CONCEPTS IN FED.TAX.,2020-W/ACCESS

20th Edition

ISBN: 9780357110362

Author: Murphy

Publisher: CENGAGE L

expand_more

expand_more

format_list_bulleted

Question

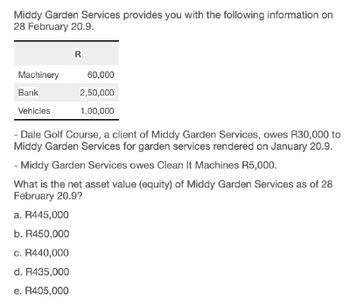

Transcribed Image Text:Middy Garden Services provides you with the following information on

28 February 20.9.

R

Machinery

60,000

Bank

2,50,000

Vehicles

1,00,000

- Dale Golf Course, a client of Middy Garden Services, owes R30,000 to

Middy Garden Services for garden services rendered on January 20.9.

- Middy Garden Services owes Clean It Machines R5,000.

What is the net asset value (equity) of Middy Garden Services as of 28

February 20.9?

a. R445,000

b. R450,000

c. R440,000

d. R435,000

e. R405,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps with 1 images

Knowledge Booster

Similar questions

- Liana Ltd bought a bank bill on 7 January 2012 for $976 751 and sold it on 3 March 2012 for $987 618. a. What simple interest rate (annual rate) did Liana Ltd earn? b. What annual effective interest rate did Liana Ltd earn? Please help to solve the following question with detailed steps and explanation. thank youarrow_forward❌❌✅✅✅✅✅arrow_forwardA bank loan of $800,000 was obtained byPWP Ltd on 1 August 2020 to purchase itsbusiness office, warehouse and factory andan upfront establishment fee of $8,000 waspaid on that date. The period of the loan waseight years and the bank charged interest atthe rate of 10 percent. 1.Explain what deductions are available to PWP for2020/21 in relation to the establishment fee andinterest paid on the bank loan. 2.What deductions would be available if PWP repaidthe $500,000 loan in full-on 30 June 2022?arrow_forward

- please help answerarrow_forwardWhat is the loan impairment loss on December 31,2016?arrow_forwardA bank customer requests financing for five air conditioning units (A/Cs) on a three – year lease from the bank. The bank buys the assets and leases them for three years. Financial details RM Cost of A/Cs 5,000.00 Five – year life – annual depreciation 1,000.00 p.a. Insurance (Takaful) 300.00 p.a. Profit required by the bank Year 1 450.00 Year 2 350.00 Year 3 250.00 REQUIRED: a. Define ljarah concept according to AAOIFI b. Calculate yearly ljarah rental in order to cover the costs and to make the required profitarrow_forward

- make journal entries for recording interest income and interest received and recognition of FV at dec31, 2023, 2024, and 2025. the entries should be: to record interest collected (3 lines) to record Fair value adjustment to record interest collected (3 lines) to record Fair value adjustment to record interest collected (3 lines) to record gain or loss Dont use AI Tools. Thank youarrow_forwardWant answer fastarrow_forwardsolve the following using the concept of amortization 1.Show the amprtization schedule for a loan ₱15.000 at 4% interest compounded monthly, payable for 12 monthsarrow_forward

- please answer in text form with proper workings and explanation for each and every part and steps with concept and introduction no AI no copy pastearrow_forwardHartman Delivery Service purchased a new delivery truck for $29,000. At the time of purchase, Hartman made a 20% down payment and financed the rest with a 3-year note. Which of the following is the appropriate journal entry for this transaction ?arrow_forwardOn June 30, Collins Management Company purchased land for $400,000 and a building for $560,000, paying $360,000 cash and issuing a 5% note for the balance, secured by a mortgage on the property. The terms of the note provide for 20 semiannual payments of $30,000 on the principal plus the interest accrued from the date of the preceding payment. If an amount box does not require an entry, leave it blank. Question Content Area a. Journalize the entry to record the transaction on June 30. b. Journalize the entry to record the payment of the first installment on December 31.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you