FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

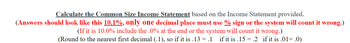

Transcribed Image Text:Calculate the Common Size Income Statement based on the Income Statement provided.

(Answers should look like this 10.1%, only one decimal place must use % sign or the system will count it wrong.)

(If it is 10.0% include the .0% at the end or the system will count it wrong.)

(Round to the nearest first decimal (.1), so if it is .13 = .1 if it is .15.2 if it is .01 .0)

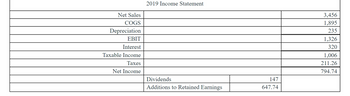

Transcribed Image Text:Net Sales

COGS

Depreciation

EBIT

Interest

Taxable Income

Taxes

Net Income

2019 Income Statement

Dividends

Additions to Retained Earnings

147

647.74

3,456

1,895

235

1,326

320

1,006

211.26

794.74

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Harlan Mining Co. has recently decided to go public and has hired you as an independent CPA. One statement that the enterprise is anxious to have prepared is a statement of cash flows. Financial statements for 2025 are provided below. Cash Accounts receivable Inventory Property, plant, and equipment Less accumulated depreciation Accounts payable Income taxes payable Bonds payable Common stock Retained earnings COMPARATIVE BALANCE SHEETS 12/31/25 Sales revenue $608000 (320000) $408000 360000 384000 288000 $1440000 $176000 352000 360000 216000 336000 $1440000 INCOME STATEMENT For the Year Ended December 31, 2025 12/31/24 $960000 (304000) $8400000 $192000 216000 480000 656000 $1544000 $96000 392000 600000 216000 240000 $1544000arrow_forwardPrecision Tools 2021 Income Statement Net sales Less: Cost of goods sold Less: Depreciation Earnings before interest and taxes Less: Interest paid $36,408 28,225 1,760 6,423 510 5,913 Taxable Income Less: Taxes 2.070 $3.843 Net Income Precision Tools 2020 and 2021 Balance Sheets 2020 2021 2020 2021 $ Cash 2,060 1,003 Accounts 7,250 8,384 payable Accounts 3,411 4,218 receivable 21.908 27,129 Inventory 18,776 24,247 17,500 3.825 Common stock Retained earnings Total liability & 15,000 Net fixed assets 14,160 14.080 6.357 Total assets 38.407 41,209 38,407 41,209 equity What is the times interest earned ratio for 2021?arrow_forwardLife-Positive’s Account Balances 2021 ($) 2022 ($) Accounts Payable 24,600.00 21,250.00 Accounts receivable 15,700.00 12,340.00 Cash 23,450.00 28,600.00 Cost of goods sold 19,700.00 23,000.00 Depreciation 3,090.00 4,590.00 Dividends 5,800.00 10,800.00 Interest 2,340.00 2,890.00 Inventory 7,050.00 8,640.00 Long-term debt 28,000.00…arrow_forward

- Partial Income Statement Excel Exercise Compute the Following ՀԱՐ Sales COGS SG&A Depreciation Debt Int. Rate Tax Rate* 2019 100 40 EBITDA EBIT 25 Interest 10 EBT 0.08 Tax 0.25 Net Income ? ? ? ? ? ? Partial Balance Sheet Debt and Loans 150 Total Equity 150 Total Assets 300 Inv. Change 10 A/R Change A/P Change 35 20 Net Profit Margin Equity Multiplier Verify Dupont ROE ? סיי ? ? ? ? ? * Assume all taxes paid in current period (no accrued taxes) for rest of course CF from Operations ROE Asset Turnover CED Tt O 24arrow_forwardMultiple Choice Sa O 84 times 2.06 times 1.87 times 82 times. 1.22 timesarrow_forwardCalculate the dividend payout ratio.arrow_forward

- vas.msst Net sales Operating costs except depreciation Depreciation Earnings before interest and taxes (EBIT) Less interest Earnings before taxes (EBT) Taxes Net income Other data: Shares outstanding (millions) Common dividends (millions of $) Int rate on notes payable & L-T bonds Federal plus state income tax rate Year-end stock price $98,000 91.140 1,960 $4,900 960 $3,940 1,576 $2,364 500.00 $827.40 6% 40% $56.74 Refer to Exhibit 4.1. What is the firm's ROA? Do not round your intermediate calculations,arrow_forwardUse the below information to answer the following questions: 20202021Sales$11,573$12,936Depreciation 1661 1736Cost of goods sold 3979 4707Other Expenses 846 924Interest Expense 776 926Cash 6067 6466Accounts Receivables 8034 9427Short-term Notes Payable 1171 1147Long-term debt 20,320 24,696Net fixed assets 50,888 54,273Accounts Payable 4384 4644Tax rate 26% 34%Inventory 14,283 15,288Payout ratio 33% 30% A. Create the Balance Sheets for 2020 & 2021.arrow_forwardCALCULATE THE EBITDA For the year ended December 31, Notes 2020 2019 Revenue ₱ 10,775,731.00 ₱ 11,334,976.00 Cost of Sales 7,175,540.00 7,552,700.00 Gross profit 3,600,191.00 3,782,276.00 General and Administrative expenses 3,278,202.00 3,417,740.00 Finance Cost Or Interest Expense 48,000.00 16,000.00 Net Income before Tax 273,989.00 348,536.00 Provision for Income Tax 82,197.00 104,561.00 NET INCOME AFTER TAX ₱ 191,792.00 ₱ 243,975.00 (See Notes to Financial Statement)arrow_forward

- Sales Depreciation COGS Interest Cash Accts Receivables Notes Payable L ong-term debt Net fixed assets Accounts Payable Inventory Dividend payout Tax rate 2020 21. What is the ROE for 2021? $5,300 $5,900 750 850 2400 180 200 200 800 1500 3000 250 700 2021 2900 196 500 22. What is the Inventory period in 2021? 400 550 1950 3500 400 900 30% 35% 30% 20. What is the cash flow from operating activities?arrow_forwardDebt to Equity Total Debt Ratio Times Interest Earnedarrow_forwardMaples group Comparative Balance Sheet December 31, 2020 and 2019 2020 2019 Increase/(Decrease Assets Cash and cash equivalent 64,990 61,895 ? Accounts receivable 95,100 88,500 ? Inventories 72,500 79,855 ? Fixed Assets, net ? ? ? Total Assets 442,590 395,800 46,790 Liabilities Accounts payable 45,000 58,350 ? Accrued liabilities ? ? ? Long –term notes payable 99,500 128,550 ? Stockholder’ Equity: Common Stock 143,050 105,110 37,940 Retained earnings 43,540 24,290 19,250 Total liabilities and stockholders’ equity 442, 590 395, 800…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education