Entrepreneurial Finance

6th Edition

ISBN: 9781337635653

Author: Leach

Publisher: Cengage

expand_more

expand_more

format_list_bulleted

Question

need this question answer general accounting

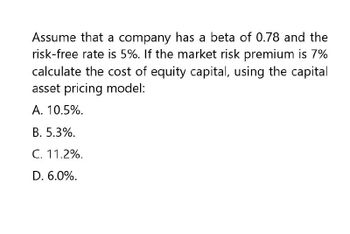

Transcribed Image Text:Assume that a company has a beta of 0.78 and the

risk-free rate is 5%. If the market risk premium is 7%

calculate the cost of equity capital, using the capital

asset pricing model:

A. 10.5%.

B. 5.3%.

C. 11.2%.

D. 6.0%.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Can you answer all the question 9,10,11arrow_forwardCalculate the cost of equity capital using CAPM if the risk - free rate of interest is 4 per cent, the return on the market portfolio is 8 per cent, the beta of the firm's assets is .8 and the and beta of equity is 1.2. Provide your answer as a percentage to two decimal places (15.32% should be entered as 15.32). Do not enter the % signarrow_forwardBelow, inputs have been arrived for the XYZ company. Using CAPM calculate its cost of equity. (Observe 2 decimal places)arrow_forward

- The cost of equity using the CAPM approach The current risk-free rate of return (rRF) is 3.86%, while the market risk premium is 6.63%. the Monroe Company has a beta of 0.92. Using the Capital Asset Pricing Model (CAPM) approach, Monroe's cost of equity isarrow_forwardThe risk-free rate of return is 2.5% and the market risk premium is 8%. Rogue Transport has a beta of 2.2. Using the capital asset pricing model, what is Rogue Transport's cost of retained earnings? a.20.1% b.19.6% c.17.7% d.16.4%arrow_forwardAssume that you are a consultant to Thornton Inc., and you have been provided with the following data: risk 1.8. What is the cost of equity from free rate rRF = 5.5%; market risk premium RPM retained earnings based on the CAPM approach? = 6.0%; and b =arrow_forward

- The current risk-free rate of return is 4.6%. The market risk premium is 6.6%. D'Amico Co. has a beta of 1.56. Using the Capital Asset Pricing Model (CAPM) approach, D'Amico's cost of equity is ... .··. ··· .... .··. .··...arrow_forwardAs per Capital Asset Pricing Model (CAPM) : Re=Rf+(Rm-Rf)βwhere, Re= Required rate of returnRf= Risk free rate of return = 0%Rm = Market return or Expected return on market = 3.3%β = Beta of the stock = 1.24Now, Re= Rf + Rm - Rf βRe= 0 + 3.3 - 0 ×1.24Re= 4.092% To calculate the abnormal return we will use the formula: = E(R) - Re= 3% - 4.092% = -1.092% or - 0.01092 How did you get the 4.092%?arrow_forwardThe current risk-free rate of return is 4.2%. The market risk premium is 6.6%. Allen Co. has a beta of 0.87. Using the Capital Asset Pricing Model (CAPM) approach, Allen's cost of equity isarrow_forward

- I need to calculate the cost of equity with the following data: The current appropriate risk-free rate is 6% and the return on the market is 13.5%. levered beta is 1.29. Using the CAPM, estimate DE’s cost of equity. Be sure to state any additional assumptionsarrow_forwardAssuming the CAPM or one-factor model holds, what is the cost of equity for a firm if the firm's equity has a beta of 1.2, the risk-free rate of return is 4%, the expected return on the market is 10%, and the return to the company's debt is 7%? A. 11.2% B. 11.4% C. 12.8% D. 12.9% E. None of these.arrow_forwardThe current risk-free rate of return is 4.67%, while the market risk premium is 6.63%. The D'Amico Company has a beta of 0.78. Using the Capital Asset Pricing Model (CAPM) approach, D'Amico's cost of equity is: a. 8.86%. b. 10.82%. C. 10.33%. d. 9.84%.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you