Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN: 9781337788281

Author: James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Question

thumb_up100%

Please need help

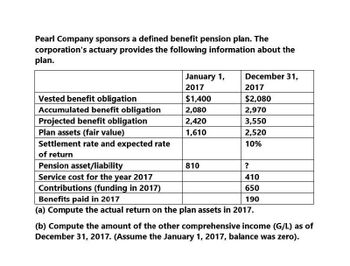

Transcribed Image Text:Pearl Company sponsors a defined benefit pension plan. The

corporation's actuary provides the following information about the

plan.

January 1,

December 31,

2017

2017

Vested benefit obligation

$1,400

$2,080

Accumulated benefit obligation

2,080

2,970

Projected benefit obligation

2,420

3,550

Plan assets (fair value)

1,610

2,520

Settlement rate and expected rate

10%

of return

Pension asset/liability

Service cost for the year 2017

Contributions (funding in 2017)

Benefits paid in 2017

810

?

410

650

190

(a) Compute the actual return on the plan assets in 2017.

(b) Compute the amount of the other comprehensive income (G/L) as of

December 31, 2017. (Assume the January 1, 2017, balance was zero).

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- In 2019, Magenta Corporation paid compensation of 45,300 to the participants in a profit sharing plan. During 2019, Magenta Corporation contributed 13,200 to the plan. a. Calculate Magentas deductible amount for 2019. b. Calculate the amount of any contribution carryover from 2019.arrow_forwardBlossom Company provides the following information about its defined benefit pension plan Service cost $ 91,800 Contribution to the plan 103,500 Prior service cost amortization 9,400 Actual and expected return on plan assets Benefits paid Plan assets at anuary 1, 2017 Projected benefit obligation at January 1, 2017 Accumulated OCI (PSC) at January 1, 2017 Interest/discount (settlement) rate 63,200 39,700 647,900 712,300 147,400 10 % Compute the pension expense for the year 2017.arrow_forwardPension data for Sterling Properties include the following: ($ in thousands)Service cost, 2021 $112Projected benefit obligation, January 1, 2021 850Plan assets (fair value), January 1, 2021 900Prior service cost—AOCI (2021 amortization, $8) 80Net loss—AOCI (2021 amortization, $1) 101Interest rate, 6%Expected return on plan assets, 10%Actual return on plan assets, 11% Required:Determine pension expense for 2021.arrow_forward

- Wildhorse Company provides the following information about its defined benefit pension plan for the year 2025. Service cost Contribution to the plan Prior service cost amortization Actual and expected return on plan assets Benefits paid Plan assets at January 1, 2025 Projected benefit obligation at January 1, 2025 Accumulated OCI (PSC) at January 1, 2025 Interest/discount (settlement) rate Compute the pension expense for the year 2025. Pension expense for 2025 $89,400 105,700 10,800 64,500 40,200 640,200 710,100 152,200 10%arrow_forwardRosaria Co. sponsors a defined benefit pension plan. For the current year ended December 31, thefollowing information relevant to the plan has been accumulated:Defined benefit obligation, 1/1 P11,250,000Fair value of plan assets, 1/1 10,500,000Current service cost 1,050,000Past service cost 2,200,000Actual return on plan assets 600,000Decrease in defined benefit obligation due tochanges in actuarial assumptions300,000Discount rate 8%Requirements:1. In the working papers computations, what balance of plan assets will be determined?2. In the working papers computations, what balance of benefit obligation will be determined?3. Calculate the amount that the entity would recognize in profit or loss for the year in accordancewith the revised PAS 19.4. Calculate the amount that the entity would recognize in other comprehensive income for theyear in accordance with the revised PAS 19.arrow_forwardThe actuary for the pension plan of Carla Vista Company calculated the following net gains and losses: Incurred during the Year (Gain) or Loss 2025 $(634,000) 2026 250,000 2027 1,020,000 2028 393,000 Other information about the company's pension obligation and plan assets is as follows: Projected Benefit As of January 1 Obligation Plan Assets (market-related asset value) 2025 $3,957,000 $3,563,000 2026 4,608,000 3,543,000 2027 4,690,000 3,729,000 2028 5,257,000 4,386,000 Carla Vista Company has a stable labor force of 250 employees who are expected to receive benefits under the plan. The total service- years for all participating employees are 2,750. The beginning balance of Accumulated OCI (G/L) is zero on January 1, 2025. The market-related value and the fair value of plan assets are the same for the 4-year period. Use the average remaining service life per employee as the basis for amortization. Compute the minimum amount of Accumulated OCI (G/L) amortized as a component of net…arrow_forward

- The actuary for the pension plan of Blossom Inc. calculated the following net gains and losses. Incurred during the Year (Gain) or Loss 2025 $302,850 2026 480,400 2027 (211,000) 2028 (289,700) Other information about the company's pension obligation and plan assets is as follows. Projected Benefit Plan Assets As of January 1, Obligation (market-related asset value) 2025 $4,004,500 $2,376,000 2026 4,531,500 2,190,900 2027 5,018,100 2,581,800 2028 4,241,640 3,061,000 Blossom Inc. has a stable labor force of 400 employees who are expected to receive benefits under the plan. The total service-years for all participating employees is 6,400. The beginning balance of accumulated OCI (G/L) is zero on January 1, 2025. The market-related value and the fair value of plan assets are the same for the 4-year period. Use the average remaining service life per employee as the basis for amortization. Prepare a schedule which reflects the minimum amount of accumulated OCI (G/L) amortized as a component…arrow_forwardThe following information is made available involving the defined benefit pension plan of Princess Company for the year 2018: Fair value of plan assets, 1/1/17 P3,500,000 Present value of benefit obligation 1/1/17 3,750,000 Current service cost 700,000 Actuarial return on plan asset 420,000 Contribution to the plan 600,000 Benefits paid to retirees 750,000, Decrease in the present value of benefit obligation due to change in actuarial assumptions 100,000 Present value of defined benefit obligation settled 250,000 Settlement price of defined benefit obligation 200,000 Discount rate 10% What is the fair value of the plan asset as of December 31, 2018?arrow_forwardCrane Enterprises Ltd. provides the following information about its defined benefit pension plan: Balances or Values at December 31, 2023 Defined benefit obligation Vested benefit obligation Fair value of plan assets $2,710,000 1,629,393 2,255,546 Other pension plan data: Current service cost for 2023 93,000 Actual return on plan assets in 2023 129,000 Return on plan assets in 2023 using discount rate 173,920 Interest on January 1, 2023 defined benefit obligation 250,000 Funding of plan in 2023 91,406 Benefits paid 139,000 (a) Calculate the January 1, 2023 balances for the pension-related accounts if Crane follows IFRS. Defined benefit obligation Fair value of plan assets Net defined benefit +A +Aarrow_forward

- The following information relates to the pension plan for the employees of Blossom Company: Accum. benefit obligation Projected benefit obligation Fair value of plan assets AOCI - net (gain) or loss Settlement rate (for year) Expected rate of return (for year) 1/1/25 $7940000 8465000 7625000 O $26250. O $17456. O $20238. O $14188. 0 12/31/25 $8360000 9158000 9620000 (1382000) 11% 8% 12/31/26 $11300000 12707000 10754000 (1550000) 11% 7% Blossom estimates that the average remaining service life is 16 years. Blossom's contribution was $1323000 in 2026 and benefits paid were $987000. The amount of AOCI (net gain) amortized in 2026 isarrow_forwardThe following information is made available involving the defined benefit pension plan of Princess Company for the year 2018: Fair value of plan assets, 1/1/17 P3,500,000 Present value of benefit obligation 1/1/17 3,750,000 Current service cost 700,000 Actuarial return on plan asset 420,000 Contribution to the plan 600,000 Benefits paid to retirees 750,000. Decrease in the present value of benefit obligation due to change in actuarial assumptions 100,000 Present value of defined benefit obligation settled 250,000 Settlement price of defined benefit obligation 200,000 Discount rate 10% What amount employee benefit cost should be reported in the profit or loss?arrow_forwardun.3arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning Individual Income TaxesAccountingISBN:9780357109731Author:HoffmanPublisher:CENGAGE LEARNING - CONSIGNMENT

Individual Income TaxesAccountingISBN:9780357109731Author:HoffmanPublisher:CENGAGE LEARNING - CONSIGNMENT

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:Cengage Learning

Individual Income Taxes

Accounting

ISBN:9780357109731

Author:Hoffman

Publisher:CENGAGE LEARNING - CONSIGNMENT