FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

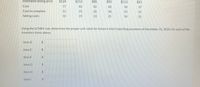

Transcribed Image Text:Nash Company uses the LCNRV method, on an individual-item basis, in pricing its inventory items. The inventory at December 31,

2020, consists of products D, E, F, G, H, and I. Relevant per unit data for these products appear below.

Item D

Item E

Item F

Item G

Item H

Item I

Estimated selling price

$124

$113

$98

$93

$113

$93

Cost

77

82

82

82

52

37

Cost to complete

31

31

26

36

31

31

Selling costs

10

19

10

21

10

21

Using the LCNRV rule, determine the proper unit value for balance sheet reporting purposes at December 31, 2020, for each of the

inventory items above.

Item D

%24

Item E

%$4

Item F

24

Item G

%24

Item H

%24

Transcribed Image Text:Estimated selling price

$124

$113

$98

$93

$113

$93

Cost

77

82

82

82

52

37

Cost to complete

31

31

26

36

31

31

Selling costs

10

19

10

21

10

21

Using the LCNRV rule, determine the proper unit value for balance sheet reporting purposes at December 31, 2020, for each of the

inventory items above.

Item D

24

Item E

24

Item F

Item G

$4

Item H

Item I

%24

%24

%24

%24

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- ll.arrow_forwardPerpetual Inventory Using Weighted Average Beginning inventory, purchases, and sales for J101 are as follows: Oct. 1 Inventory 480 units at $14 13 Sale 280 units 22 Purchase 600 units at $16 29 Sale 450 units a. Assuming a perpetual inventory system and using the weighted average method, determine the weighted average unit cost after the October 22 purchase. Round your answer to two decimal places. per unit b. Assuming a perpetual inventory system and using the weighted average method, determine the cost of the merchandise sold on October 29. Round your "average unit cost" to two decimal places. c. Assuming a perpetual inventory system and using the weighted average method, determine the inventory on October 31. Round your "average unit cost" to two decimal places.arrow_forwardPerpetual Inventory Using LIFO Beginning inventory, purchases, and sales for Item 88-HX are as follows: Oct. 1 Inventory 88 units @ $27 8. Sale 70 units 15 Purchase 98 units @ $29 27 Sale 82 units Assuming a perpetual inventory system and using the last-in, first-out (LIFO) method, determine (a) the cost of goods sold on Oct. 27 and (b) the inventory on Oct. 31. a. Cost of goods sold on Oct. 27 b. Inventory on Oct. 31 $arrow_forward

- Please answer completely required a1and a2arrow_forwardAL LUSE AL RELdi Beginning inventory Net purchases $127, 600 231,240 $256, 800 393, 600 Assume that in addition to estimating its ending Inventory by the retall method, Harmony Co. also took a physical Iinventory at the marked selling prices of the Inventory Items at the end of 2020. Assume further that the total of this physical Inventory at marked selling prices was $109,200. a. Determine the amount of this Inventory at cost. (Round your intermedlete calculatlons and final answer to 2 decimal places.) Inventory at cost b. Determine Harmony's 2020 Inventory shrinkage from breakage, theft, or other causes at retall and at cost. (Round your Intermedlate calculatlons and final answers to 2 decimal places.) At Cost At Retail Estimated inventory that should have been on hand Physical inventory Inventory shrinkagearrow_forwardSh15arrow_forward

- Please help mearrow_forwardPlease do not give solution in image format thankuarrow_forwardQuestion 2 Grouper Company began operations on January 1, 2018, and uses the average-cost method of pricing inventory. Management is contemplating a change in inventory methods for 2021. The following information is available for the years 2018-2020. 2018 2019 2020 Net Income Computed Using Average-Cost Method FIFO Method $15,910 $19.060 21,170 25,200 2018 (a) Prepare the journal entry necessary to record a change from the average cost method to the FIFO method in 2021. (Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter O for the amounts.) Account Titles and Explanation 2019 18,170 $ 19,880 $ (b) Determine net income to be reported for 2018, 2019, and 2020, after giving effect to the change in accounting principle. 2020 $ LIFO Method $12,010 14,110 17,040 Net Income Debit Account Titles and Explanation Credit (c) Assume Grouper Company used the LIFO method instead…arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education