Intermediate Financial Management (MindTap Course List)

13th Edition

ISBN: 9781337395083

Author: Eugene F. Brigham, Phillip R. Daves

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Question

financial accounting question

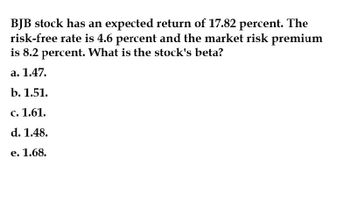

Transcribed Image Text:BJB stock has an expected return of 17.82 percent. The

risk-free rate is 4.6 percent and the market risk premium

is 8.2 percent. What is the stock's beta?

a. 1.47.

b. 1.51.

c. 1.61.

d. 1.48.

e. 1.68.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- AA Corporations stock has a beta of 0.8. The risk-free rate is 4%, and the expected return on the market is 12%. What is the required rate of return on AAs stock?arrow_forwardA stock has a beta of 1.4 when the risk premium is 6.2%. If the risk free rate is 2.4, what is the stock's fair return? Convert to a percent and round to two decimal places. a. 2.4+1.4 b. 6.2*1.4+2.4 c. 2.4+6.2arrow_forwardStock A's stock has a beta of 1.30, and its required return is 12.00%. Stock B's beta is 0.80. If the risk-free rate is 4.75%, what is the required rate of return on B's stock? (Hint: First find the market risk premium.) a. 8.76% b. 8.98% c. 9.21% d. 9.44% e. 9.68%arrow_forward

- The risk-free rate of return is 3.7 percent and the market risk premium is 6.2 percent. What is the expected rate of return on a stock with a beta of 1.21 O a. 10.92 percent O b. 11.40 percent O c. 11.20 percent O d. 12.47 percentarrow_forwardStock A's stock has a beta of 1.30, and its required return is 13.75%. Stock B's beta is 0.80. If the risk-free rate is 4.75%, what is the required rate of return on B's stock? (Hint: First find the market risk premium.) Select the correct answer. a. 10.26% b. 10.32% c. 10.29% d. 10.35% e. 10.38%arrow_forwardThe risk-free rate of return is 4 percent and the market risk premium is 8 percent. What is the expected rate of return on a stock with a beta of 1.28? a. 9.12 percent b. 10.24 percent c. 13.12 percent d. 14.24 percent e. 5.36 percentarrow_forward

- The risk-free rate of return is 3.9 percent and the market risk premium is 6.2 percent. What is the expected rate of return on a stock with a beta of 1.21? a. 11.4%b. 13.6%c. 15.4%d. 17%arrow_forwardA stock has an expected return of 14.3 percent, the risk-free rate is 3.2 percent, and the market risk premium is 8.1 percent. What must the beta of this stock be? O 0.88 O 0.94 O 1.08 O 1.21 O 1.37arrow_forwardA stock has a beta of 1.5. If the market risk premium is 7 percent and the risk-free rate is 2.2 percent. What is the expected return on this stock? A. 9.2% B. 9.4% C. 12.7%arrow_forward

- Beta and required rate of return A stock has a required return of 11 percent; the risk-free rate is 7 percent; and the market risk premium is 4 percent. a. What is the stock's beta?arrow_forwardWhat is the beta of a stock where the expected rate of return is 14%, the market premium is 7%, and the risk free rate is 3%? a. 1.90 b. 0.95 C. 1.45 d. 1.57arrow_forward2. Calculate the expected (required) return for each of the following stocks when the risk-free rate is 0.08 and you expect the market return to be 0.14. Stock Beta B C A P ש ח ס ח D E 1.72 1.14 0.76 F 0.44 0.03 -0.79arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

Intermediate Financial Management (MindTap Course...

Finance

ISBN:9781337395083

Author:Eugene F. Brigham, Phillip R. Daves

Publisher:Cengage Learning