Entrepreneurial Finance

6th Edition

ISBN: 9781337635653

Author: Leach

Publisher: Cengage

expand_more

expand_more

format_list_bulleted

Question

Provide correct answer the accounting question

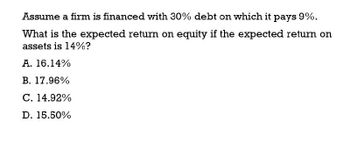

Transcribed Image Text:Assume a firm is financed with 30% debt on which it pays 9%.

What is the expected return on equity if the expected return on

assets is 14%?

A. 16.14%

B. 17.96%

C. 14.92%

D. 15.50%

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- The assets of company X have a beta equal to 1. Assume that the company's debt has a beta equal to 0.5 and that X's equity has a beta equal to 2. Consider an investor who holds 10% of the company's total debt liabilities and 10% of the company's equity. The beta of the investor's portfolio is equal to A) 0.1 B)1 C) 0.25 D) 1.25arrow_forwardThe asset of company X have a beta equal to 1. Assume that company’s debt has a beta to 0.5 and that X’s equity has a Beta equal to 2, consider an investor who holds 10% of company’s debt and 10% of the company’s equity, the beta of the investor’s portfolio is equal to? A. 0.25 B. 1 C. 1.25 D. 0.1arrow_forwardAssume a firm is financed with $1000 debt that has a market beta of 0.4 and $3000 equity. The risk -free rate is 3%, the equity premium is 6%, and the firmʹs overall cost of capital is 11%. What is the expected return on the firmʹs debt? Group of answer choices 5.4% 4.5% 6.0% 3.0%arrow_forward

- Given the following calculate the Cost of Equity. Beta Equity Risk Premium Pre-tax Yield on Debt Return on the Bond Market Return on the Stock Market Risk Free Rate Tax Weight of Debt in the Total Capital Structure Weight of Equity in the Total Capital Structure 1.5 5.5% 6.0% 4.5% 8.0% 2.5% 25.0% 25.0% 75.0%arrow_forwardwhat is the cost of Equity of KDP? Beta: 68 market risk premium:5.08% 3 month treasury yield: 5.34 % 10 year treasury yield: 4.27%arrow_forwardM12-15. Estimating Cost of Equity Capital Assume that a company’s market beta equals 0.6, the risk-free rate is 5%, and the market return equals 13%. Compute the company’s cost of equity capital. Round answer to one decimal place (ex: 0.0245 = 2.5%) Answer%arrow_forward

- 11. With risk-free rate of 5%, Beta of 1.5, market return of 8%, prevailing credit spread of 3%, tax rate of 30% and Equity ratio of 30%, compute for the weighted average cost of capital. a. 6.00% b. 6.77% c. 7.00% d. 7.77%arrow_forwardWhich of the following is the better option for an average firm? A. A debt ratio = 30% and a timed interest earned 15. B. A debt ratio = 80% and a timed interest earned = 8. C. A debt ratio 60% and a timed interest earned = 2. D. A debt ratio = 10% and a timed interest earned = 7. - =arrow_forwardSuppose TRF = 5%, M = 12%, and b; = 0.75, what is the cost of equity? 5.00% 10.25% 12.00% 6.00%arrow_forward

- Below, inputs have been arrived for the XYZ company. Using CAPM calculate its cost of equity. (Observe 2 decimal places)arrow_forwardConsider the following average annual returns: Investment Average Return 23.4% Small Stocks S&P 500 13.7% 7.4% Corporate Bonds Treasure Bonds Treasury Bills What is the excess return for corporate bonds? O A. 0% B. 3.1% C. 6.2% O D. 1.6% 6.1% 4.3%arrow_forwardCalculate the cost of equity capital using CAPM if the risk - free rate of interest is 4 per cent, the return on the market portfolio is 8 per cent, the beta of the firm's assets is .8 and the and beta of equity is 1.2. Provide your answer as a percentage to two decimal places (15.32% should be entered as 15.32). Do not enter the % signarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you