FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

thumb_up100%

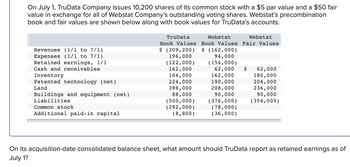

Transcribed Image Text:On July 1, TruData Company issues 10,200 shares of its common stock with a $5 par value and a $50 fair

value in exchange for all of Webstat Company's outstanding voting shares. Webstat's precombination

book and fair values are shown below along with book values for TruData's accounts.

Revenues (1/1 to 7/1)

Expenses (1/1 to 7/1)

Retained earnings, 1/1

Cash and receivables

Inventory

Patented technology (net)

Land

Buildings and equipment (net)

Liabilities

Common stock

Additional paid-in capital

Webstat

Webstat

Book Values Book Values Fair Values

$ (309,200)

196,000

(122,000)

162,000

164,000

224,000

398,000

88,000

(500,000)

(292,000)

(8,800)

TruData

$ (162,000)

94,000

(154,000)

62,000

162,000

190,000

208,000

90,000

(376,000)

(78,000)

(36,000)

$

62,000

180,000

204,000

236,000

90,000

(354,000)

On its acquisition-date consolidated balance sheet, what amount should TruData report as retained earnings as of

July 1?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Similar questions

- On July 1, 2021, Nall Co. issued 2,500 shares of its $10 par common stock and 5,000 shares of its $12 par preferred stock for a lump sum of $140,000. At this date Nall's common stock was selling for $18 per share and the preferred stock for $24 per share. A. Record the journal entry for this allocation and insurance using the proportional method. Record the journal entry for this allocation and issuance using the incremental method, assuming you do not have the market value for preferred stock.arrow_forwardTop-Value Corporation has 256,500 shares of $35 par common stock outstanding. On September 2, Top-Value Corporation declared a 3% stock dividend to be issued November 30 to stockholders of record on October 3. The market price of the stock was $50 per share on September 2. Required: Journalize the entries required on September 2, October 3, and November 30. If no entry is required, simply skip to the next transaction. Refer to the chart of accounts for the exact wording of the account titles. CNOW journals do not use lines for journal explanations. Every line on a journal page is used for debit or credit entries. CNOW journals will automatically indent a credit entry when a credit amount is entered.arrow_forwardQuestions # 21-22 are based on the following: Clothing Emporium was organized on January 1, 2021. The firm was authorized to issue 100,000 shares of $5 par value common stock. During 2021, Clothing Emporium had the following transactions relating to shareholders' equity: B. C. D. 21. What is the ending balance in the Retained Earnings account at the end of 2021? A. Jan. 1 Feb. 15 May 8 Oct. 2 ABCD B. Issued 30,000 shares of common stock at $7 per share. Issued 20,000 shares of common stock at $8 per share. Reported a net income of $100,000. Paid dividends of $50,000. $50,000. $370,000. $420,000. $100,000. 22. What is the total stockholders' equity at the end of 2021? A. $370,000. $420,000. C. $470,000. D. $320,000.arrow_forward

- Pro-Builders corporation has 1,500,000 shares par common stock outstanding. On September 2, pro- builders corporation declared a $3 stock dividend to be issued November 30 to stockholders of record on October 3. The market price of the stock was $36 per share on September 2. Journalize the entries required on September 2, October 3,and November 30. If no entry is required, simply skip to the next transaction.arrow_forwardAlma Corp. issues 1,120 shares of $7 par common stock at $15 per share. When the transaction is journalized, credits are made to a.Common Stock, $7,840 and Paid-In Capital in Excess of Par—Common Stock, $8,960. b.Common Stock, $16,800. c.Common Stock, $8,960 and Paid-In Capital in Excess of Stated Value, $7,840. d.Common Stock, $7,840 and Retained Earnings, $8,960.arrow_forwardIvanhoe Corporation has 10.50 million shares of common stock issued and outstanding. On June 1, the board of directors voted an 83 cents per share cash dividend to stockholders of record as of June 14, payable June 30. (a) Prepare the journal entries for each of the dates above assuming the dividend represents a distribution of earnings. (Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter 0 for the amounts.) Date Account Titles and Explanation ◄► A n Debit Creditarrow_forward

- On March 15, American eagle declares a quarterly cash dividend of $0.035 per-share payable on April 13 to all stockholders of record on March 30. Record American Eagle‘s declaration and payment of cash dividends for its 228 million shares. (If no entry is required for a transaction/event, select “ no journal entry required” in the first account field enter your answer in dollars not in millions)arrow_forwardClothing Frontiers began operations on January 1 and engages in the following transactions during the year related to stockholders' equity. January 1 Issues 700 shares of common stock for $34 per share. April 1 Issues 110 additional shares of common stock for $38 per share. 2. Record the transactions, assuming Clothing Frontiers has either $1 par value or $1 stated value common stock. (If no entry is required for a particular transaction/event, select "No Journal Entry Required" in the first account field.) View transaction list Journal entry worksheet 1 2 Record the issuance of 700 shares of common stock for $34 per share. Note: Enter debits before credits. Date General Journal Debit Credit January 01arrow_forwardOn May 27, Kick Off Inc. reacquired 3,000 shares of its common stock at $54 per share. On August 3, Kick Off sold 1,700 of the reacquired shares at $57 per share. November 14, Kick Off sold the remaining shares at $53 per share. Journalize the transactions of May 27, August 3, and November 14. For a compound transaction, if an amount box does not require an entry, leave it blank. May 27 Aug. 3 Nov. 14arrow_forward

- On February 14, Marine Company reacquired 7,500 shares of its common stock at $30 per share. On March 15, Marine sold 4,500 of the reacquired shares at $34 per share. On June 2, Marine sold the remaining shares at $28 per share. Required: Journalize the transactions of Februaryl4, March 5, and June 2.arrow_forwardVienna Corporation has 31,000 shares of $90 par common stock outstanding. On June 8, Vienna Corporation declared a 4% stock dividend to be issued August 12 to stockholders of record on July 13. The market price of the stock was $120 per share on June 8. Journalize the entries required on June 8, July 13, and August 12. For a compound transaction, if an amount box does not require an entry, leave it blank. If no entry is required, select "No Entry Required" and leave the amount boxes blank. Jun. 8 Stock Dividends Common Stock Paid-In Capital in Excess of Par-Common Stock Jul. 13 No Entry Required No Entry Required Aug. 12 Stock Dividends Distributable Common Stockarrow_forwardThe Sneed Corporation issues 12,700 shares of $46 par preferred stock for cash at $63 per share. The entry to record the transaction will consist of a debit to Cash for $800,100 and a credit or credits to: a.Preferred Stock for $584,200 and Retained Earnings for $215,900. b.Preferred stock for $584,200 and Paid-in Capital in Excess of Par Value−Preferred Stock for $215,900. c.Preferred Stock for $800,100. d.Paid-in Capital from Preferred Stock for $800,100.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education