FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

Instructions:

1. Prepare the

2. Prepaid an adjusted trial balance at June 30, 2025.

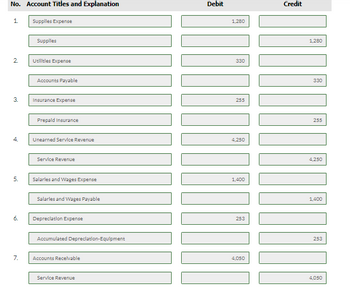

Transcribed Image Text:No. Account Titles and Explanation

1

2

3.

4.

5.

6.

7.

Supplies Expense

Supplies

Utilitles Expense

Accounts Payable

Insurance Expense

Prepaid Insurance

Unearned Service Revenue

Service Revenue

Salarles and Wages Expense

Salarles and Wages Payable

Depreciation Expense

Accumulated Depreciation-Equipment

Accounts Receivable

Service Revenue

Debit

1,280

330

255

4,250

1,400

.....

.....

253

Credit

4,050

1,280

3:30

255

4,250

1,400

253

4,050

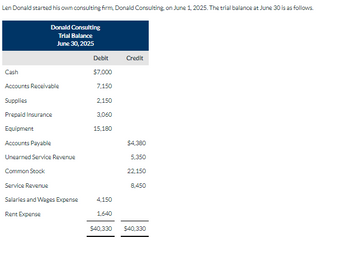

Transcribed Image Text:Len Donald started his own consulting firm, Donald Consulting, on June 1, 2025. The trial balance at June 30 is as follows.

Cash

Donald Consulting

Trial Balance

June 30, 2025

Accounts Receivable

Supplies

Prepaid Insurance

Equipment

Accounts Payable

Unearned Service Revenue

Common Stock

Service Revenue

Salaries and Wages Expense

Rent Expense

Debit

$7,000

7,150

2,150

3,060

15,180

4,150

1,640

Credit

$4,380

5,350

22,150

8,450

$40,330 $40,330

Expert Solution

arrow_forward

Explanation -

1. T-Accounts -

T-Accounts are ledgers prepared for an individual ledger account. Ledgers are prepared to record all the journals into specific ledgers and take out the ending balance to prepared trial balance.

2. Adjusted Trial Balance -

Adjusted trial balance is a statement that includes ending balance of all the ledgers.

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- use the following adjusted. trial balance to prepare the classified balance sheet for Nu2U for June 30, 2021. Nu2U, Inc. Adjusted Trial Balance At June 30, 2021 (in thousands) Accounts title Debit Credit Cash $ 102 Accounts receivable 40 Supplies 23 Prepaid insurance 15 land 288 buildings and equipment 450 Accumulated depreciation 63 trademark 65 account payable 35 accrued liabilities 15 unearned revenue 66 long-term-mortgage note payable 125 common stock 350 retained earnings, 07/01/20 324 dividends 45 commission revenue 475 wages expenses 160 supplies expenses 27 depreciation expenses 97 general and administrative expenses 102 interest expense 32 income tax expense 7 totals $1,453 $1,453arrow_forwardEnter the adjusted balances in the T-accounts.2. Write the closing entries on a journal page. Number each journal entry (e.g., CJE-1) and use proper form.arrow_forwardCrane Company Ltd. publishes a monthly sports magazine, Fishing Preview. Subscriptions to the magazine cost $28 per year. During November 2022, Crane sells 5,400 subscriptions for cash, beginning with the December issue. Crane prepares financial statements quarterly and recognizes subscription revenue at the end of the quarter. The company uses the accounts Unearned Subscription Revenue and Subscription Revenue. The company has a December 31 year-end.arrow_forward

- Please Answer In Excel Sheet....!arrow_forwardI need help with this practice problem. Put the balances from the adjusted trial balance into the T accountsCreate properly formatted income statement and balance sheet for the year and the balance sheet as of 12/31.Create the closing entries.Post the results of the closing entries into the T accountDraw off balances for the T accounts.Create the post-closing trial balancearrow_forwardAt December 31, 2021, Skysong, Inc. reported this information on its balance sheet. Accounts receivable Less: Allowance for doubtful accounts During 2022, the company had the following transactions related to receivables. 1. 2. 3. 4. 5. $630,000 41,000 Sales on account Sales returns and allowances Collections of accounts receivable Write-offs of accounts receivable deemed uncollectible Recovery of bad debts previously written off as uncollectible $2,669.000 54,000 2,056,000 41,000 17,000arrow_forward

- Carla Vista Corporation has the following selected transactions during the year ended December 31, 2024: Jan. 1 Purchased a copyright for $117.480 cash. The copyright has a useful life of six years and a remaining legal life of 30 years. Mar. 1 Sept. 1 Dec. 31 Acquired a franchise with a contract period of nine years for $500,850; the expiration date is March 1, 2033, Paid cash of $38,820 and borrowed the remainder from the bank. Purchased a trademark with an indefinite life for $73,190 cash. As the purchase was being finalized, spent $33.150 cash in legal fees to successfully defend the trademark in court. Purchased an advertising agency for $640,000 cash. The agency's only assets reported on its statement of financial position immediately before the purchase were accounts receivable of $58,000, furniture of $170,000, and leasehold improvements of $320,000. Carla Vista hired an independent appraiser who estimated that the fair value of these assets was accounts receivable $58,000,…arrow_forwardRequirement 1. Journalize the adjusting entries using the letter and March 31 date in the date column. (Record debits first, then able. Check your spelling carefully and do not abbreviate. Use the account names provided in the problem.) a. Service revenue accrued, $600. Date (a) Mar. 31 Accounts and Explanation Debit Creditarrow_forwardPlease do not give image formatarrow_forward

- Required information [The following information applies to the questions displayed below.] On January 1, 2024, the general ledger of ACME Fireworks includes the following account balances: Accounts Cash Accounts Receivable Allowance for Uncollectible Accounts Inventory Land Equipment Accumulated Depreciation Accounts Payable Notes Payable (68, due April 1, 2025) Common Stock Retained Earnings. Totals Debit $27,000 50,000 21,900 65,000 24,500 3. Prepare an adjusted trial balance as of January 31, 2024. $188,400 Credit $6,100 3,400 30,400 69,000 54,000 25,500 $188,400 During January 2024, the following transactions occur: January 2 Sold gift cards totaling $11,800. The cards are redeemable for merchandise within one year of the purchase date. January 6 Purchase additional inventory on account, $166,000. ACME uses the perpetual inventory system. January 15 Firework sales for the first half of the month total $154,000. All of these sales are on account. The cost of the units sold in…arrow_forwardOn July 15, 2024, the Niche Car Company purchased 2,800 tires from the Treadwell Company for $35 each. The terms of the sale were 2/10, ¹/30 . Niche uses a perpetual inventory system and the net method of accounting for purchase discounts.arrow_forwardCan you please show me how to do the worksheet including the trial balance, adjustments, adjusted trial balance, income statement, and balance sheet. with the figures below the unadjusted trial balance should come equal $47,094. Adjustment column should be $4,040, and adjusted trial balance should equal $48,439. Please guide me in right direction. arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education