SWFT Comprehensive Volume 2019

42nd Edition

ISBN: 9780357233306

Author: Maloney

Publisher: Cengage

expand_more

expand_more

format_list_bulleted

Question

expert solve this

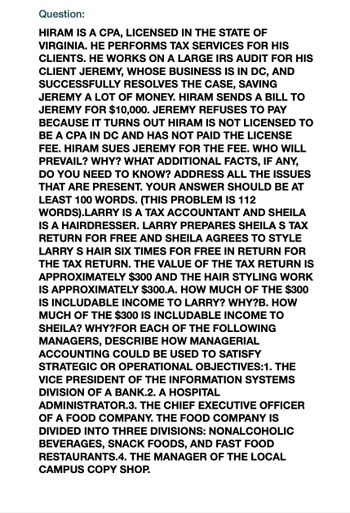

Transcribed Image Text:Question:

HIRAM IS A CPA, LICENSED IN THE STATE OF

VIRGINIA. HE PERFORMS TAX SERVICES FOR HIS

CLIENTS. HE WORKS ON A LARGE IRS AUDIT FOR HIS

CLIENT JEREMY, WHOSE BUSINESS IS IN DC, AND

SUCCESSFULLY RESOLVES THE CASE, SAVING

JEREMY A LOT OF MONEY. HIRAM SENDS A BILL TO

JEREMY FOR $10,000. JEREMY REFUSES TO PAY

BECAUSE IT TURNS OUT HIRAM IS NOT LICENSED TO

BE A CPA IN DC AND HAS NOT PAID THE LICENSE

FEE. HIRAM SUES JEREMY FOR THE FEE. WHO WILL

PREVAIL? WHY? WHAT ADDITIONAL FACTS, IF ANY,

DO YOU NEED TO KNOW? ADDRESS ALL THE ISSUES

THAT ARE PRESENT. YOUR ANSWER SHOULD BE AT

LEAST 100 WORDS. (THIS PROBLEM IS 112

WORDS).LARRY IS A TAX ACCOUNTANT AND SHEILA

IS A HAIRDRESSER. LARRY PREPARES SHEILA S TAX

RETURN FOR FREE AND SHEILA AGREES TO STYLE

LARRY S HAIR SIX TIMES FOR FREE IN RETURN FOR

THE TAX RETURN. THE VALUE OF THE TAX RETURN IS

APPROXIMATELY $300 AND THE HAIR STYLING WORK

IS APPROXIMATELY $300.A. HOW MUCH OF THE $300

IS INCLUDABLE INCOME TO LARRY? WHY?B. HOW

MUCH OF THE $300 IS INCLUDABLE INCOME TO

SHEILA? WHY?FOR EACH OF THE FOLLOWING

MANAGERS, DESCRIBE HOW MANAGERIAL

ACCOUNTING COULD BE USED TO SATISFY

STRATEGIC OR OPERATIONAL OBJECTIVES:1. THE

VICE PRESIDENT OF THE INFORMATION SYSTEMS

DIVISION OF A BANK.2. A HOSPITAL

ADMINISTRATOR.3. THE CHIEF EXECUTIVE OFFICER

OF A FOOD COMPANY. THE FOOD COMPANY IS

DIVIDED INTO THREE DIVISIONS: NONALCOHOLIC

BEVERAGES, SNACK FOODS, AND FAST FOOD

RESTAURANTS.4. THE MANAGER OF THE LOCAL

CAMPUS COPY SHOP.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Why did the IRS deny the political rival’s request to see the Carpenters tax return?arrow_forwardExample 1 concludes that Miranda cannot deduct her annual CPA license fee because her mother paid it for her. Correspondingly, Example 2 concludes that Marty’s mother cannot deduct her annual property taxes since Marty paid them for her. Are these two examples consistent with the Tax Court’s reasoning in Lang? Why or why not? plzzz and asap..... (Hint: Example1 Miranda is a public accountant and is required by state law to have a license to practice public accounting. When the state license renewal fee comes due, Miranda is short of money and cannot renew her license. Miranda’s mother pays the license renewal fee for her so she can continue working as a public accountant. Can Miranda deduct the fee as a business expense? Discussion: The license renewal fee is Miranda’s business expense, and only she can deduct the payment of the fee. Because Miranda does not pay the license renewal fee, she is not allowed a deduction for the business expense. Because the license renewal fee is not…arrow_forwardWhat choices do the Carpenters have in the face of the IRS’s decision about their tax liability?arrow_forward

- T uses frequent flyer miles to take his family on a vacation. T received the miles duringbusiness travel paid for by his employer. The normal airfare for his vacation wouldhave cost $7,000.a. T must realize and recognize $7,000 as income.b. Although T has realized income, he will not be required to recognize it becausethe IRS has chosen, as a matter of administrative convenience, not to requiretaxpayers to recognize the value of frequent flyer tickets earned duringemployer-paid travel.c. Had T earned the frequent flyer miles during travel he had paid for himself, theissue of income realization and recognition would not arise.d. Both (a) and (c) are correct.e. Both (b) and (c) are correct. T buys a parcel of real estate for $100,000, which he finances by giving the seller a nonrecoursemortgage for the full purchase price. The debt is due in one balloon payment inYear 5. When the debt becomes due in Year 5, T decides to give the property back to theseller in satisfaction of the debt…arrow_forward1 Required information [The following information applies to the questions displayed below.] Jasper and Crewella Dahvill were married in year O. They filed joint tax returns in years 1 and 2. In year 3, their relationship was strained and Jasper insisted on filing a separate tax return. In year 4, the couple divorced. Both Jasper and Crewella filed single tax returns in year 4. In year 5, the IRS audited the couple's joint year 2 tax return and each spouse's separate year 3 tax returns. The IRS determined that the year 2 joint return and Crewella's separate year 3 tax return understated Crewella's self-employment income, causing the joint return year 2 tax liability to be understated by $9,000 and Crewella's year 3 separate return tax liability to be understated by $6,950. The IRS also assessed penalties and interest on both of these tax returns. Try as it might, the IRS has not been able to locate Crewella, but they have been able to find Jasper. Note: Leave no answer blank. Enter O…arrow_forward13. Assess the following situation to determine whether you need to report the income to the IRS on your tax return. A. You received $9 in interest from your bank. Your bank doesn't issue a 1099-int unless you received $10 in interest do you need to claim the me$9 and interest on income on your tax return. B. You are a bartender with your neighbor who is an attorney you babysat their children in the state called $1,000 in legal services do you need to report this and come on your tax return.arrow_forward

- Note:- Do not provide handwritten solution. Maintain accuracy and quality in your answer. Take care of plagiarism. Answer completely. You will get up vote for sure.arrow_forwardAndy Simmons is a CPA with his own accounting and tax practice. He occasionally does an audit for small business clients. One day an audit client shows Andy a letter from the local Property Tax Assessor’s office. It seems the client inquired about the process to be followed to appeal the 20 percent increase in his property taxes. He already wrote an appeal letter and was denied. The letter said that most folks who appeal those decisions hire a CPA to represent them before the administrative board in property tax assessment hearings. If your client asks you to represent him in the appeal process, can you do so under the AICPA Code? Explain.arrow_forwardRequired information Skip to question [The following information applies to the questions displayed below.] Emily, who is single, has been offered a position as a city landscape consultant. The position pays $143,000 in cash wages. Assume Emily has no dependents. Emily deducts the standard deduction instead of itemized deductions, she is not eligible for the qualified business income deduction, and she did not make any charitable donations. (Use the tax rate schedules.) a. What is the amount of Emily’s after-tax compensation (ignore payroll taxes)? (Round your intermediate calculations and final answers to the nearest whole dollar amount.) 2021 Tax Rate Schedules IndividualsSchedule X-Single If taxable income is over: But not over: The tax is: $ 0 $ 9,950 10% of taxable income $ 9,950 $ 40,525 $995 plus 12% of the excess over $9,950 $ 40,525 $ 86,375 $4,664 plus 22% of the excess over $40,525 $ 86,375 $ 164,925 $14,751 plus 24% of the excess…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Individual Income TaxesAccountingISBN:9780357109731Author:HoffmanPublisher:CENGAGE LEARNING - CONSIGNMENT

Individual Income TaxesAccountingISBN:9780357109731Author:HoffmanPublisher:CENGAGE LEARNING - CONSIGNMENT

Individual Income Taxes

Accounting

ISBN:9780357109731

Author:Hoffman

Publisher:CENGAGE LEARNING - CONSIGNMENT