Principles of Accounting Volume 1

19th Edition

ISBN: 9781947172685

Author: OpenStax

Publisher: OpenStax College

expand_more

expand_more

format_list_bulleted

Textbook Question

Chapter 7, Problem 1PA

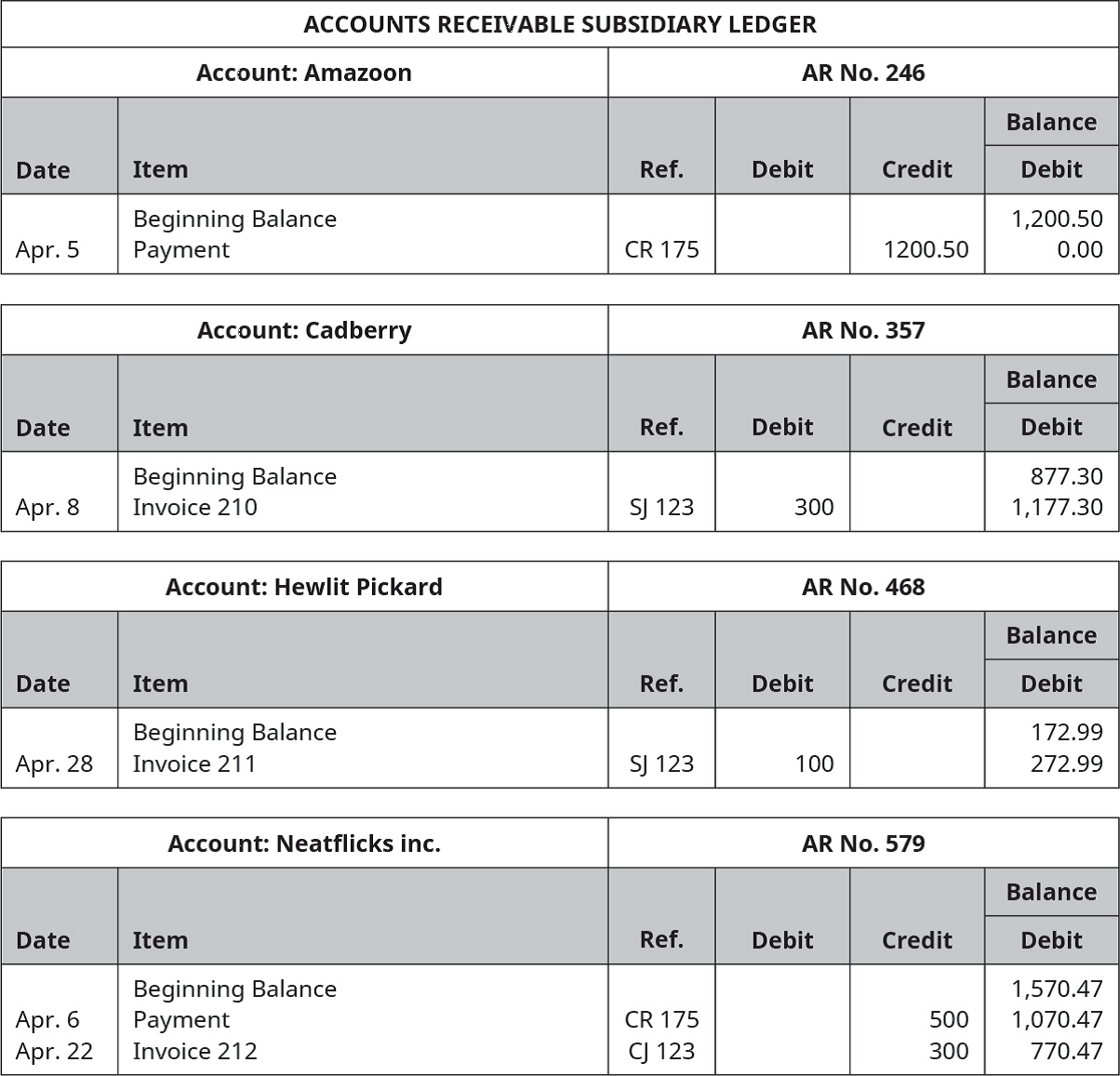

On June 30, Oscar Inc.’s bookkeeper is preparing to close the books for the month. The

Expert Solution & Answer

Trending nowThis is a popular solution!

Students have asked these similar questions

Give me Answer

Don't use ai given answer accounting questions

Need answer

Chapter 7 Solutions

Principles of Accounting Volume 1

Ch. 7 - So far, computer systems cannot yet ________. A....Ch. 7 - Any device used to provide the results of...Ch. 7 - Source documents ________. A. are input devices B....Ch. 7 - All of the following can provide source data...Ch. 7 - A document that asks you to return an identifying...Ch. 7 - Which of the following is false about accounting...Ch. 7 - An unhappy customer just returned $50 of the items...Ch. 7 - A customer just charged $150 of merchandise on the...Ch. 7 - A customer just charged $150 of merchandise using...Ch. 7 - The company just took a physical count of...

Ch. 7 - Your company paid rent of $1,000 for the month...Ch. 7 - On January 1, Incredible Infants sold goods to...Ch. 7 - Received a check for $72 from a customer, Mr....Ch. 7 - You returned damaged goods you had previously...Ch. 7 - Sold goods for $650 cash. Which journal would the...Ch. 7 - Sandren Co. purchased inventory on credit from...Ch. 7 - Sold goods for $650, credit terms net 30 days....Ch. 7 - You returned damaged goods to C.C. Rogers Inc. and...Ch. 7 - The sum of all the accounts in the accounts...Ch. 7 - AB Inc. purchased inventory on account from YZ...Ch. 7 - You just posted a debit to ABC Co. in the accounts...Ch. 7 - You just posted a credit to Stars Inc. in the...Ch. 7 - You just posted a debit to Cash in the general...Ch. 7 - You just posted a credit to Accounts Receivable....Ch. 7 - You just posted a credit to Sales and a debit to...Ch. 7 - An enterprise resource planning (ERP) system...Ch. 7 - Which of the following is not a way to prevent...Ch. 7 - Big data is mined ________. A. to find business...Ch. 7 - Artificial intelligence refers to ________. A....Ch. 7 - Blockchain is a technology that ________. A. is in...Ch. 7 - Which of the following is not true about...Ch. 7 - Why does a student need to understand how to use a...Ch. 7 - Provide an example of how paper-based accounting...Ch. 7 - Why are scanners better than keyboards?Ch. 7 - Why are there so many different accounting...Ch. 7 - Which area of accounting needs a computerized...Ch. 7 - The American Institute of Certified Public...Ch. 7 - Which special journals also require an entry to a...Ch. 7 - What is a schedule of accounts receivable?Ch. 7 - How often do we post the cash column in the cash...Ch. 7 - The schedule of accounts payable should equal...Ch. 7 - Which amounts do we post daily and which do we...Ch. 7 - Why are special journals used?Ch. 7 - Name the four main special journals.Ch. 7 - A journal entry that requires a debit to Accounts...Ch. 7 - The purchase of equipment for cash would be...Ch. 7 - Can a sales journal be used to record sales on...Ch. 7 - When should entries from the sales journal be...Ch. 7 - We record a sale on account that involves sales...Ch. 7 - We record purchases of inventory for cash in which...Ch. 7 - Should the purchases journal have a column that is...Ch. 7 - Forensic means suitable for use in a court of law....Ch. 7 - For each of the following, indicate if the...Ch. 7 - All of the following information pertains to...Ch. 7 - Match the special journal you would use to record...Ch. 7 - For each of the transactions, state which special...Ch. 7 - Catherines Cookies has a beginning balance in the...Ch. 7 - Record the following transactions in the sales...Ch. 7 - Record the following transactions in the cash...Ch. 7 - Maddie Inc. has the following transactions for its...Ch. 7 - For each of the following, indicate if the...Ch. 7 - The following information pertains to Crossroads...Ch. 7 - Match the special journal you would use to record...Ch. 7 - For each of the following transactions, state...Ch. 7 - Catherines Cookies has a beginning balance in the...Ch. 7 - Record the following transactions in the purchases...Ch. 7 - Record the following transactions in the cash...Ch. 7 - Piedmont Inc. has the following transactions for...Ch. 7 - On June 30, Oscar Inc.s bookkeeper is preparing to...Ch. 7 - Evie Inc. has the following transactions during...Ch. 7 - Use the journals and ledgers that follow. Total...Ch. 7 - Brown Inc. records purchases in a purchases...Ch. 7 - On June 30, Isner Inc.s bookkeeper is preparing to...Ch. 7 - Use the journals and ledgers that follows. Total...Ch. 7 - Why must the Accounts Receivable account in the...Ch. 7 - Why would a company use a subsidiary ledger for...Ch. 7 - If a customer owed your company $100 on the first...

Additional Business Textbook Solutions

Find more solutions based on key concepts

Trade Notes Payables. On February 1, Seville Sales, Inc. purchased Inventory costing 450,000 using a 6-month tr...

Intermediate Accounting (2nd Edition)

5. Which inventory costing method results in the lowest net income during a period of rising inventory costs?

W...

Horngren's Financial & Managerial Accounting, The Financial Chapters (Book & Access Card)

Preference for current ratio and quick ratio. Introduction: Current ratio explains the liquidity position of a ...

Gitman: Principl Manageri Finance_15 (15th Edition) (What's New in Finance)

What is an action plan? Why are action plans such an important part of market planning? Why is it so important ...

MARKETING:REAL PEOPLE,REAL CHOICES

Tennessee Tool Works (TTW) is considering investment in five independent projects, Any profitable combination o...

Engineering Economy (17th Edition)

1-13. Identify a product, either a good or a service, that will take advantage of this opportunity. Although yo...

Business Essentials (12th Edition) (What's New in Intro to Business)

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Provide answerarrow_forwardCompute the depreciation chargearrow_forwardFor its inspecting cost pool, Brilliant Professor Mullen Company expected an overhead cost of $360,000 and an estimated 14,200 inspections. The actual overhead cost for that cost pool was $395,000 for 16,000 actual inspections. The activity-based overhead rate (ABOR) used to assign the costs of the inspecting cost pool to products is __.arrow_forward

- Can you help me with accounting questionsarrow_forwardCompute the depreciation charge for 2016arrow_forwardFor this year, Jackson Enterprises has $25,000 net earnings on the income statement and $10,000 net cash inflow from operating activities, $18,000 net cash outflow from investing activities, and $22,000 cash inflow from financing activities on the statement of cash flows. What is the accruals total reported for this period?arrow_forward

- What was the cost of goods sold?arrow_forwardTrue option? General accountingarrow_forwardAide Industries is a division of a major corporation. Data concerning the most recent year appears below: Sales Net operating income $18,310,000 $920,000 Average operating assets $6,300,000 The division's margin-is closest to:arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

- Principles of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub

College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub  Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning Survey of Accounting (Accounting I)AccountingISBN:9781305961883Author:Carl WarrenPublisher:Cengage LearningCentury 21 Accounting Multicolumn JournalAccountingISBN:9781337679503Author:GilbertsonPublisher:Cengage

Survey of Accounting (Accounting I)AccountingISBN:9781305961883Author:Carl WarrenPublisher:Cengage LearningCentury 21 Accounting Multicolumn JournalAccountingISBN:9781337679503Author:GilbertsonPublisher:Cengage

Principles of Accounting Volume 1

Accounting

ISBN:9781947172685

Author:OpenStax

Publisher:OpenStax College

Financial Accounting

Accounting

ISBN:9781305088436

Author:Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:Cengage Learning

College Accounting (Book Only): A Career Approach

Accounting

ISBN:9781337280570

Author:Scott, Cathy J.

Publisher:South-Western College Pub

Financial Accounting

Accounting

ISBN:9781337272124

Author:Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:9781305961883

Author:Carl Warren

Publisher:Cengage Learning

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:9781337679503

Author:Gilbertson

Publisher:Cengage

Accounting Changes and Error Analysis: Intermediate Accounting Chapter 22; Author: Finally Learn;https://www.youtube.com/watch?v=c2uQdN53MV4;License: Standard Youtube License