Principles of Accounting Volume 1

19th Edition

ISBN: 9781947172685

Author: OpenStax

Publisher: OpenStax College

expand_more

expand_more

format_list_bulleted

Question

Get correct answer general accounting question

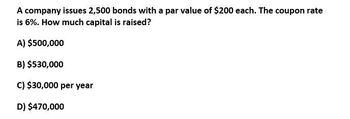

Transcribed Image Text:A company issues 2,500 bonds with a par value of $200 each. The coupon rate

is 6%. How much capital is raised?

A) $500,000

B) $530,000

C) $30,000 per year

D) $470,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- D&G Enterprises issues bonds with a $1,000 face value that make coupon payments of $30 every 3 months. What is the coupon rate? A) 0.30% B) 3.00% C) 9.00% D) 12.00% E) 30.00%arrow_forwardA company has issued 10-year bonds, with a face value of $1,000,000 in 1,000 dollar units. Interest at 16% is paid quarterly. If an investor desires to earn 20% nominal interest on $100,000 worth of these bonds, what would be the selling price have to be?arrow_forwardABC Company will issue $5,100,000 in 8%, 10-year bonds when the market rate of interest is 10%. Interest is paid semiannually. Required: Determine how much cash ABC Company will realize from the bond issue. Note: Use tables, Excel, or a financial calculator. Round your intermediate calculations to the nearest whole dollar. (FV of $1, PV of $1, FVA of $1, PVA of $1, FVAD of $1 and PVAD of $1) Bond issue pricearrow_forward

- CG Forest and Paper LTD. raises capital; by selling 5,000,000 worth of debt with flotation xost equal to 3% of its par value. If the debt matures in 15 years and has coupon rate of 6% (paid annually).What is the bond's YTMSubject: Financial Accountingarrow_forwardYou have the following information about a company:Debt: 5,000 3% bonds with twelve years to maturity. The face value of the bond is $1000. The bonds currently sell for $1190 and the bonds make semi-annual paymentsEquity: 125,000 shares outstanding selling for $65 per share. The beta is 1.35. The last dividend paid was $3.25.Market: There is a 5% market risk premium. The risk free rate is 2%. The corporate tax rate is 25%Given the above information, calculate the firm’s WACC.arrow_forwardA company issued 10%, 10-year bonds with a face amount of $100 million. The market yield for bonds of similar risk and maturity is 6%. Interest is paid semiannually. At what price did the bonds sell? Note: Do not round intermediate calculations. Round your final answer to the nearest whole dollar. Use tables, Excel, or a financial calculator.(FV of $1. PV of $1. FVA of $1. PVA of $1. FVAD of $1 and PVAD of $1) Price of bondsarrow_forward

- The following is the capital structure of your company. Debt: 25,000 bonds. 7.4 annual % coupon, with semiannual payments. $1,000 face value. 21 years to maturity. Priced at $1,060 per bond. Preferred stock: 26,000 shares preferred stock. Priced at $97 per share. $5.20 dividend per share. Common Stock: 580,000 shares. Priced at $76 per share. Beta is 1.15. Market: 6% market risk premium. 4.8% risk-free rate. Company's tax rate is 25%. What is the company's Weighted Average Cost of Capital? (Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 12.34.) WACCarrow_forwardA company has issued 10-year bonds, with a face value of $1,000,000, in $1,000 units. Interestat 16% is paid quarterly. If an investor desires to earn 20% nominal interest (compoundedquarterly) on $100,000 worth of these bonds, what would the purchase price have to be?arrow_forwardA company issues a 5-year, 4% coupon bond with a face value of $100,000. The effective market interest rate at the time of issuance is 2%. What are the proceeds from issuing the bond? $109,427 $109,471 $128,414 $83,778 $100,000 O O Oarrow_forward

- Assume that Bunch Inc. has an issue of 18 -year $1,000 par value bonds that pay 7% interest, annually. Further assume that today's required rate of return on these bonds is 5%. How much would these bonds sell for today? Round off to the nearest $1. Select one:$1,201.32$1,233.79$1,032.56$1,134.88arrow_forwardBacon Signs Inc. has $500,000 outstanding of $1000 par value bonds with a coupon interest rate of 7.5% and 2 0 years to maturity. If Bacon Signs makes semiannual payments, how large is each payment per bond? a. $40.00 b. $75.00 c. $37.50 d. $40.50arrow_forwardSuppose Westerfield Co. has the following financial information: Debt: 900,000 bonds outstanding with a face value of $1,000. The bonds currently trade at 85% of par and have 12 years to maturity. The coupon rate equals 7%, and the bonds make semiannual interest payments. Preferred stock: 600,000 shares of preferred stock outstanding; currently trading for $108 per share, paying a dividend of $9 annually. Common stock: 25,000,000 shares of common stock outstanding; currently trading for $185 per share. Beta equals 1.22. Market and firm information: The expected return on the market is 9%, the risk-free rate is 5%, and the tax rate is 21%. Calculate the weight of the common stock in the capital structure. (Enter percentages as decimals and round to 4 decimals)arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

- Principles of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

Principles of Accounting Volume 1

Accounting

ISBN:9781947172685

Author:OpenStax

Publisher:OpenStax College

Intermediate Financial Management (MindTap Course...

Finance

ISBN:9781337395083

Author:Eugene F. Brigham, Phillip R. Daves

Publisher:Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:9781337514835

Author:MOYER

Publisher:CENGAGE LEARNING - CONSIGNMENT