Cornerstones of Cost Management (Cornerstones Series)

4th Edition

ISBN: 9781305970663

Author: Don R. Hansen, Maryanne M. Mowen

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Question

I need this question answer general Accounting

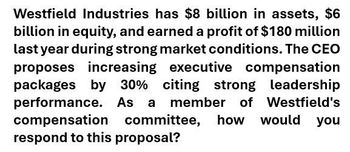

Transcribed Image Text:Westfield Industries has $8 billion in assets, $6

billion in equity, and earned a profit of $180 million

last year during strong market conditions. The CEO

proposes increasing executive compensation

packages by 30% citing strong leadership

performance. As a member of Westfield's

compensation committee, how would you

respond to this proposal?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Please give me answer Accountingarrow_forwardQuyox Sdn Bhd manufactures a special toy called Omma that are sold through a network of sales agents throughout Malaysia. The company sold 67,500 units of Omma in 2022 with equivalent to sales amounting to RM1,350,000. The sales agents are currently paid at 15% commission on sales. The following is the pro forma (projected) statement of profit or loss and other comprehensive income for the year ended 31 December 2022. Qu Yox Sdn Bhd Pro Forma Statement of Profit or Loss and Other Comprehensive Income For the Year Ended 31 December 2022 Sales Cost of Goods Sold: Variable Fixed Gross Profit Operating expenses: Sales Commision Fixed Advertising Expenses General and Administrative Expenses: Rental expenses Administrative Salaries Expenses Insurance Expenses Net Income 675,000 135,000 202,500 33,750 27,000 67,500 20,250 1,350,000 810,000 540,000 351,000 189,000arrow_forwardLast year Rosenberg Corp. had $195, 000 of assets, S18,775 of net income, and a debt-to-total-assets ratio of 32%. Now suppose the new CFO convinces the president to increase the debt ratio to 48%. Sales and total assets will not be affected, but interest expenses would increase. However, the CFO believes that better cost controls would be sufficient to offset the higher interest expense and thus keep net income unchanged. By how much would the change in the capital structure improve the ROE? Question 5 options: 4.36% 4.57% 4.80% 5.04%arrow_forward

- Need helparrow_forwardLast year ABC Company had $200,000 of total assets, $25,746 of net income, and a debt-to-total-assets ratio of 32%. Now suppose the new CFO convinces the president to increase the debt-to-total assets ratio to 45%. Sales and total assets will not be affected, but interest expenses would increase. However, the CFO believes that better cost controls would be sufficient to offset the higher interest expense and thus keep net income unchanged. By how much would the change in the capital structure improve the ROE (that is, new ROE - old ROE)? Round your answer to two decimal places of percentage. (Hint: ROE = net income/common equity) Group of answer choices 4.39% 4.47% 4.42% 4.53% 4.50%arrow_forwardneed help with this questionarrow_forward

- The executive officers of Rouse Corporation have a performance-based compensation plan. The performance criteria of this plan is linked to growth in earnings per share. When annual EPS growth is 12%, the Rouse executives earn 100% of the shares; if growth is 16%, they earn 125%. If EPS growth is lower than 8%, the executives receive no additional compensation. In 2020, Joan Devers, the controller of Rouse, reviews year-end estimates of bad debt expense and warranty expense. She calculates the EPS growth at 15%. Kurt Adkins, a member of the executive group, remarks over lunch one day that the estimate of bad debt expense might be decreased, increasing EPS growth to 16.1%. Devers is not sure she should do this because she believes that the current estimate of bad debts is sound. On the other hand, she recognizes that a great deal of subjectivity is involved in the computation. Instructions Answer the following questions. a. What, if any, is the ethical dilemma for Devers? b. Should…arrow_forwardLast year, a company had $355,000 in assets, $26,275 of net income, and a debt-to-total-assets ratio of 44%. Now suppose the newly hired CFO convinces the president to increase the debt ratio to 58%. Sales and total assets will not be affected, but interest expenses would increase. However, the CFO believes that better cost controls would be sufficient to offset the higher interest expense and therefore keep net income unchanged. What was the original return on equity (ROE) for this company?arrow_forwardLast year Chantler Corp. had $200,000 of assets, $20,000 of net income, and a debt-to-total-assets ratio of 30%. Now suppose the new CFO convinces the president to increase the debt ratio to 45%. Sales and total assets will not be affected, but interest expenses would increase. However, the CFO believes that better cost controls would be sufficient to offset the higher interest expense and thus keep net income unchanged. By how much would the change in the capital structure improve the ROE?arrow_forward

- Nancy Tercek, the financial vice president, and Margaret Lilly, the controller, of Romine Manufacturing Company are reviewing the financial ratios of the company for the years 2020 and 2021. The financial vice president notes that the profit margin on sales ratio has increased from 6% to 12%, a hefty gain for the 2-year period. Tercek is in the process of issuing a media release that emphasizes the efficiency of Romine Manufacturing in controlling cost. Margaret Lilly knows that the difference in ratios is due primarily to an earlier company decision to reduce the estimates of warranty and bad debt expense for 2021. The controller, not sure of her supervisor's motives, hesitates to suggest to Tercek that the company's improvement is unrelated to efficiency in controlling cost. To complicate matters, the media release is scheduled in a few days. Instructions What, if any, is the ethical dilemma in this situation? Should Lilly, the controller, remain silent? Give reasons. What…arrow_forwardGive true calculation for this questionarrow_forwardBarb is asked to analyze a new software firm. This year the firm has total revenues of $110 million and expenses (excluding interest payments) of $50 million. The firm has $90 million of capital, of which $30 million is in debt financed at an 8% annual interest rate and the rest is equity. Barb estimates that the cost of equity capital here is 15%. Barb determines this firm has accounting profi of [Select] [Select] economic profit of [Select] a good use of capital. く andarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...

Accounting

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...

Accounting

ISBN:9781337115773

Author:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:Cengage Learning