FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

Need answer

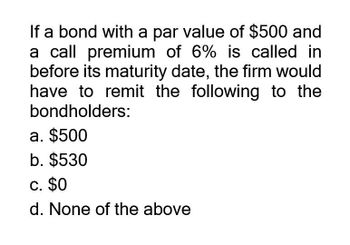

Transcribed Image Text:If a bond with a par value of $500 and

a call premium of 6% is called in

before its maturity date, the firm would

have to remit the following to the

bondholders:

a. $500

b. $530

c. $0

d. None of the above

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Hi expart Provide solutionarrow_forwardHi expert please give me answer general accountingarrow_forwardThe following information about bonds A, B, C, and D are given. Assume that bond prices admit noarbitrage opportunities. What is the convexity of Bond D?Cash Flow at the end ofBond Price Year 1 Year 2 Year 3A 91 100 0 0B 86 0 100 0C 78 0 0 100D ? 5 5 105arrow_forward

- Calculating the risk premium on bonds The text presents a formula where (1+1) = (1-p)(1 +i+x) + p(0) where i is the nominal interest rate on a riskless bond x is the risk premium p is the probability of default (bankruptcy) If the probability of bankruptcy is zero, the rate of interest on the risky bond is When the nominal interest rate for a risky borrower is 8% and the nominal policy rate of interest is 3%, the probability of bankruptcy is %. (Round your response to two decimal places.) When the probability of bankruptcy is 6% and the nominal policy rate of interest is 4%, the nominal interest rate for a risky borrower is %. (Round your response to two decimal places.) When the probability of bankruptcy is 11% and the nominal policy rate of interest is 4%, the nominal interest rate for a risky borrower is %. (Round your response to two decimal places.) The formula assumes that payment upon default is zero. In fact, it is often positive. How would you change the formula in this case?…arrow_forwardPlease answer both partsarrow_forwardThe coupon rate of a bond is typically __________.a. fixed at the time of bond issuanceb.subject to change based on the federal funds ratec.zero in the case of zero - coupon bondsd. Both A and Carrow_forward

- please do the compuations and formulas, show it to me explain steps of fianncial calculator C Compute the YTM for a bond with the listed information. Annual Coupon Par Maturity Bond Price Semiannual Coupon Maturity Bond Price Calculation 6,50% $1 000,00 15 ($980,00) N PMT FV PV I/Y YTMarrow_forwardIf the YTM on the following bonds are identical except, what is the price of bond B? Bond A Bond B Face value $1,000 $1,000 Semiannual coupon $45 $35 Years to maturity 20 20 Price $1,098.96 ?arrow_forwarda. Assuming the bonds will be rated AA, what will the price of the AA-rated bonds be? b. How much total principal amount of these bonds must HMK issue to raise $9million today, assuming the bonds are AA rated? (Because HMK cannot issue a fraction of a bond, assume all fractions are rounded to the nearest whole number.) c. What must the rating of the bonds be for them to sell at par? d. Suppose that when the bonds are issued, the price of each bond is $970.43. What is the likely rating of the bonds?Are they junk bonds? Note: Assume annual compounding.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education