FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

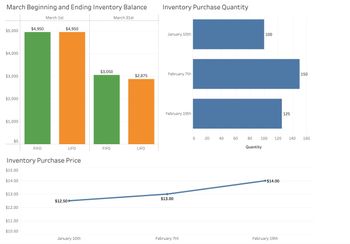

Capistrano Retail is a seller of glassware. They began operations on January 1st and have just finished their first quarter. They are evaluating inventory costing methods, specifically FIFO and LIFO, and want to compare the impacts of the different methods on their first quarter results. They made three purchases during the first quarter at varying prices and quantities. They have only recorded one sale so far which occurred on March 15th. Using the dashboard below, answer a few of the questions posed by management at Capistrano Retail:

Transcribed Image Text:March Beginning and Ending Inventory Balance

March 1st

$4,950

$4,950

$5,000

$4,000

$3,000

$2,000

$1,000

$0

$3,050

March 31st

$2,875

LIFO

FIFO

LIFO

Inventory Purchase Quantity

January 10th

February 7th

100

150

E

February 19th

0

20

40

60

80

Quantity

125

100 120 140 160

FIFO

Inventory Purchase Price

$15.00

$14.00

$13.00

$12.50

$12.00

$13.00

$14.00

$11.00

$10.00

January 10th

February 7th

February 19th

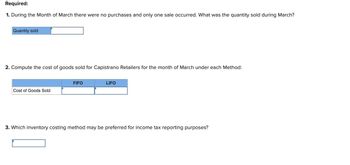

Transcribed Image Text:Required:

1. During the Month of March there were no purchases and only one sale occurred. What was the quantity sold during March?

Quantity sold

2. Compute the cost of goods sold for Capistrano Retailers for the month of March under each Method:

FIFO

Cost of Goods Sold

LIFO

3. Which inventory costing method may be preferred for income tax reporting purposes?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Advice the closing inventory value as at July 31st Qty On Hand Cost $0.05 $0.20 $2.00 $6.20 $2,500.00 $1.50 Product NRV $1.00 $0.90 $1.60 $6.18 $2,550.00 $1.55 WJ01 225 WJ02 114 WJ03 74 WJ04 35 WJ05 WJ06 58arrow_forwardUnits Cost Beginning inventory 50 $10 Purchase (June 5) 10 16 Purchase (June 15) 30 14 Sale (June 20) 40 Sale (June 25) 20 Purchase (June 30) 10 20 26. Refer to Exhibit 7-4. Assuming RJ uses a perpetual moving average cost flow assumption, cost of goods sold for June would be a. $512 b. $560 c. $768 d. $720 27. Refer to Exhibit 7-4. Assuming RJ, Inc. uses a periodic weighted average cost flow assumption, ending inventory for June would be a. $512 b. $560 c. $768 d. $720arrow_forwardFE9Advice the closing inventory value as at July 31stProduct Qty On Hand Cost NRVWJ01 225 $0.05 $1.00WJ02 114 $0.20 $0.90WJ03 74 $2.00 $1.60WJ04 35 $6.20 $6.18WJ05 3 $2,500.00 $2,550.00WJ06 58 $1.50 $1.55a) 7,986.05b) 7,955.75c) 8,402.20d) 7,960.65arrow_forward

- C Cengage NOWv2 | Onlin Perpetual Inventory Using FIFO Beginning inventory, purchases, and sales for Item PK95 are as follows: July 1 Inventory 44 units @ $15 9 Sale 30 units 13 Purchase 25 Sale 30 units @ $17 23 units Assuming a perpetual inventory system and using the first-in, first-out (FIFO) method, determine (a) the cost of merchandise sold on July 25 and (b) the inventory c July 31. a. Cost of merchandise sold on July 25 b. Inventory on July 31 402 X 348 X Incorrect Feedback Check My Workarrow_forwardvcbvrrrrrrrrarrow_forwardNash Company uses the LCNRV method, on an individual-item basis, in pricing its inventory items. The inventory at December 31, 2020, consists of products D, E, F, G, H, and I. Relevant per unit data for these products appear below. Item D Item E Item F Item G Item H Item I Estimated selling price $124 $113 $98 $93 $113 $93 Cost 77 82 82 82 52 37 Cost to complete 31 31 26 36 31 31 Selling costs 10 19 10 21 10 21 Using the LCNRV rule, determine the proper unit value for balance sheet reporting purposes at December 31, 2020, for each of the inventory items above. Item D %24 Item E %$4 Item F 24 Item G %24 Item H %24arrow_forward

- Inventory Date Quantity Unit Cost Total Cost Mar. 1 850 $98 $83,300 1,275 $95 $121,125 Mar. 8 650 $98 $63,700 Mar. 11 325 $98 $31,850 Mar. 14 325 $98 $31,850 780 $103 $80,340 Mar. 22 260 $98 $25,480 Mar. 25 260 $98 $25,480 1,800 $100 $180,000 Study the inventory record for March and answer the questions that follow. 1. Assuming that the product sells for $155 and that 85% of sales are on account, determine the gross profit from sales for March. 2. Making the same assumptions as in (1), determine the ending inventory cost for March. $ 3. Which inventory method is being used? LIFOarrow_forward14arrow_forwardQUESTION 14 ABC Corporation has the following inventory information for March, 2019: Units $Unit cost $ Total Cost Beg. Inv. 10.50 26,250 2,500 Purchase 1 10.75 34,400 3,200 Purchase 2 11.00 29,700 2,700 Purchase 3 11.25 22,500 2,000 Total 112,850 10,400 On March 31, ABC has 2,700 units in ending inventory. Using the periodic LIFO (last-in, first-out) method, what is the value of ending inventory on March 31? O a. $28,400 O b. $28,350 O c. $30,375 O d. $30,200arrow_forward

- Date of purchase Beginning inventory February 5 February 19 March 3 Goods available for sale Units sold Ending inventory Units purchased 40 20 15 26 82 Cost per Total cost unit $850 $1,770 $965 $480 Retail price per unit $965 $2,105 $2,016 $600 Total retail valuearrow_forwardQuestion 5 options: 7565.23 7415.65 7433.44 7395.58arrow_forward%24 Perpetual Inventory Using FIFO Beginning inventory, purchases, and sales for Item Zeta9 are as followS: Oct. 1 Inventory 72 units @ $20 7. Sale 58 units 15 Purchase 50 units @ $24 24 Sale 22 units Assuming a perpetual inventory system and using the first-in, first-out (FIFO) method, determine (a) the cost of goods sold on October 24 and (b) the inventory on October 31. a. Cost of goods sold on October 24 b. Inventory on October 31arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education