FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

Need help

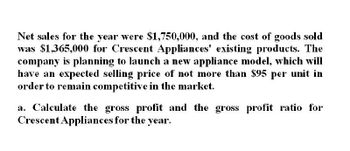

Transcribed Image Text:Net sales for the year were $1,750,000, and the cost of goods sold

was $1,365,000 for Crescent Appliances' existing products. The

company is planning to launch a new appliance model, which will

have an expected selling price of not more than $95 per unit in

order to remain competitive in the market.

a. Calculate the gross profit and the gross profit ratio for

Crescent Appliances for the year.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- MBI Incorporated had sales of $35 million for fiscal 2022. The company's gross profit ratio for that year was 26%. Required: a. Calculate the gross profit and cost of goods sold for MBI for fiscal 2022. b. Assume that a new product is developed and that it will cost $469 to manufacture. Calculate the selling price that must be set for this new product if its gross profit ratio is to be the same as the average achieved for all products for fiscal 2022. c. From a management viewpoint, it could use the estimated selling price as a "target" in conducting marketing research studies to assess its ultimate prospects for success at this price. Complete this question by entering your answers in the tabs below. Required A Required B Required C From a management viewpoint, it could use the estimated selling price as a "target" in conducting marketing research studies to assess its ultimate prospects for success at this price.arrow_forwardNet sales for the year were $1,100,000 and cost of goods sold was $796,000 for the company's existing products. A new product is presently under development and will have an expected selling price of not more than $73 per unit in order to remain competitive with similar products in the marketplace. Calculate gross profit and the gross profit ratio for the year.arrow_forwardAnsarrow_forward

- Calculate gross profit, cost of goods sold, and selling price MBI Inc, had sales of $900 million for fiscal 2022. The company’s gross profit ratio for that year was 37.5%.Required:Calculate the gross profit and cost of goods sold for MBI for fiscal 2022.Assume that a new product is developed and that it will cost $1,625 to manufacture. Calculate the selling price that must be set for this new product if its gross profit ratio is to be the same as the average achieved for all products for fiscal 2022.From a management viewpoint, what would you do with this information?arrow_forwardCalculate the answer of the Problemarrow_forwardPlease provide answer the questionarrow_forward

- Calculate the answer to the Problem of accountingarrow_forwardNet sales for the year were $450,000 and cost of goods sold was $297,000 for the company's existing products. A new product is presently under development and has an expected selling price of not more than $75 per unit in order to remain competitive with similar products in the marketplace. Required: a. Calculate gross profit and the gross profit ratio for the year. Net sales Cost of goods sold Gross profit $ 450,000 $ 153,000 b. What is the maximum cost per unit that can be incurred to manufacture the new product so that the product can be priced competitively and will not result in a reduction to the company's gross profit ratio? (Round your final answer to 2 decimal places.) Maximum manufacturing cost per unitarrow_forwardYour company has sales of $97,200 this year and cost of goods sold of $71,200. You forecast sales to increase to $113,100 next year. Using the percent of sales method, forecast next year's cost of goods sold.arrow_forward

- Payton Inc. reports in its Year 7 annual report, sales of $7,362 million and cost of goods sold of $2,945 million. For next year, you project that sales will grow by 3% and that cost of goods sold percentage will be 1 percentage point higher. Projected cost of goods sold for Year 8 will be: Select one: a. $3,033 million b. $3,019 million c. There is not enough information to determine the amount. d. $3,109 million e. $2,945 millionarrow_forwardNet sales for the year were $1,100,000 and cost of goods sold was $781,000 for the company's existing products. A new product is presently under development and will have an expected selling price of not more than $69 per in order to remain competitive with similar products in the marketplace. unit • Calculate gross profit and the gross profit ratio for the year.arrow_forwardGeneral Accountingarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education