FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

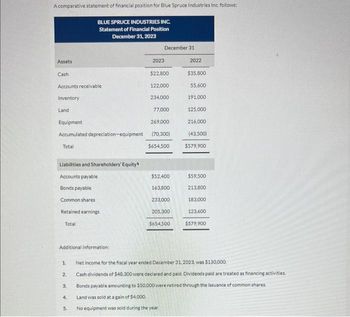

Transcribed Image Text:A comparative statement of financial position for Blue Spruce Industries Inc. follows:

BLUE SPRUCE INDUSTRIES INC.

Statement of Financial Position

December 31, 2023

Assets

Cash

Accounts receivable

Inventory.

Land

Equipment

Accumulated depreciation-equipment

Total

Liabilities and Shareholders' Equity

Accounts payable

Bonds payable

Common shares

Retained earnings

Total

Additional information:

1

2.

3.

vi

December 31

2023

$22,800

122,000

234,000

77,000

269,000

(70,300)

$654,500

$52,400

163,800

233,000

205,300

$654,500

No equipment was sold during the year.

2022

$35,800

55,600

191.000

Net income for the fiscal year ended December 31, 2023, was $130,000.

Cash dividends of $48,300 were declared and paid. Dividends paid are treated as financing activities.

Bonds payable amounting to $50,000 were retired through the issuance of common shares.

4. Land was sold at a gain of $4,000

125.000

216.000

(43,500)

$579,900

$59,500

213,800

183,000

123.600

$579,900

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Here are comparative financial statement data for Vaughn Company and Mary Company, two competitors. All data are as of December 31, 2022, and December 31, 2021. Net sales Cost of goods sold Operating expenses Interest expense Income tax expense Current assets Plant assets (net) Current liabilities $ Long-term liabilities Common stock, $10 par Retained earnings (a) Vaughn Company Dollars 2022 $1,842,000 1,040,730 268,932 9,210 53,418 323,500 $314,800 520,500 501,500 64,000 109,000 497,500 173,500 $ 2021 74,800 Vaughn Company 91,000 497,500 153,000 Dollars I Condensed Income Statement Percent % 2022 % Mary Company $561,000 297,330 77.979 3,927 Prepare a vertical analysis of the 2022 income statement data for Vaughn Company and Mary Company. (Round percentages to 1 decimal place, e.g. 12.1%) 83,200 6,732 30,600 138,300 125,400 34,000 28,600 Vaughn Company 2021 4 $78,600 117,000 117,000 39,900 $ 24,200 Condensed Income Statement 34,200 Percent Dollars % % % % % % % % % $ Mary Company…arrow_forwardSelected comparative statement data for Carla Vista Corporation are presented below. All balance sheet data are as at December 31. Net sales Profit for the year Total assets Total common shareholders' equity (a) Your answer is correct. Asset turnover (b) eTextbook and Media Your answer is incorrect. 2024 $850,000 Return on assets 84,000 615,000 450,000 Calculate asset turnover for 2024. (Round answer to 1 decimal place, e.g. 12.5.) 2023 $810,000 67,000 525,000 13.7 % 320,000 1.4 times Calculate return on assets for 2024. (Round answer to 1 decimal place, e.g. 12.5.)arrow_forwardForecast an Income StatementSeagate Technology reports the following income statement for fiscal 2019. SEGATE TECHNOLOGY PLC Consolidated Statement of Income For Year Ended June 28, 2019, $ millions Revenue $20,780 Cost of revenue 14,916 Product development 1982 Marketing and administrative 906 Amortization of intangibles 46 Restructuring and other, net (44) Total operating expenses 17,806 Income from operations 2,974 Interest income 168 Interest expense (448) Other, net 50 Other expense, net (230) Income before income taxes 2,744 (Benefit) provision for income taxes (1,280) Net income $4,024 Forecast Seagate’s 2020 income statement assuming the following income statement relations ($ millions). Revenue growth 5% Cost of revenue 71.8% of revenue Product development 9.5% of revenue Marketing and administrative 4.4% of revenue Amortization of intangibles No change Restructuring and other, net $0 Interest income No change…arrow_forward

- Oriole Company's income statement contained the following condensed information ORIOLE COMPANY Income Statement For the Year Ended December 31, 2022 Service revenue Operating expenses, excluding depreciation $624.500 Depreciation expense Loss on disposal of plant assets Income before income taxes Income tax expense Net income Accounts receivable Accounts payable Income taxes payable 2022 $74,400 40.300 Oriole's balance sheets contained the comparative data at December 31, shown below. 12.900 2021 54,600 $61000 27.000 6.400 24.100 $972,000 703,200 268,800 40,100 $228.700 Accounts payable pertain to operating expenses. Prepare the operating activities section of the statement of cash flows using the direct method. (Show amounts that decrease cash flow with either a-sign e.g.-15.000 or in parenthesis e.g. (15.000))arrow_forwardProvided below are the financial statements for J Ltd.: Income statement Balance Sheet Net sales $984 2021 2020 Assets Cost of goods sold $752 Current assets $452 $354 Depreciation $27 Long-term assets $389 $374 EBIT $205 Total assets $841 $728 Interest expense $25 Liabilities and shareholders' equity Current liabilities $247 $164 Income before taxes $180 Long-term debt $157 $145 Taxes $27 Shareholders' equity $437 $419 Net income $153 Total liabilities and shareholders' equity $841 $728 Calculate economic value added (EVA), assuming cost of capital is 7.5%. (Round all the intermediate calculations and the final answer to 2 decimal places) $131.95 $135.70 $98.40 $129.70arrow_forwardQuestion 9 Comparative balance sheets of Belch Ltd for 2022 and 2021 are as follows. Assets Current assets Cash Accounts receivable Notes receivable Inventories Total current assets Noncurrent assets Land Machinery Accumulated depreciation Total noncurrent assets Total assets Liabilities and shareholders' equity Current liabilities Accounts payable Interest payable Total current liabilities Long-term debt Total liabilities Belch Ltd Comparative Statement of Financial Position Dec. 31, 2022 Dec. 31, 2021 Shareholders equity Common shares Retained earnings Total shareholders' equity Total liabilities and shareholders' equity $ 200,000 160,000 70,000 399.000 829,000 525,000 483,000 (143,000) 865,000 $1,694,000 $ 145,000 17,500 162,500 350.000 512,500 650,000 531.500 1.181,500 $1,694,000 $ 188,000 133,000 61,000 326,000 708,000 500,000 238,000 (97,500) 640,500 $1,348.500 $ 153,000 15,000 168,000 200,000 368,000 550,000 430,500 980,500 $1,348,500 Additional information: 1. Net income is…arrow_forward

- Is Maness Corporation more or less liquid than the average company in the industry?arrow_forwardComparative financial statement data for Blossom Company and Oriole Company, two competitors, appear below. All balance sheet data are as of December 31, 2022. Net sales. Cost of goods sold Operating expenses Interest expense Income tax expense Current assets Plant assets (net) Current liabilities Long-term liabilities Net cash common by operating activities Capital expenditures Dividends paid on common stock Weighted-average common shares outstanding Blossom Company Oriole Company 2022 Net Income $2,592,000 1,692,000 407,520 9,980 $ 122,500 496,600 766,000 95,500 157,020 198,720 129,600 51,840 80,000 2022 $892,800 489,600 141,120 4,240 51,840 213,840 201,160 (a) Compute the net income and earnings per share for each company for 2022. (Round Earnings per share to 2 decimal places, eg $2.78) Earnings per share 48,600 58,470 51,840 28,800 21,600 50,000arrow_forwardelected items from Lemus Enterprises 12-31-2019 and 12-31-2018, financial statements are presented below: 2019 2018 Accounts receivable $ 40,000 $ 36,000 Merchandise inventory $ 28,000 35,000 Net sales 190,000 186,000 Cost of goods sold 114,000 108,000 Total assets 425,000 405,000 Total shareholders' equity 240,000 225,000 Net income 32,500 28,000 Lemus's 2019 asset turnover is (rounded): Group of answer choices 3.73. 2.79. 2.24. 0.46.arrow_forward

- The following are financial statements of Carla Vista Co.. Carla Vista Co.Income StatementFor the Year Ended December 31, 2022 Net sales $2,247,500 Cost of goods sold 1,018,500 Selling and administrative expenses 901,000 Interest expense 82,000 Income tax expense 75,000 Net income $ 171,000 Carla Vista Co.Balance SheetDecember 31, 2022 Assets Current assets Cash $ 56,300 Debt investments 81,000 Accounts receivable (net) 169,500 Inventory 118,900 Total current assets 425,700 Plant assets (net) 574,000 Total assets $ 999,700 Liabilities and Stockholders’ Equity Current liabilities Accounts payable $ 161,000 Income taxes payable 37,000 Total current liabilities 198,000 Bonds payable 201,880 Total liabilities 399,880 Stockholders’ equity Common stock 355,000 Retained earnings 244,820…arrow_forwardVertical Analysis of Balance Sheets Consolidated balance sheets for Winged Manufacturing follow. Winged ManufacturingConsolidated Balance Sheets(dollars in thousands) December 31 ASSETS 2023 2023 Current assets: Cash and cash equivalents $1,203,488 $676,413 Short-term investments 54,368 215,890 Accounts receivable, net of allowance for doubtful accountsof $90,992 ($83,776 in 2022) 1,581,347 1,381,946 Inventories 1,088,434 1,506,638 Deferred tax assets 293,048 268,085 Other current assets 255,767 289,383 Total current assets $4,476,452 $4,338,355 Property, plant, and equipment: Land and buildings $484,592 $404,688 Machinery and equipment 572,728 578,272 Office furniture and equipment 158,160 167,905 Leasehold improvements 236,708 261,792 $1,452,188 $1,412,657 Accumulated depreciation and amortization (785,088) (753,111) Net property, plant, and equipment $667,100 $659,546 Other assets…arrow_forwardOperating data for Sandhill Corporation are presented as follows. 2027 2026 Net sales $827,400 $647,900 Cost of goods sold 525,399 408,177 Selling expenses 124,110 77,748 Administrative expenses 74,466 51,832 Income tax expense 37,233 25,916 Net income 66,192 84,227 Prepare a schedule showing a vertical analysis for 2027 and 2026. (Round percentages to 1 decimal place, e.g. 12.1%.) SANDHILL CORPORATION Condensed Income Statements For the Years Ended December 31 Net sales $ Cost of goods sold Gross profit Selling expenses Administrative expenses Total operating expenses Income before income taxes Income tax expense Net income 2027 Amount Percent % $ % % % % ' " % % 10 $ % $ Amount 2026 Perarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education