Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN: 9781337788281

Author: James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Question

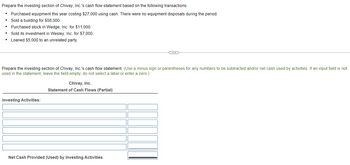

Transcribed Image Text:Prepare the investing section of Chivay, Inc.'s cash flow statement based on the following transactions:

• Purchased equipment this year costing $27,000 using cash. There were no equipment disposals during the period.

•

Sold a building for $58,000.

Purchased stock in Wedge, Inc. for $11,000.

⚫ Sold its investment in Wesley, Inc. for $7,000.

Loaned $5,000 to an unrelated party.

Prepare the investing section of Chivay, Inc.'s cash flow statement. (Use a minus sign or parentheses for any numbers to be subtracted and/or net cash used by activities. If an input field is not

used in the statement, leave the field empty; do not select a label or enter a zero.)

Chivay, Inc.

Statement of Cash Flows (Partial)

Investing Activities:

Net Cash Provided (Used) by Investing Activities

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Three Gray Ladies, Inc. had the following activities during the year. What would be reported on the Statement of Cash Flows as the net cash flow from investing activities? • Sold equipment with a $50,000 book value for a gain of $12,000. • Paid $34,000 on a long-term note payable. • Received $100,000 from common stock issuance. • Purchased land. Paid a down payment of $10,000. The balance of $90,000 will be paid via a five-year promissory note with quarterly payments. • Purchased an investment of IBM Stock for $5,000. • Paid $17,000 cash for purchase of merchandise inventory.arrow_forwardRainey Enterprises loaned $20,000 to Small Company on June 1, Year 1, for one year at 6 percent interest. Required Show the effects of the following transactions in a horizontal statements model. In the Statement of Cash Flows column, indicate whether the item is an operating activity (OA), an investing activity (IA), or a financing activity (FA). For any element not affected by the event, leave the cell blank. Note: Enter any decreases to account balances and cash outflows with a minus sign. Leave cells blank if no input is needed. (1) The loan to Small Company (2) The adjusting entry at December 31, Year 1. (3) The adjusting entry and collection of the note on June 1, Year 2. 3. Date 1. 6/1/Y1 2. 12/31/Y1 3. 6/1/72 (Adjusting entry) 6/1/Y2 (Collection of the note) Cash + + + + Assets Notes Receivable + + + + + RAINEY ENTERPRISES Horizontal Statements Model Balance Sheet Interest Receivable = Liabilities + + + + + Stockholders' Equity Retained Earnings Income Statement Revenue -…arrow_forwardThe following events occurred last year at Dorder Corporation: Purchase of plant and equipment Sale of long-term investment $ 45,000 Depreciation expense $ 24,000 Dividends received on long- $ 9,000 term investments Paid off bonds payable $ 12,000 $ 32,000 Based on the above information, the net cash provided by (used in) investing activities for the year on the statement of cash flows would be:arrow_forward

- Assume a company’s balance sheet showed beginning and ending balances in the Long-Term Investments account of $1,100,000 and $900,000, respectively. The company sold a long-term investment that cost $300,000 and recorded a gain on this sale of $35,000. Based solely on the information provided, the company’s net cash provided by (used in) investing activities would be: Multiple Choice $200,000. $300,000. $235,000. $335,000.arrow_forwardRainey enterprises loaned $50,000 to Small Co. on June 1, Year 1, for one year at 6% interest. Rainey Enterprises loaned $50,000 to Small Co. on June 1, Year 1, for one year at 6 percent interest. Required Show the effects of the following transactions in a horizontal statements. In the Cash Flow column, indicate whether the item is an operating activity (OA), an investing activity (IA), or a financing activity (FA). For any element not affected by the event, leave the cell blank. (Not every cell will require entry. Do not round intermediate calculations. Enter any decreases to account balances and cash outflows with a minus sign. Round your answers to the nearest whole dollar.) (1) The loan to Small Co. (2) The adjusting entry at December 31, Year 1. (3) The adjusting entry and collection of the note on June 1, Year 2. RAINEY ENTERPRISES Horizontal Statements Model Assets Equity Income Statenment Statement of Cash Flow Date Liabilinies Notes Receivable Interest Receivable Retained…arrow_forwardSub : AccountingPls answer very fast.I ll upvote correct answer. Thank Youarrow_forward

- Use the following information to calculate the net cash provided (inflow) or used by (outflow) from financing activities for the Lulu Corporation: (a) Net income, $10,000 (b) Sold common stock for $40,000 cash (c) Paid cash dividend of $13,000 (d) Repayment of bond payable, $26,000 (e) Purchased equ for $12,000 cash (f) Issued long term mortgage notes payable for $250,000 cash. (Note: in the answer space, write only the number, with no $ signs or commas. That is, if your answer is $1,000, white it as : 1000 ). Answer:arrow_forwardPlease answer in good accounting form thankyou 12. What is the net cash provided by financing activities?arrow_forwardConsider the following events: Cash of $112,000 was used to purchase a truck. Cash of $80,000 was used to retire bonds. Cash of $50,000 was received from the sale of an investment at a loss. Cash dividends of $28,000 were paid to stockholders. Plant assets were depreciated $12,000 under the straight line method. Compute the net cash flow from INVESTING activities (parentheses indicate an outflow):arrow_forward

- In Year 2, Lansing Company purchased equipment for $357,000 and also sold some special purpose machinery with a book value of $152,600 for $177,000. In its statement of cash flows for Year 2, the company should report the following with respect to the above transactions: 5 Multiple Choice $180,000 net cash used by investing activities. Jhm $357,000 net cash used by investing avities. $180,000 net cash used by investing activities; $24,400 net cash provided by operating activities. $357,000 cash used by investing activities; $177,000 cash provided by financing activities.arrow_forwardUse the following excerpts from Eagle Company's financial records to determine net cash flows from financing activities. acquired new plant assets $18,000 borrowed from bank, note payable 40,000 declared and paid dividends to shareholders 15,000arrow_forwardRainey Enterprises loaned $40,000 to Small Company on June 1, Year 1, for one year at 6 percent interest. Required: Show the effects of the following transactions in a horizontal statements model. Note: Enter any decreases to account balances and cash outflows with a minus sign. For changes on the Statement of Cash Flows, indicate whether the item is an operating activity (OA), investing activity (IA), or financing activity (FA). Not all cells require input. Do not round intermediate calculations. Round your final answers to the nearest whole dollar. (1) The loan to Small Company (2) The adjustment at December 31, Year 1. (3) The adjustment and collection of the note on June 1, Year 2. RAINEY ENTERPRISES Horizontal Statements Model Balance Sheet Date Assets Cash + Notes Receivable + Interest Receivable + + 1. 6/1/Year 1 2. 12/31/Year 1 3. 6/1/Year 2 Adjustment 3. 6/1/Year 2 Note Collection + ++ + ++ Liabilities + Stockholders' Equity Retained Earnings Income Statement Statement of Cash…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:Cengage Learning