Financial Accounting: The Impact on Decision Makers

10th Edition

ISBN: 9781305654174

Author: Gary A. Porter, Curtis L. Norton

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Question

thumb_up100%

Financial accounting q-29

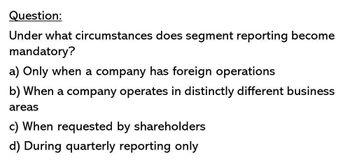

Transcribed Image Text:Question:

Under what circumstances does segment reporting become

mandatory?

a) Only when a company has foreign operations

b) When a company operates in distinctly different business

areas

c) When requested by shareholders

d) During quarterly reporting only

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Which of the following statements is true regarding interim reporting for companies that prepare their financial statements in accordance with IFRS? * • Interim reports are required on a quarterly basis. • Interim reports are not required for IFRS reporting. • The discrete view is required for interim financial statements. • Interim reports require the preparation of only a statement of earnings and a statement of financial position.arrow_forwardRequirement Referring to the qualitative characteristics of accounting information, indicate the fundamental characteristic (relevance or representationally faithful) and its related attribute (confirmatory value, completeness, materiality, neutrality, or predictive value) for each of the following uses of accounting information. Use of Accounting Information This year's reported earnings per share is a. $.50 below analysts' forecasts Potential creditors review a company's long- term liabilities footnote to determine that b. entity's ability to assume additional debt. A corporation discloses both favorable and unfavorable tax settlements. C. A company discloses the write-off of an accounts receivable. The receivable due from a major customer accounts for 35% of the d. company's current assets. A financial analyst computes a company's five-year average cost of goods sold in order e. to forecast next year's profit margin. ***** Fundamental Characteristic Attributearrow_forwardExamine Note 4.1.1 of AF’s annual report. What accounting principles were used toprepare AF’s financial statements? Under those accounting principles, could AF’sfinancial information differ from that of a company that exactly followed IFRS aspublished by the IASB? Explain.arrow_forward

- 13...Various types of accounting changes can affect the financial statements of a business enterprise differently. Assume that the following list describes changes that have a material effect on the financial statements for the current year of your business enterprise.Identify the type of change that is described in each item above and indicate whether the prior year’s financial statements should be recast when presented in comparative form with the current year’s financial statements. 1. A change from the completed-contract method to the percentage-of-completion method of accounting for long-term construction-type contracts. 2. A change in the estimated useful life of previously recorded fixed assets as a result of newly acquired information.…arrow_forwardEntities should disclose all of the following in interim financial report, except: a. Basic and diluted earnings per share b. Change in accounting policy c. Events after the end of reporting period d. Seasonal revenue, cost or expensesarrow_forward_______ accounting standards require companies to group items within OCI based on __________: U.S. GAAP; whether they will be reclassified subsequently into net income or whether they will be subsequently reclassified into income when specific conditions are met. IFRS; whether they will be reclassified subsequently into net income or whether they will be subsequently reclassified into income when specific conditions are met. U.S. GAAP; their expected future categorization on the income statement into income from continuing operations and discontinued operations. IFRS; their expected future categorization on the income statement into income from continuing operations and discontinued operations.arrow_forward

- Answer with explanation & give short summaryarrow_forwardGive explanation of Questionarrow_forward5.) For each definition, list the “ratio category (or grouping)” that is described by filling in the blanks from (a) to (f) and provide one example for each category or grouping. a) Determines a company’s ability to pay off short term obligations or debts as they come due. ________________________ b) Relates company’s internal performance to the external judgment of the marketplace in terms of what it is worth. ________________________ c) Identifies percentage of earnings paid out to shareholders and what is reinvested for internal growth. ________________________ d) Speed at which company turns over its inventory, receivables and long-term assets. ________________________ e) How a company is financed between debt [lenders] and equity [owners]. ________________________ f) Measures return on sales, assets and total capital. ________________________arrow_forward

- In the event of a change in the functional currency, is a company required to restate previously issued financial statements in terms of the new financial currency? Are measurement ring gains and losses considered to be extraordinary items? Also respond to the posting of at least one of your classmates.arrow_forwardInterim reporting under IFRS:(a) is prepared using the discrete approach.(b) is prepared using a combination of the discrete and integral approach.(c) requires a complete set of financial statements for each interim period.(d) permits companies to omit disclosure of material events subsequent to the interim reporting date.arrow_forwardQ025: Which accounting concept requires that financial statements reflect the assumption that the business will continue operating indefinitely? A) Economic Entity Assumption B) Going Concern Assumption C) Monetary Unit Assumption D) Periodicity Assumptionarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning

Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage LearningPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage LearningPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College Auditing: A Risk Based-Approach (MindTap Course L...AccountingISBN:9781337619455Author:Karla M Johnstone, Audrey A. Gramling, Larry E. RittenbergPublisher:Cengage Learning

Auditing: A Risk Based-Approach (MindTap Course L...AccountingISBN:9781337619455Author:Karla M Johnstone, Audrey A. Gramling, Larry E. RittenbergPublisher:Cengage Learning

Financial Accounting: The Impact on Decision Make...

Accounting

ISBN:9781305654174

Author:Gary A. Porter, Curtis L. Norton

Publisher:Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:9781947172685

Author:OpenStax

Publisher:OpenStax College

Auditing: A Risk Based-Approach (MindTap Course L...

Accounting

ISBN:9781337619455

Author:Karla M Johnstone, Audrey A. Gramling, Larry E. Rittenberg

Publisher:Cengage Learning