Auditing: A Risk Based-Approach (MindTap Course List)

11th Edition

ISBN: 9781337619455

Author: Karla M Johnstone, Audrey A. Gramling, Larry E. Rittenberg

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Question

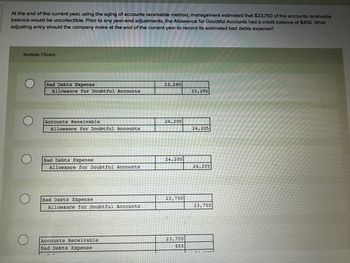

Transcribed Image Text:At the end of the current year, using the aging of accounts receivable method, management estimated that $23,750 of the accounts receivable

balance would be uncollectible. Prior to any year-end adjustments, the Allowance for Doubtful Accounts had a credit balance of $455. What

adjusting entry should the company make at the end of the current year to record its estimated bad debts expense?

Multiple Choice

Bad Debts Expense

23,295

Allowance for Doubtful Accounts

23,295

О

Accounts Receivable

24,205

Allowance for Doubtful Accounts

24,205

О

Bad Debts Expense

24,205

Allowance for Doubtful Accounts

24,205

Bad Debts Expense

Allowance for Doubtful Accounts

Accounts Receivable

Bad Debts Expense

23,750

23,750

23,750

455

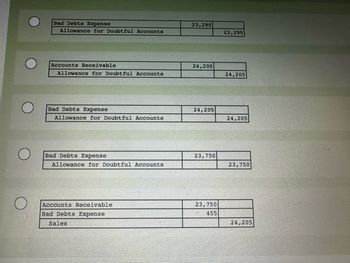

Transcribed Image Text:Bad Debts Expense

Allowance for Doubtful Accounts

23,295

23,295

Accounts Receivable

24,205

Allowance for Doubtful Accounts

24,205

Bad Debts Expense

24,205

Allowance for Doubtful Accounts

24,205

Bad Debts Expense

Allowance for Doubtful Accounts

Accounts Receivable

Bad Debts Expense

Sales

23,750

23,750

23,750

455

24,205

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Multiple Choice Bad Debts Expense Allowance for Doubtful Accounts Accounts Receivable Bad Debts Expense Sales 21,750 21,750 21,750 575 22,325 Bad Debts Expense 22,325 Allowance for Doubtful Accounts 22,325 Bad Debts Expense Allowance for Doubtful Accounts 21,175 21,175 Accounts Receivable 22,325 Allowance for Doubtful Accounts 22,325arrow_forwardQuestion 3 of 8 > -/2 View Policies Current Attempt in Progress What is the journal entry to record an uncollectible accounts receivable? Bad Debt Expense XXX Allowance for Doubtful Accounts XXX Bad Debt Expenses XXX Accounts Receivable XXX Accounts Receivable XXX Allowance for Doubtful Accounts XXX Allowance for Doubtful Accounts XXX Accounts Receivable XXX Save for Later Attempts: 0 of 1 used Submit Ansarrow_forwardQUESTION 10 Match the term on the left to the appropriate classification or description on the right. v Allowance for doubtful accounts A. Discounts for early payment of A/R, recorded as contra- revenues v Net accounts receivable B. An account that the firm credits when it records bad debt v Sales discounts expense v Write-offs of A/R C. Entries that reduce gross accounts receivable D. Gross accounts receivable minus Allowance for doubtful accountsarrow_forward

- Question 7arrow_forward8- Under allowance method,the journal entry to record uncollectible accounts expense is a. Dr. Allowance for Doubtful Accounts and Cr. Bad debts Expense b. Dr. Bad debts expense and Cr. Accounts Receivable c. Dr. Accounts Receivable and Cr. Bad debts expense d. Dr. Bad debts expense and Cr. Allowance for Doubtful Accountsarrow_forwardA B UD C |7. If bad debts expense is determined by estimating uncollectible accounts receivable, the entry to record the write-off of a specific uncollectible account would decrease: allowance for uncollectible accounts. net income. net book value of accounts receivable. bad debts expense. 8. If management intentionally underestimates bad debts expense, then net income is A overstated and assets are understated. B understated and assets are overstated C understated and assets are understated. D overstated and assets are overstated 9. Which of these items will not appear in the retained earnings statement? A Net Loss B Prior period adjustment, net of taxes с Cumulative effect on prior years of a change in accounting principles, net of tax D Dividends. E All of the above appear in the statement of retained earningsarrow_forward

- The difference between accounts receivable and allowance for doubtful accounts is O a. the bad debt expense O b. the net realizable value of accounts receivable O c. the accounts receivable turnover O d. none of these choicesarrow_forwardWhich of the following entries would be the appropriate entry for writing off an uncollectible account receivable under the allowance method? O Dr. Bad Debt Expense Cr. Accounts Receivable O Dr. Sales Cr. Accounts Receivable O Dr. Accounts Receivable Cr. Bad Debt Expense O Dr. Allowance for Doubtful Accounts Cr. Accounts Receivablearrow_forwardUnder allowance method, the journal entry to record uncollectible accounts expense is a. Dr. Bad debts expense & Cr. Accounts Receivable b. Dr. Allowance for Doubtful Accounts & Cr. Bad debts Expense c. Dr. Accounts Receivable & Cr. Bad debts expense d. Dr. Bad debts expense & Cr. Allowance for Doubtful Accountsarrow_forward

- Which accounting concept supports recording bad debt expense before accounts are actually uncollectible? a) Full disclosure principle b) Materiality concept c) Going concern concept d) Matching principlearrow_forward15-The accounts receivable that cannot be collected because of their bankruptcy or another reason are termed as a. Bad customers b. Uncollectible accounts c. Collectible accounts d. Doubtful accountsarrow_forwardAll bad debts balances should be removed from accounts receivable balances when they are determined to be uncollectible True o falsearrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Auditing: A Risk Based-Approach (MindTap Course L...AccountingISBN:9781337619455Author:Karla M Johnstone, Audrey A. Gramling, Larry E. RittenbergPublisher:Cengage Learning

Auditing: A Risk Based-Approach (MindTap Course L...AccountingISBN:9781337619455Author:Karla M Johnstone, Audrey A. Gramling, Larry E. RittenbergPublisher:Cengage Learning

Auditing: A Risk Based-Approach (MindTap Course L...

Accounting

ISBN:9781337619455

Author:Karla M Johnstone, Audrey A. Gramling, Larry E. Rittenberg

Publisher:Cengage Learning