Cornerstones of Cost Management (Cornerstones Series)

4th Edition

ISBN: 9781305970663

Author: Don R. Hansen, Maryanne M. Mowen

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Question

Help me

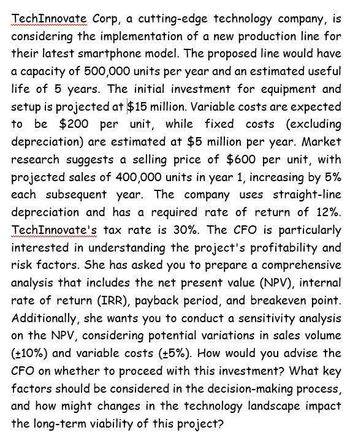

Transcribed Image Text:TechInnovate Corp, a cutting-edge technology company, is

considering the implementation of a new production line for

their latest smartphone model. The proposed line would have

a capacity of 500,000 units per year and an estimated useful

life of 5 years. The initial investment for equipment and

setup is projected at $15 million. Variable costs are expected

to be $200 per unit, while fixed costs (excluding

depreciation) are estimated at $5 million per year. Market

research suggests a selling price of $600 per unit, with

projected sales of 400,000 units in year 1, increasing by 5%

each subsequent year. The company uses straight-line

depreciation and has a required rate of return of 12%.

TechInnovate's tax rate is 30%. The CFO is particularly

interested in understanding the project's profitability and

risk factors. She has asked you to prepare a comprehensive

analysis that includes the net present value (NPV), internal

rate of return (IRR), payback period, and breakeven point.

Additionally, she wants you to conduct a sensitivity analysis

on the NPV, considering potential variations in sales volume

(±10%) and variable costs (±5%). How would you advise the

CFO on whether to proceed with this investment? What key

factors should be considered in the decision-making process,

and how might changes in the technology landscape impact

the long-term viability of this project?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Caduceus Company is considering the purchase of a new piece of factory equipment that will cost $565,000 and will generate $135,000 per year for 5 years. Calculate the IRR for this piece of equipment. For further instructions on internal rate of return In Excel, see Appendix C.arrow_forwardThe Rodriguez Company is considering an average-risk investment in a mineral water spring project that has an initial after-tax cost of 170,000. The project will produce 1,000 cases of mineral water per year indefinitely, starting at Year 1. The Year-1 sales price will be 138 per case, and the Year-1 cost per case will be 105. The firm is taxed at a rate of 25%. Both prices and costs are expected to rise after Year 1 at a rate of 6% per year due to inflation. The firm uses only equity, and it has a cost of capital of 15%. Assume that cash flows consist only of after-tax profits because the spring has an indefinite life and will not be depreciated. a. What is the present value of future cash flows? (Hint: The project is a growing perpetuity, so you must use the constant growth formula to find its NPV.) What is the NPV? b. Suppose that the company had forgotten to include future inflation. What would they have incorrectly calculated as the projects NPV?arrow_forwardFriedman Company is considering installing a new IT system. The cost of the new system is estimated to be 2,250,000, but it would produce after-tax savings of 450,000 per year in labor costs. The estimated life of the new system is 10 years, with no salvage value expected. Intrigued by the possibility of saving 450,000 per year and having a more reliable information system, the president of Friedman has asked for an analysis of the projects economic viability. All capital projects are required to earn at least the firms cost of capital, which is 12 percent. Required: 1. Calculate the projects internal rate of return. Should the company acquire the new IT system? 2. Suppose that savings are less than claimed. Calculate the minimum annual cash savings that must be realized for the project to earn a rate equal to the firms cost of capital. Comment on the safety margin that exists, if any. 3. Suppose that the life of the IT system is overestimated by two years. Repeat Requirements 1 and 2 under this assumption. Comment on the usefulness of this information.arrow_forward

- Ansarrow_forwardCaroline’s Chill Chronometers (3C) is considering buying a machine for $600 million. The machine has a useful life of 20 years. Sales are projected to be $120 million per year, with operating expenses of $35 million per year. An initial NWC investment of $10 million would be needed. NWC, however, would decrease by $300,000 per year over the 15 year life of the project due to improved inventory efficiency. The machine can be sold for $175 million at the end of the project. The tax rate is 20% and the required rate of return is 7%. Find the NPV using straight-line depreciation.arrow_forwardDeep Drill Inc. is evaluating a project to produce a high-tech deep-sea oil exploration device. The investment required is $80 million for a plant with a capacity of 15,000 units a year for 5 years. The device will be sold for a price of $12,000 per unit. Sales are expected to be 12,000 units per year. The variable cost is $7,000 and fixed costs, excluding depreciation, are $25 million per year. Assume Deep Drill employs straight-line depreciation on all depreciable assets, and assume that they are taxed at a rate of 36%. If the required rate of return is 12%, what is the approximate NPV of the project?arrow_forward

- U.S. Steel is considering a plant expansion to produce austenitic, precipitation hardened, duplex, and martensitic stainless steel round bars that is expected to cost $14 million now and another $10 million 1 year from now. If total operating costs will be $1.3 million per year starting 1 year from now, and the estimated salvage value of the plant is virtually zero, how much must the company make annually in years 1 through 9 to recover its investment plus a return of 23% per year? The company must make $ 7.560 million annually in years 1 through 9 to recover its investment plus a return of 23% per yeararrow_forwardCisco, Inc., has a proposal from the Engineering Planning Division to invest Cisco retained earnings in the design, testing, and development of the next generation of smart grids useful in the Internet of Things (IoT) environment. The initial investment projection is $5,600,000 in year 0, $2,600,000 in year 5, and $96,474 in years 11 and beyond. At i = 9% per year, calculate the infinite-life equivalent annual cost in years 0 through infinity of the proposal. Note:- Do not provide handwritten solution. Maintain accuracy and quality in your answer. Take care of plagiarism. Answer completely. You will get up vote for sure.arrow_forwardU.S. Steel is considering a plant expansion to produce austenitic, precipitation hardened, duplex, and martensitic stainless steel round bars that is expected to cost $13 million now and another $10 million 1 year from now. If total operating costs will be $1.2 million per year starting 1 year from now, and the estimated salvage value of the plant is virtually zero, how much must the company make annually in years 1 through 10 to recover its investment plus a return of 15% per year?arrow_forward

- Turik Electronics manufactures microprocessorbased soft starters that use thyristors for controlled reduced voltage during starting and stopping. The company is planning a production-line expansion that will cost $1.3 million. If the company uses a minimum attractive rate of return of 15% per year, what is the equivalent annual cost in years 1 through 5 of the investment?arrow_forwardU.S. Steel is considering a plant expansion to produce austenitic, precipitation hardened, duplex, and martensitic stainless steel roundbars that is expected to cost $14 million now and another $10 million 1 year from now. If total operating costs will be $1.5 million per year starting 1 year from now, and the estimated salvage value of the plant is virtually zero, how much must the company make annually in years 1 through 10 to recover its investment plus a return of 18% per year?The company must make $______ million annually in years 1 through 10 to recover its investment plus a return of 18% per yeararrow_forwardA company is considering a project which would involve purchasing amachine for $20,000 which will have no value at the end of the project.It will be used to produce a product which will have sales of 600 unitsper year for 4 years. The sales price per unit will be $50, the variablecosts per unit $20 and the incremental fixed costs of the project will be$10,000 per annum. These are all expressed in real terms and will besubject to inflation.Sales will inflate at 5% per annum, variable costs at 6% per annumand fixed costs at 7% per annum.The cost of capital is 15%Required:-Calculate NPV of the projectarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning- Principles of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Cornerstones of Cost Management (Cornerstones Ser...

Accounting

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:9781337514835

Author:MOYER

Publisher:CENGAGE LEARNING - CONSIGNMENT

Managerial Accounting: The Cornerstone of Busines...

Accounting

ISBN:9781337115773

Author:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:9781947172609

Author:OpenStax

Publisher:OpenStax College