FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

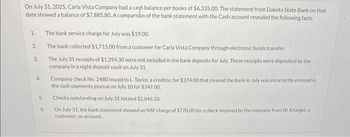

Transcribed Image Text:On July 31, 2025, Carla Vista Company had a cash balance per books of $6,335.00. The statement from Dakota State Bank on that

date showed a balance of $7,885,80. A comparison of the bank statement with the Cash account revealed the following facts.

1.

2.

3.

4.

5.

6.

The bank service charge for July was $19.00.

The bank collected $1.715.00 from a customer for Carla Vista Company through electronic funds transfer.

The July 31 receipts of $1,394,30 were not included in the bank deposits for July. These receipts were deposited by the

company in a night deposit vault on July 31.

Company check No. 2480 issued to L. Taylor, a creditor, for $374.00 that cleared the bank in July was incorrectly entered in

the cash payments journal on July 10 for $347.00.

Checks outstanding on July 31 totaled $2,046.10.

On July 31, the bank statement showed an NSF charge of $770.00 for a check received by the company from W. Krueger, a

customer, on account.

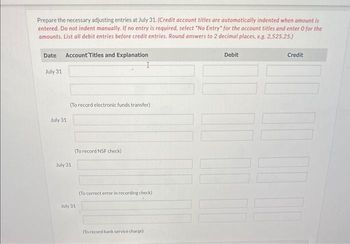

Transcribed Image Text:Prepare the necessary adjusting entries at July 31. (Credit account titles are automatically indented when amount is

entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter 0 for the

amounts, List all debit entries before credit entries. Round answers to 2 decimal places, e.g. 2,525.25.)

Date Account Titles and Explanation

July 31

July 31

(To record electronic funds transfer)

July 31

(To record NSF check)

July 31

(To correct error in recording check)

(To record bank service charge)

Debit

Credit

DO D

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Please help me fill out this bank reconciliation showing the true cash balance.arrow_forwardOn July 31, 2022, Metlock Company had a cash balance per books of $6,280.00. The statement from Dakota State Bank on that date showed a balance of $7,830.80. A comparison of the bank statement with the Cash account revealed the following facts. 1. The bank service charge for July was $22.00. 2. The bank collected $1,660.00 for Metlock through electronic funds transfer. 3. The July 31 cash receipts of $1,336.30 were not included in the bank statement for July. These receipts were deposited by the company in a night deposit vault on July 31. 4. 5. Company check No. 2480 issued to L. Taylor, a creditor, for $364.00 that cleared the bank in July was incorrectly recorded as a cash payment on July 10 for $346.00. Checks outstanding on July 31 totaled $1,982.10. 6. On July 31, the bank statement showed an NSF charge of $715.00 for a check received by the company from W. Krueger, a customer, on account.arrow_forwardBrangelina Adoption Agency's general ledger shows a cash balance of $4,586. The balance of cash in the March-end bank statement is $7,331. A review of the bank statement reveals the following information: checks outstanding of $2,796, bank service fees of $78, and interest earned of $27. Calculate the correct balance of cash at the end of March. (Amounts to be deducted should be indicated with a minus sign.)arrow_forward

- On June 30, 2019, Wally Company's bank statement showed a $7,500.10 bank balance. Wally has a beginning checkbook balance of $9,800.00. The bank statement also showed that it collected a $1,200.50 note for the company. A $4,500.10 June 30 deposit was in transit. Check No. 119 for $650.20 and check No. 130 for $381.50 are outstanding. Wally's bank charges $.40 cents per check. This month, 80 checks were processed. Prepare a reconciled statement. (Round your answers to the nearest cent.) Checkbook balance Wally's checkbook balance Add: Deduct: Reconciled balance WALLY COMPANY Bank Reconciliation as of June 30, 2019 Bank balance Add: Deduct: Reconciled balance Bank balancearrow_forwardBourne Incorporated reports a cash balance at the end of the month of $2,620. A comparison of the company's cash records with the monthly bank statement reveals several additional cash transactions: bank service fees ($85), an NSF check from a customer ($350), a customer’s note receivable collected by the bank ($1,000), and interest earned ($35). Required: Record the necessary entries to adjust the balance of cash.arrow_forwardThe Cash account of Gate City Security Systems reported a balance of $2,490 at December 31, 2024. There were outstanding checks totaling $1,000 and a December 31 deposit in transit of $300. The bank statement, which came from Tri Cities Bank, listed the December 31 balance of $3,810. Included in the bank balance was a collection of $630 on account from Nicole Lee, a Gate City customer who pays the bank directly. The bank statement also shows a $20 service charge and $10 of interest revenue that Gate City earned on its bank balance. Prepare Gate City's bank reconciliation at December 31. Gate City Security Systems Bank Reconciliation December 31, 2024 Bank: Balance, December 31, 2024 ADD: LESS Adjusted bank balance, December 31, 2024 Book: Balance, December 31, 2024 ADD: LESS Adjusted book balance, December 31, 2024arrow_forward

- On April 3, Erin Gardner received her bank statement showing a balance of $2,086.93. Her checkbook showed a balance of $1,912.47. Outstanding checks were $234.15, $317.80, $78.10, $132.42, and $212.67. The account earned $20.43. Deposits in transit amount to $814.11, and there is a service charge of $7.00. Use the form below to calculate the reconciled balance. CHECKBOOK BALANCE Add: Interest Earned & Other Credits SUBTOTAL Deduct: Service Charges & Other Debits ADJUSTED CHECKBOOK BALANCE tA ta ta ta tA STATEMENT BALANCE Add: Deposits in Transit SUBTOTAL Deduct: Outstanding Checks LA tA ·SA $ LA ADJUSTED STATEMENT BALANCE $ LA Earrow_forwardThe Cash account of ReeseCorporation had a balance of $3,540 at October 31, 2018. Included were outstanding checkstotaling $1,800 and an October 31 deposit of $300 that did not appear on the bank statement.The bank statement, which came from Turnstone State Bank, listed an October 31 balance of$5,570. Included in the bank balance was an October 30 collection of $600 on account froma customer who pays the bank directly. The bank statement also showed a $30 service charge,$10 of interest revenue that Reese earned on its bank balance, and an NSF check for $50.Prepare a bank reconciliation to determine how much cash Reese actually had at October 31.arrow_forwardUsing the following information, prepare a bank reconciliation for Cole Co. for May 31 of the current year: (a) The bank statement balance is $3,012. (b) The cash account balance is $3,165. (c) Outstanding checks amounted to $590. (d) Deposits in transit are $704. (e) The bank service charge is $30. (f) A check for $76 for supplies was recorded as $67 in the ledger.arrow_forward

- Bourne Incorporated reports a cash balance at the end of the month of $2,620. A comparison of the company's cash records with the monthly bank statement reveals several additional cash transactions: bank service fees ($85), an NSF check from a customer ($350), a customer’s note receivable collected by the bank ($1,000), and interest earned ($35). Required: Record the necessary entries to adjust the balance of cash. (If no entry is required for a particular transaction/event, select "No Journal Entry Required" in the first account field.) 2 Service Fee Expense selected answer correct 85 selected answer correct Notes receivable incorrect answer please help me finish the problem i keep getting stuck. Its not -85 for credit and its not -35 so what is itarrow_forwardUsing the following information: The bank statement balance is $3,718. The cash account balance is $4,086. Outstanding checks amounted to $866. Deposits in transit are $1,177. The bank service charge is $48. A check for $78 for supplies was recorded as $69 in the ledger. Prepare a bank reconciliation for Candace Co. for May 31.arrow_forwardNeed help with this Questionarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education