Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

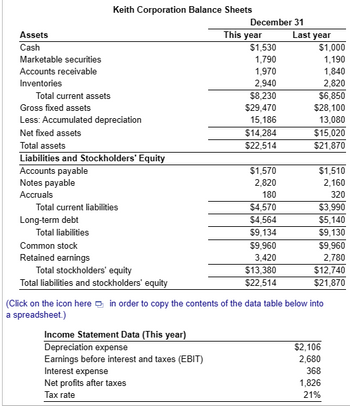

Transcribed Image Text:Finding operating and free cash flows Consider the balance sheets and selected data from the income statement of Keith Corporation that follow

a. Calculate the firm's net operating profit after taxes (NOPAT) for this year.

b. Calculate the firm's operating cash flow (OCF) for the year.

c. Calculate the firm's free cash flow (FCF) for the year.

d. Interpret, compare and contrast your cash flow estimate in parts (b) and (c).

a. The net operating profit after taxes is $

(Round to the nearest dollar.)

Transcribed Image Text:Assets

Cash

Marketable securities

Accounts receivable

Inventories

Total current assets

Gross fixed assets

Less: Accumulated depreciation

Net fixed assets

Total assets

Liabilities and Stockholders' Equity

Accounts payable

Notes payable

Accruals

Keith Corporation Balance Sheets

Total current liabilities

Long-term debt

Total liabilities

Common stock

Retained earnings

Total stockholders' equity

Total liabilities and stockholders' equity

Income Statement Data (This year)

Depreciation expense

Earnings before interest and taxes (EBIT)

Interest expense

December 31

Net profits after taxes

Tax rate

This year

$1,530

1,790

1,970

2,940

$8,230

$29,470

15,186

$14,284

$22,514

$1,570

2,820

180

$4,570

$4,564

$9,134

$9,960

3,420

$13,380

$22,514

Last year

$1,000

1,190

1,840

2,820

$6,850

$28,100

13,080

$15,020

$21,870

$1,510

2,160

320

$3,990

$5,140

$9,130

$9,960

2,780

(Click on the icon here in order to copy the contents of the data table below into

a spreadsheet.)

$12,740

$21,870

$2,106

2,680

368

1,826

21%

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 5 steps with 2 images

Knowledge Booster

Similar questions

- Please assist and show working with explanarrow_forwardCurrent Position Analysis The following data were taken from the balance sheet of Albertini Company at the end of two recent fiscal years: Previous Year Current assets: Cash Marketable securities Accounts and notes receivable (net) Inventories Prepaid expenses. Total current assets. Current liabilities: Accounts and notes payable (short-term) Accrued liabilities Total current liabilities 1. Working capital 2. Current ratio: Current Year 3. Quick ratio b. The liquidity of Albertini has $356,400 412,700 168,900 1,547,700 797,300 $3,283,000 $388,600 281,400 $670,000 $278,400 313,200 104,400 1,167,500 746,500 $2,610,000 a. Determine for each year (1) the working capital, (2) the current ratio, and (3) the quick ratio. Round ratios to one decimal place. Current Year Previous Year $406,000 174,000 $580,000 from the preceding year to the current year. The working capital, current ratio, and quick ratio have all in current assets relative to current liabilities. Most of these changes are the…arrow_forwarduse attachment and additional information to answer the following Required:a. Write a statement of cashflows (indirect method) for the year ended December 31,Year 2. CHECK Year 2 CFO, $0 b. Prepare a side-by-side comparative statement contrasting two bases of reporting: (1) net income and (2) cash flows from operations. c. Which of the two financial reports in(b)better reflects profitability? Explain. Additional data for the period January 1, Year 2, through December 31, Year 2, are: Sales on account,$70,000. Purchases on account,$40,000. Depreciation,$5,000. Expenses paid in cash,$18,000(including$4,000 of interest and $6,000 in taxes). Decrease in inventory, $2,000. Sales of fixed assets for $6,000 cash; cost $21,000 and two-thirds depreciated (loss or gain is included in income). Purchase of fixed assets for cash, $4,000. Fixed assets are exchanged for bonds payable of $30,000. Sale of investments for $9,000 cash. Purchase of treasury stock for cash, $11,500. Retire bonds…arrow_forward

- Prepare the statement of cash flows in good form usingINDIRECT METHOD. Be sure to provide a proper heading for thestatement. Thank you.arrow_forwardThe following condensed information is reported by Sporting Collectibles. Income Statement Information Sales revenue Cost of goods sold Net income Balance Sheet Information Current assets Long-term assets Total assets Current liabilities Long-term liabilities Common stock Retained earnings Total liabilities and stockholders' equity Profitability Ratios a. Gross profit ratio b. Return on assets c. Profit margin d. Asset turnover e. Return on equity % % % The amount of dividends paid Required: 1. Calculate the following profitability ratios for 2021: (Round your answers to 1 decimal place.) times % 2021 $10,440,000 6,827,760 360,000 2. Determine the amount of dividends paid to shareholders in 2021. 2020 $8,400,000 5,900,000 248,000 $ 1,600,000 2,200,000 $ 3,800,000 $ 1,200,000 1,500,000 800,000 $ 900,000 1,500,000 800,000 300,000 200,000 $ 3,800,000 $3,400,000 $1,500,000 1,900,000 $3,400,000arrow_forwardQuestion: Which of the following financial statements provides a snapshot of a company's financial position at a specific point in time? A) Income statement B) Balance sheet C) Statement of cash flows D) Statement of retained earningsarrow_forward

- Please calculate the Gross profit percentage, current ratio, debt-to-equity ratio, and earnings per share for Columbia Sportswear Company. Using the ratios, evaluate the financial statements from Columbia Sportswear Company. What does each of your four ratios indicate about the financial performance of the company? Based on your financial analysis: would you invest in this company? Why or why not?arrow_forwardThe accountant for Sysco Company is preparing the company's statement of cash flows for the fiscal year just ended. The following information is available: Net income for the year Cash dividends declared for the year Cash dividends payable at the beginning of the year Cash dividends payable at the end of the year 325,000 61,000 13,800 16,700 What is the amount of cash dividends paid that should be reported in the financing section of the statement of cash flows? Multiple Choice $61000 $63,900arrow_forwardGladys Inc. reported current assets totaling $65,800 and current liabilities totaling $28,750 at December 31, Year 2. The company’s income statement and statement of cash flow for Year 2 appear below: Calculate the following ratios and measures for Gladys Inc. for Year 2: Operating funds ratio, Operating cash flow-to-current liabilities ratio, Cash conversion ratio, Earnings before interest, taxes, depreciation and amortization (EBITDA), Free cash flow, Discretionary cash flowarrow_forward

- Evaluate and comment on businesses financial performance by calculating and analysing 2 profitability, liquidity and solvency ratios based on the information from financial statements Consider whether certain aspects (profitability, liquidity or solvency) can be improved and if so, how? (300 words)arrow_forwardWhich financial statement would show the revenues of the company for the year? Group of answer choices Statement of Shareholders' Equity Income Statement Balance Sheet Statement of Cash Flowsarrow_forward1. Calculate the following values for the company for the year ending in 20x9. Present evidence of all your calculations.a. NOPAT - Net Operating Profit after Taxesb. OCF - Operating Cash Flowc. FCF - Free Cash Flow2. Discuss what meaning each of the measures calculated in the previous question has, both for management and for investors and creditors, among other constituents.3. What is the main cause of the differences that exist between the company's earnings and the cash flows of the same evaluated period?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education