FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

A10

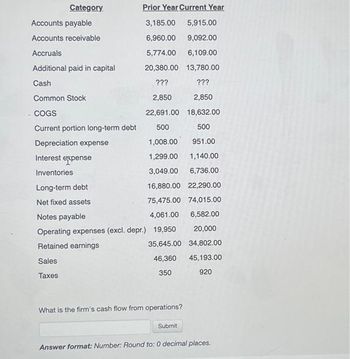

Transcribed Image Text:Category

Accounts payable

Accounts receivable

Accruals

Additional paid in capital

Cash

Common Stock

. COGS

Current portion long-term debt

Prior Year Current Year

3,185.00 5,915.00

6,960.00 9,092.00

5,774.00

6,109.00

20,380.00

13,780.00

???

???

2,850

2,850

22,691.00

18,632.00

500

500

1,008.00 951.00

1,299.00 1,140.00

3,049.00 6,736.00

16,880.00 22,290.00

75,475.00 74,015.00

4,061.00 6,582.00

Depreciation expense

Interest expense

Inventories

Long-term debt

Net fixed assets

Notes payable

Operating expenses (excl. depr.) 19,950

Retained earnings

35,645.00

Sales

46,360

Taxes

350

What is the firm's cash flow from operations?

Submit

20,000

34,802.00

45,193.00

920

Answer format: Number: Round to: 0 decimal places.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Please do not give solution in image format thankuarrow_forwardSolve this calculationarrow_forwardhttps://cxp-cdn.cengage.info/protected/prod/assets/f0/e/f0ed7b87-70a8-4a94-ad45-3346ee92c25e.pdf?__gda__=st=1643305989~exp=1643910789~acl=%2fprotected%2fprod%2fassets%2ff0%2fe%2ff0ed7b87-70a8-4a94-ad45-3346ee92c25e.pdf*~hmac=b18165161e57bb910f7606f9e3288392cdb5f98d9240940c6b70007dd18cff7carrow_forward

- Carpenter Corporation uses the weighted-average method in its process costing system. This month, the beginning inventory in the first processing department consisted of 600 units. The costs and percentage completion of these units in beginning inventory were: Materials costs Conversion costs Cost $ 5,200 $ 8,500 Percent Complete 60% 55% A total of 7,800 units were started and 7,100 units were transferred to the second processing department during the month. The following costs were incurred in the first processing department during the month: Materials costs Conversion costs Cost $ 95,000 $ 169,200 The ending inventory was 85% complete with respect to materials and 70% complete with respect to conversion costs. How many units are in ending work in process inventory in the first processing department at the end of the month?arrow_forwardBermuda Cruises issues only common stock and coupon bonds. The firm has a debt-equity ratio of 1.41. The cost of equity is 13.5 percent and the pretax cost of debt is 7.6 percent. What is the capital structure weight of the firm's equity if the firm's tax rate is 25 percent?arrow_forwardO O O O 0.021 0.000 0.059 0.081arrow_forward

- * 0O T # 3 la Uni X L Grades for Cristian Catala: 22s X WP Ch7quiz with TF5 WP NWP Assessment Player UI Ap X + tion.wiley.com/was/ui/v2/assessment-player/index.html?launchld%3Dafd8fa6a-bc9b-4f11-82e4-3c0d1d4a7063#/question/8 TF5 Question 9 of 10 -/1 Cullumber Consulting Company is headquartered in Atlanta and has branch offices in Nashville and Birmingham. Cullumber uses an activity-based costing system. The Atlanta office has its costs for Administration and Legal allocated to the two branch offices. Cullumber has provided the following information: Activity Cost Pool Cost Driver Costs Administration % of time devoted to branch $703000 Legal Hours spent on legal research $141000 Hours % of time spend devoted to branch on legal research Nashville 000 Birmingham How much of Atlanta's cost will be allocated to Nashville? (round to nearest dollar) O $632900 O $670862 O $672962 O $675200 Save for Later Attemnts: 0 of 1 used MacBook Pro G Search or type URL 000 +, 000 %23 %24 7. 8. 4. 9-…arrow_forwardF8'Ch X Book 4 xlsx Bb Signature E UTF-8Lece x Connect 9 Question 2 E Chapter 7E x 8 BUS 214 14 X Question 6 neducation.com/ext/map/index.html?_con=con&external_browser=0&launchUrl=https%253A%252F%252Fperustatecollege.blackboard.com%252Fwebapps%252Fportal%252Ffra pters 7-9) 6 Saved Help Misu Sheet, owner of the Bedspread Shop, knows his customers will pay no more than $140 for a comforter. Misu wants a 50% markup on selling price. What is the most that Misu can pay for a comforter? Misu's payment Ac Graw DII & %23 %24 96 2. 4. y. e NEIARDarrow_forward(31) 41 ← → C Permiss Pos X Drag ea в HELP! CB U.S. Ce M (no sub + f2.app.edmentum.com/assessments-delivery/ua/la/launch/69158/45467537/aHR0cHM6Ly9mMi5hcHAUZWRtZW50dW0uY29tL2xlYX... < 21 https:// Graph.x ABC Co Previous 21♥ Next → Post Test: Mathematical Models and Investments Type the correct answer in each box. Use numerals instead of words. An investment worth $50,000 has these expectations of returns: • 30% chance of ending up worth $40,000 • 50% chance of ending up worth $50,100 • 20% chance of ending up worth $65,000 Determine the expected value and risk. The expected value of the investment is $ © 2023 Edmentum. All rights reserved. C The investment is risky because it has only a Reset OG Next R https:// Submit Test TXVS N ES Reader Tools % chance of making a significant return. Apr 21 12:07 S Inarrow_forward

- Bumgardner Incorporated has provided the following data concerning one of the products in its standard cost system. Inputs Direct materials Standard Quantity or Hours per Unit of Output 8.0 liters Standard Price or Rate $ 5.00 per liter The company has reported the following actual results for the product for April: Actual output Raw materials purchased 7,400 units 65,400 liters $ 5.70 per liter 59,210 liters Actual price of raw materials Raw materials used in production The raw materials price variance for the month is closest to: (Round your intermediate calculations to 2 decimal places.)arrow_forwardThe following information is provided for the first month of operations for Legal Services Inc.: A. The business was started by selling $103,000 worth of common stock. B. Six months' rent was paid in advance, $4,100. C. Provided services in the amount of $1,500. The customer will pay at a later date. D. An office worker was hired. The worker will be paid $277 per week. E. Received $520 in payment from the customer in "C". F. Purchased $300 worth of supplies on credit. G. Received the electricity bill. We will pay the $120 in thirty days. H. Paid the worker hired in "D" for one week's work. I. Received $130 from a customer for services we will provide next week. J. Dividends in the amount of $1,800 were distributed. Prepare the necessary journal entries to record these transactions. If no entry is required, select "No Entry Required" and leave the amount boxes blank. If an amount box does not require an entry, leave it blank. A. B. 111arrow_forward1. EX. 14.01.ALGO 2. EX.14.02 3. EX.14.03 4. EX.14.04 5. EX.14.05.BLANKSHEET.AL... 6. EX.14.06.BLANKSHEET.AL... 7. EX.14.07.BLANKSHEET.AL... 8. EX.14.08.BLANKSHEET.AL... 9. EX.14.09.BLANKSHEET.AL... 10. EX.14.11.BLANKSHEET.A... 11. EX.14.14.ALGO 12. PR.14.04.BLANKSHEET.A... 13. PR.14.02.BLANKSHEET.A... C Effect of Financing on Earnings per Share Henriksen Co., which produces and sells biking equipment, is financed as follows: Bonds payable, 10% (issued at face amount) $1,000,000 Preferred $2 stock, $20 par 1,000,000 Common stock, $25 par 1,000,000 Income tax is estimated at 40% of income. Determine the earnings per share of common stock, assuming that the income before bond interest and income tax is (a) $470,000, (b) $570,000, and (c) $670,000. Enter answers in dollars and cents, rounding to two decimal places. a. Earnings per share on common stock $ b. Earnings per share on common stock $ c. Earnings per share on common stock $ JAN 20 A I 0.28 1.3 W X Parrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education