity financing)

b. Determine the cash flows if the asset is financed entirely through Bank A (100%

debt financing)

C.

Determine the cash flows if the asset is financed entirely through Bank B (100%

debt financing)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- The Rodriguez Company is considering an average-risk investment in a mineral water spring project that has an initial after-tax cost of 170,000. The project will produce 1,000 cases of mineral water per year indefinitely, starting at Year 1. The Year-1 sales price will be 138 per case, and the Year-1 cost per case will be 105. The firm is taxed at a rate of 25%. Both prices and costs are expected to rise after Year 1 at a rate of 6% per year due to inflation. The firm uses only equity, and it has a cost of capital of 15%. Assume that cash flows consist only of after-tax profits because the spring has an indefinite life and will not be depreciated. a. What is the present value of future cash flows? (Hint: The project is a growing perpetuity, so you must use the constant growth formula to find its NPV.) What is the NPV? b. Suppose that the company had forgotten to include future inflation. What would they have incorrectly calculated as the projects NPV?arrow_forwardAlthough the Chen Company’s milling machine is old, it is still in relatively good working order and would last for another 10 years. It is inefficient compared to modern standards, though, and so the company is considering replacing it. The new milling machine, at a cost of $110,000 delivered and installed, would also last for 10 years and would produce after-tax cash flows (labor savings and depreciation tax savings) of $19,000 per year. It would have zero salvage value at the end of its life. The project cost of capital is 10%, and its marginal tax rate is 25%. Should Chen buy the new machine?arrow_forwardEach of the following scenarios is independent. All cash flows are after-tax cash flows. Required: 1. Patz Corporation is considering the purchase of a computer-aided manufacturing system. The cash benefits will be 800,000 per year. The system costs 4,000,000 and will last eight years. Compute the NPV assuming a discount rate of 10 percent. Should the company buy the new system? 2. Sterling Wetzel has just invested 270,000 in a restaurant specializing in German food. He expects to receive 43,470 per year for the next eight years. His cost of capital is 5.5 percent. Compute the internal rate of return. Did Sterling make a good decision?arrow_forward

- Friedman Company is considering installing a new IT system. The cost of the new system is estimated to be 2,250,000, but it would produce after-tax savings of 450,000 per year in labor costs. The estimated life of the new system is 10 years, with no salvage value expected. Intrigued by the possibility of saving 450,000 per year and having a more reliable information system, the president of Friedman has asked for an analysis of the projects economic viability. All capital projects are required to earn at least the firms cost of capital, which is 12 percent. Required: 1. Calculate the projects internal rate of return. Should the company acquire the new IT system? 2. Suppose that savings are less than claimed. Calculate the minimum annual cash savings that must be realized for the project to earn a rate equal to the firms cost of capital. Comment on the safety margin that exists, if any. 3. Suppose that the life of the IT system is overestimated by two years. Repeat Requirements 1 and 2 under this assumption. Comment on the usefulness of this information.arrow_forwardGina Ripley, president of Dearing Company, is considering the purchase of a computer-aided manufacturing system. The annual net cash benefits and savings associated with the system are described as follows: The system will cost 9,000,000 and last 10 years. The companys cost of capital is 12 percent. Required: 1. Calculate the payback period for the system. Assume that the company has a policy of only accepting projects with a payback of five years or less. Would the system be acquired? 2. Calculate the NPV and IRR for the project. Should the system be purchasedeven if it does not meet the payback criterion? 3. The project manager reviewed the projected cash flows and pointed out that two items had been missed. First, the system would have a salvage value, net of any tax effects, of 1,000,000 at the end of 10 years. Second, the increased quality and delivery performance would allow the company to increase its market share by 20 percent. This would produce an additional annual net benefit of 300,000. Recalculate the payback period, NPV, and IRR given this new information. (For the IRR computation, initially ignore salvage value.) Does the decision change? Suppose that the salvage value is only half what is projected. Does this make a difference in the outcome? Does salvage value have any real bearing on the companys decision?arrow_forwardYour company is considering a new computer system that will initially cost $1 million. It will save $400,000 a year in inventory and receivables management costs. The system is expected to last for five years and will be depreciated using 3-year MACRS. The system is expected to have a salvage value of $50,000 at the end of year 5. The project will require an initial $20,000 investment in net working capital and the marginal tax rate is 40%. The required return is 8%. 0 OCF NCS NWC CFFA Year 1 $373,320 - $1,000,000 $ 20,000 - $1,020,000 $373,320 - Answer: What is the correct vaule for blank ? 2 ($) ($ @ ) 3 4 5 $299,280 $269,640 $ 240,000 ($ @ ) ($ @ ) ($ ® ) With all this, the NPV of the project is ($). Therefore, this project should be accepted. $299,280 $269,640arrow_forward

- 1. Your company is considering a new computer system initially costing $1.25 million. It will save $400,000 per year in inventory and receivables management costs. The system is expected to last for five years and will be depreciated using 3-year MACRS. The system is expected to have a salvage value of $25,000 at the end of year 5. There is no impact on net working capital. The marginal tax rate is 21 %. The required return is 9%. Calculate the NPV and IRR for the project.arrow_forwardXYZ is considering buying a new, high efficiency interception system. The new system would be purchased today for $47,700.00. It would be depreciated straight-line to SO over 2 years. In 2 years, the system would be sold for an after-tax cash flow of $14,600.00. Without the system, costs are expected to be $100,000.00 in 1 year and $100,000.00 in 2 years. With the system, costs are expected to be $79,000.00 in 1 year and $69,700.00 in 2 years. If the tax rate is 46.50% and the cost of capital is 8.40%, what is the net present value of the new interception system project? a. $11893.11 (plus or minus $50) b. $12724.27 (plus or minus $50) c. $8553.76 (plus or minus $50) d. $9953.14 (plus or minus $50) e. None of the above is within $50 of the correct answerarrow_forwardGenesis Corporation want to purchase a piece of machinery for $150,000 that will cost $20,000 to have it delivered and installed. Based on past information, they believe they can sell the machinery for $25,000 in 5 years. The company’s marginal tax rate is 34%. If the applicable CCA rate is 20% and the required return on this project is 15%, what is the present value of the CCA tax shield?arrow_forward

- b) You purchase equipment for $50,000 and it costs $5,000 to have it delivered and installed. Based on past information, you believe that you can sell the equipment for $8,500 when you are done with it in 3 years. The company's marginal tax rate is 20%. If the applicable CCA rate is 10% and the required return on this project is 5%, what is the present value of the CCA tax shield by using the formula (10 Marks) IdTc 1+0.5r 1 PV tax shield on CCA Hea d+r 1+r d+r (1 + r)" redictions: On Ps video DELLarrow_forwardRiver Corporation wants to purchase a new machine for its plant. The new machine is expected to generate annual after tax cash savings of $300,000 for four years. The machine will have no residual value at the end of its useful life. The company has a required rate of return of 12% and a tax rate of 35%. What is the maximum dollar amount River Corporation would be willing to spend for the new machine? Round your answer to the nearest dollar. a. $300,000 b. $336,000 c. $592,283 d. $911,205 e. $683,404 f. $599,084 g. $672,014 h. None of the above 4.arrow_forwardA corporation is considering purchasing a machine that will save $150,000 per year before taxes. The cost of operating the machine (including maintenance) is $30,000 per year. The machine will be needed for five years, after which it will have a zero salvage value. MACRS depreciation will be used, assuming a three-year class life. The marginal income tax rate is 25%. If the firm wants 15% return on investment after taxes, how much can it afford to pay for this machine? Click the icon to view the MACRS depreciation schedules Click the icon to view the interest factors for discrete compounding when /- 15% per year. If the firm wants 15% return on investment after taxes, it can afford to pay thousand for this machine. (Round to one decimal place.)arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Intermediate Financial Management (MindTap Course...

Finance

ISBN:9781337395083

Author:Eugene F. Brigham, Phillip R. Daves

Publisher:Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:9781337514835

Author:MOYER

Publisher:CENGAGE LEARNING - CONSIGNMENT

Cornerstones of Cost Management (Cornerstones Ser...

Accounting

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Cengage Learning