FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

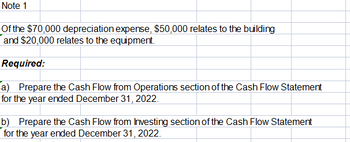

Transcribed Image Text:Note 1

Of the $70,000 depreciation expense, $50,000 relates to the building

and $20,000 relates to the equipment.

Required:

a) Prepare the Cash Flow from Operations section of the Cash Flow Statement

for the year ended December 31, 2022.

b) Prepare the Cash Flow from Investing section of the Cash Flow Statement

for the year ended December 31, 2022.

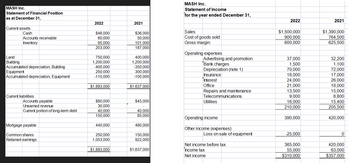

Transcribed Image Text:MASH Inc.

Statement of Financial Position

as at December 31,

Current assets

Cash

Accounts receivable

Inventory

Land

Building

Accumulated depreciation, Building

Equipment

Accumulated depreciation, Equipment

Current liabilities

Accounts payable

Unearned revenue

Current portion of long-term debt

Mortgage payable

Common shares

Retained earnings

2022

$48,000

60,000

95,000

203,000

750,000

1,200,000

-400,000

250,000

-110,000

$1,893,000

$80,000

30,000

40,000

150,000

440,000

250,000

1,053,000

$1,893,000

2021

$36,000

50,000

101,000

187,000

400,000

1,200,000

-350,000

300,000

-100,000

$1,637,000

$45,000

40,000

85,000

480,000

150,000

922,000

$1,637,000

MASH Inc.

Statement of Income

for the year ended December 31,

Sales

Cost of goods sold

Gross margin

Operating expenses

Advertising and promotion

Bank charges

Depreciation (note 1)

Insurance

Interest

Office

Repairs and maintenance

Telecommunications

Utilities

Operating income

Other income (expenses)

Loss on sale of equipment

Net income before tax

Income tax

Net income

2022

$1,500,000

900,000

600,000

37,000

1,500

70,000

18,000

24,000

21,000

13,500

9,000

16,000

210,000

390,000

-25,000

365,000

55,000

$310,000

2021

$1,390,000

764,500

625,500

32,200

1,100

72,000

17,000

26,000

18,000

15,000

8,800

15,400

205,500

420,000

0

420,000

63,000

$357,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Select information from BUI Balance Sheets as of December 31 Current Assets Net Plant and Equipment Total Assets Accounts Payable Notes Payable Accruals Long-Term Bonds Total Common Equity Total Liabilities & Equity Income Statement Earnings before interest and taxes Depreciation and Amortization Interest Taxes 40% Net Income Other Information WACC Number of shares outstanding Price per share What was 2014 EVA? $0 $197,600 $140,000 $57,600 2013 1,200,000 900,000 2,800,000 2,700,000 4,000,000 3,600,000 2014 200,000 216,000 280,000 108,000 120,000 252,000 1,040,000 864,000 2,360,000 2,160,000 4,000,000 3,600,000 2014 1,200,000.0 140,000.0 104,000.0 438,400.0 657,600.0 2014 18.00% 80,000 $22.13arrow_forwardGiven the data in the following table, accounts receivable in 2023 was…arrow_forwardFlint Corp. Statement of Financial Position For the Year Ended December 31, 2023 Current assets Cash (net of bank overdraft of $40,000 ) $450,000 Accounts receivable (net) Inventory at the lower of cost and net realizable value FV-NI investments (at cost-fair value $320,000 ) Property, plant, and equipment Buildings (net) 590,000 Equipment (net) 190,000 Land held for future use ,265,000 Intangible assets Goodwill Investment in bonds to collect cash flows, at amortized cost 100,000 Prepaid expenses Current liabilities Accounts payable 365,000 Notes payable (due next year) Pension obligation Rent payable 505,000 511,000 340,000 265,000 Long-term liabilities Bonds payable 681,000 Shareholders' equity Common shares, unlimited authorized, 380,000 issued 380,000 Contributed surplus 210,000 Retained earningsarrow_forward

- A comparative statement of financial position for Blue Spruce Industries Inc. follows: BLUE SPRUCE INDUSTRIES INC. Statement of Financial Position December 31, 2023 Assets Cash Accounts receivable Inventory. Land Equipment Accumulated depreciation-equipment Total Liabilities and Shareholders' Equity Accounts payable Bonds payable Common shares Retained earnings Total Additional information: 1 2. 3. vi December 31 2023 $22,800 122,000 234,000 77,000 269,000 (70,300) $654,500 $52,400 163,800 233,000 205,300 $654,500 No equipment was sold during the year. 2022 $35,800 55,600 191.000 Net income for the fiscal year ended December 31, 2023, was $130,000. Cash dividends of $48,300 were declared and paid. Dividends paid are treated as financing activities. Bonds payable amounting to $50,000 were retired through the issuance of common shares. 4. Land was sold at a gain of $4,000 125.000 216.000 (43,500) $579,900 $59,500 213,800 183,000 123.600 $579,900arrow_forwardThe following data are taken from the records of Grouper Company. Cash Current assets other than cash Long-term debt investments Plant assets Accumulated depreciation Current liabilities Bonds payable Common stock Retained earnings Additional information: 1. 2. 3. 4. 5. December 31, December 31, 2025 2024 $15,100 84,300 10,000 334,300 $443,700 $20,100 39,900 74,800 255,400 53,500 $443,700 $8,000 60,600 52,500 214,900 $336,000 $40,400 21,800 -0- 255,400 18,400 $336,000 Held-to-maturity debt securities carried at a cost of $42,500 on December 31, 2024, were sold in 2025 for $34,300. The loss (not unusual) was incorrectly charged directly to Retained Earnings. Plant assets that cost $50,300 and were 80% depreciated were sold during 2025 for $8,000. The loss was incorrectly charged directly to Retained Earnings. Net income as reported on the income statement for the year was $57,100. Dividends paid amounted to $11,740. Depreciation charged for the year was $19,940.arrow_forwardFinanced by: Paid-up: Share Capital Retained Earnings Reserves Long Term Liabilities Current Other payables Trade creditors Liabilities Accrued expense Barakah Company Balance Sheet as at 31st December 2019 100,000 245,500 30,000 Additional Information: i) ii) 600,000 155,500 75,000 830,500 25,000 375,500 1,231,000 Fixed Assets (net after depreciation) $ Land & Buildings Equipment Vehicles Fixtures & Fittings Current Assets Inventory Accounts Receivable Prepayments Cash at Bank Cash in Hand Work-in-Progress is one-sixth of the total Inventory. Prepayments are related to the rental of buildings. Bad debt is 5% for the year. Non-Muslim ownership is at 20%. 350,500 200,500 150,000 50,000 751,000 Required: Determine the zakat base and due for the company using: (a) Net Current Assets method; and (b) Net Invested Fund Method. 125,000 215,000 10,000 110,000 20,000 1,231,000arrow_forward

- Text Predictions: On ABC Inc. Balance Sheet as at December 31, 2015 and 2016 ($ thousands) Current Assets Cash Accounts Receivable Inventory Total Current Assets Fixed Assets Property, Plant & Equipment Less Accumulated Depreciation Property, Plant & Equipment, net Total Assets Liabilities and S/H Equity Current Liabilities Accounts Payable Notes Payable and short-term debt Total Current Liabilities Long-Term Debt Shareholders' Equity Common Shares Paid-In Capital Retained Earnings Total Total Liabilities and S/H Equity ABC Inc. Income Statement for 2015 and 2016 ($ thousands) Revenue Cost of Goods Sold Operating Expenses Depreciation Earnings Before Interest & Taxes (EBIT) Interest Paid Income Before Taxes (EBT) Taxes Paid Net Income (NI) Dividend Accessibility: Investigate 2015 $ 200 450 550 $1,200 2.200 (1.000) 1,200 $2,400 $ 200 0 $ 200 $ 600 300 600 700 $1,600 $2,400 2015 $1,200 700 30 220 S 250 50 $ 200 180 $ 120 $ S 2016 $ 150 425 625 $1,200 2016 $1,450 850 40 200 $360 160 $ 300…arrow_forwardPresented below are data taken from the records of Wildhorse Company. December 31,2020 December 31,2019 Cash $15,200 $8,100 Current assets other than cash 84,700 60,600 Long-term investments 10,000 52,900 Plant assets 332,400 215,200 $442,300 $336,800 Accumulated depreciation $20,100 $40,100 Current liabilities 39,600 22,100 Bonds payable 74,800 –0– Common stock 254,500 254,500 Retained earnings 53,300 20,100 $442,300 $336,800 Additional information: 1. Held-to-maturity debt securities carried at a cost of $42,900 on December 31, 2019, were sold in 2020 for $33,600. The loss (not unusual) was incorrectly charged directly to Retained Earnings. 2. Plant assets that cost $50,500 and were 80% depreciated were sold during 2020 for $8,000. The loss was incorrectly charged directly to Retained Earnings. 3. Net income as reported on the…arrow_forwardSelected financial info for Strand Corp is below: Cash Accounts receivable (net) Inventory Land Equipment Accumulated depreciation TOTAL Accounts payable Notes payable- current Notes payable- non-current Common stock Retained earnings TOTAL 2022 2021 $63,000 $42,000 $151,200 $84,000 $201,600 $168,000 $21,000 $58,800 $789,600 $504,000 ($115,600) ($84,000) $1,110,800 $772,800 $86,000 $50,400 $29,400 $67,200 $302,400 $168,000 $487,200 $420,000 $205,800 $67,200 $1,110,800 $772,800 Additional info for 2022: 1) Net Income was $235,200 2) Depreciation expense was recorded 3) Land was sold at its original cost. No other assets were sold 4) Cash dividends were paid 5) Equipment was purchased for cash REQUIRED: A) Prepare a formal Statement of Cash Flows for 2022 B) Prepare a calculation for Free Cash Flowarrow_forward

- Barakah Company Balance Sheet as at 31st December 2019 Financed by: Fixed Assets (net after depreciation) 2$ $ Paid-up: Share Capital Retained Earnings Reserves 350,500 200,500 150,000 50,000 Land & Buildings 600,000 155,500 75,000 830,500 Equipment Vehicles Fixtures & Fittings Long Term Liabilities 25,000 751,000 Current Assets 125,000 Accounts Receivable 215,000 10,000 110,000 20,000 1,231,000 Inventory Current Other payables Trade creditors Liabilities 100,000 245,500 Prepayments Cash at Bank Cash in Hand Accrued expense 30.000 375,500 1,231.000 Additional Information: i) Work-in-Progress is one sixth of the total Inventory. Prepayments is related to rental of buildings. ii) ii) Bad Debts is 5% for the year. iv) Non Muslim ownership is at 20%. Required: Determine the zakat base and due for the company using: (a) Net Current Assets method; and (b) Net Invested Fund Method.arrow_forwardLong-term assets: Equipment Less: Accumulated depreciation Total assets Liabilities and Stockholders' Equity Current liabilities: Accounts payable Interest payable Income tax payable Long-term liabilities: $104,000 0 34,500 490,000 Notes payable Stockholders' equity: Common stock 590,000 590,000 Retained earnings 1,815,500 1,754,200 Total liabilities and stockholders' equity $3,034,000 $2,948,000 Earnings per share for the year ended December 31, 2024, are $1.25. The closing stock price on December 31, 2 Required: Calculate the following profitability ratios for 2024. (Use 365 days a year. Round your final answers to 1 decima Profitability Ratios 1. Gross profit ratio 2. Return on assets 3. Profit margin 4. Asset turnover 5. Return on equity 6. Price-earnings ratio 38.6% 42.3 % 14.4 % 2.9 times 53.2 % 17.1 1,095,000 (398,000) $3,034,000 1,095,000 (199,000) $2,948,000 $80,000 3,900 29,900 490,000arrow_forwardOn January 1, 2025, Artic Inc. had the following balance sheet: Cash Total Debt investments (available-for-sale) 363,000 $434,000 Assets Interest revenue ARTIC INC. BALANCE SHEET AS OF JANUARY 1, 2025 ARTIC INC. INCOME STATEMENT FOR THE YEAR ENDED DECEMBER 31, 2025 $11,000 Gain on sale of investments Net income $71,000 Common stock (a) The accumulated other comprehensive income related to unrealized holding gains on available-for-sale debt securities. The fair value of Artic Inc.'s available-for-sale debt securities at December 31, 2025, was $310,000; its cost was $277,000. No debt securities were purchased during the year. Artic Inc.'s income statement for 2025 was as follows: (Ignore income taxes.) 28,000 $39,000 (Assume all transactions during the year were for cash.) Accumulated other comprehensive income Total Equity $389,000 Debit 45,000 $434,000 Prepare the journal entry to record the sale of the available-for-sale debt securities in 2025. (Credit account titles are…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education