FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

Transcribed Image Text:Multiple Choice

Sa

O

84 times

2.06 times

1.87 times

82 times.

1.22 times

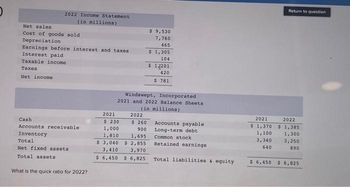

Transcribed Image Text:2022 Income Statement

(in millions)

Net sales

Cost of goods sold

Depreciation

Earnings before interest and taxes

Interest paid

Taxable income

Taxes

Net income

Cash

Accounts receivable

Inventory

Total

Net fixed assets.

Total assets

What is the quick ratio for 2022?

2021

$ 230

$ 260

1,000

1,8107

900

1,695

$ 3,040 $ 2,855

3,410

3,970

$ 6,450 $ 6,825

$ 9,530

7,760

465

$ 1,305

104

Windswept, Incorporated

2021 and 2022 Balance Sheets

(in millions)

2022

$ 1,201

420

$ 781

Accounts payable

Long-term debt

Common stock

Retained earnings.

Total liabilities & equity

Return to question

2021

2022

$ 1,370 $ 1,385

1,100

3,340

640

1,300

3,250

890

$ 6,450 $6,825

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Precision Tools 2021 Income Statement Net sales Less: Cost of goods sold Less: Depreciation Earnings before interest and taxes Less: Interest paid $36,408 28,225 1,760 6,423 510 5,913 Taxable Income Less: Taxes 2.070 $3.843 Net Income Precision Tools 2020 and 2021 Balance Sheets 2020 2021 2020 2021 $ Cash 2,060 1,003 Accounts 7,250 8,384 payable Accounts 3,411 4,218 receivable 21.908 27,129 Inventory 18,776 24,247 17,500 3.825 Common stock Retained earnings Total liability & 15,000 Net fixed assets 14,160 14.080 6.357 Total assets 38.407 41,209 38,407 41,209 equity What is the times interest earned ratio for 2021?arrow_forwardect Assignment The preliminary 2024 income statement of Alexian Systems, Incorporated, is presented below: ALEXIAN SYSTEMS, INCORPORATED Income Statement. For the Year Ended December 31, 2024 ($ in millions, except earnings per share) Revenues and gains: Sales revenue Interest revenue Other income Total revenues and gains. Expenses: Cost of goods sold Selling and administrative expense Income tax expense Total expenses Net Income Earnings per share $ 435 6 128 569 247 158 41 446 $123 $ 12.30 Saved Help Additional information: 1. Selling and administrative expense includes $28 million in restructuring costs. 2. Included in other income is $120 million in income from a discontinued operation. This consists of $90 million in operating income and a $30 million gain on disposal. The remaining $8 million is from the gain on sale of investments. 3. Cost of Goods Sold in 2024 includes an increase of $10 million to correct an understatement of Cost of Goods Sold in 2023. The amount is material.…arrow_forwardPlease help me with the attached problemarrow_forward

- Use the following information to answer this question. Windswept, Incorporated 2022 Income Statement (in millions) Het sales Cost of goods sold Depreciation Earnings before interest and taxes Interest paid Taxable income Taxes Net income Cash Accounts receivable Inventory Total Net fixed assets Total assets 2021 What is the equity multiplier for 20227 $11,100 8,050 430 $ 2,620 104 $2,516 881 $ 1,635 Windswept, 2921 and 2022 Balance Sheets. (in millions) 2022 $300 1,150 1,050 2,060 1,775 $ 3,510 $3,155 3,520 4,120 $7,030 $7,275 $ 330 porated Accounts payable Long-term debt Common stock Retained earnings Total liabilities & equity 2021 $1,870 1,090 3,400 670 2022 $1,932 1,373 3,050 920 $7,030 $7,275.arrow_forwardUse the below information to answer the following questions: 20202021Sales$11,573$12,936Depreciation 1661 1736Cost of goods sold 3979 4707Other Expenses 846 924Interest Expense 776 926Cash 6067 6466Accounts Receivables 8034 9427Short-term Notes Payable 1171 1147Long-term debt 20,320 24,696Net fixed assets 50,888 54,273Accounts Payable 4384 4644Tax rate 26% 34%Inventory 14,283 15,288Payout ratio 33% 30% A. Create the Balance Sheets for 2020 & 2021.arrow_forwardPlease do not give solution in image format thankuarrow_forward

- What is Naboo Manufacturing's 2019 Current Ratio?arrow_forwardIncome Statement: The income statement of Taco Bell company is given for the years 2020 & 2019. 2020 2019 General and administrative expenses 25,000 24,000 Interest expense 1,200 1,500 Net sales $124,000 S138,000 Selling expenses 11,880 12,720 Income taxes $1,109.5 1,883 108 000 95,000 COGS 450 600 Gain on Sale of land l2020 andarrow_forward2023 Income Statement Sales Cost of Goods Sold $ 770,000 $ 340,000 Depreciation Expense $ 95,000 Earnings before Interest and Taxes $ 335,000 Interest Expense $ 19,800 Taxable Income Tax Expense Net Income Dividends Paid Retained Earnings $ 315,200 $ 104,016 $ 211,184 $ 10,300 $ 200,884 Balance Sheet End of 2023 Beginning of 2023 Cash $ 280,000 $ 122,000 Accounts Receivable $ 50,000 $ 22,300 Inventory $ 188,000 $ 119,000 Net Fixed Assets $ 630,000 $ 630,000 Total Assets $1,148,000 $ 893.300 Accounts Payable Long-term Debt $ 158,000 $ $ 14,116 $ 71,800 121,500 Common Stock $ 375,000 $ 300,000 Accumulated Retained Earnings $ 600,884 $ 400,000 Total Liabilities & Shareholders' Equity $1,148,000 $ 893,300 Consider the financial statements displayed above. Based on these statements, calculate the firm's quick ratio as of the end of 2023. Note: Report your answer as a number rounded to two decimal points.arrow_forward

- How do you find the red numbers on the balance sheet and income statement?arrow_forwardThe financial information on Lazy Day, Inc. is as follows: 2019 2020 Cash $ 138 $ 97 Sales 10,204 11,317 Inventory 5,209 5,138 Depreciation 956 948 Cost of goods sold 4,207 4,618 Accounts payable 3,338 3,209 Long-term debt 4,200 3,800 Shareholders’ equity 9,229 9,906 Accounts receivable 2,780 2,960 Net fixed assets 8,640 8,720 Interest expense 350 320 Selling and administrative expenses 1,015 984 Taxes 1,250 1,512 What is the cash flow to creditors for 2020?arrow_forwardPhoto from shiyalsuresh901arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education