FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

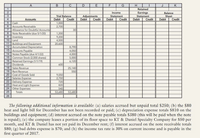

Devlin Company has prepared following partially completed worksheet for the year ended December 31, 2019:

1. Complete the worksheet. (Round to the nearest dollar.)

2. Prepar company's financial statements.

3. Prepare (a) adjusting and (b ) closing entries in the general journal.

Transcribed Image Text:A

D

F.

H.

Retained

Earnings

Statement

Debit

J

K

Income

Balance

Sheet

Debit

3

Trial Balance

Adjustments

Statement

Debit

Credit

4

Accounts

Debit

Credit

Debit

Credit

Credit

Credit

1,000

2,700

Cash

6

Accounts Receivable

Allowance for Doubtful Accounts

Note Receivable (due 5/1/20)

Inventory

10 Land

11 Buildings and Equipment

12 Accumulated Depreciation

13 Accounts Payable

14 Notes Payable (due 4/1/22)

15 Common Stock (2,000 shares)

16

30

1,200

9,200

4,500

20,600

8,790

4,050

4,000

5,000

6,120

Retained Earnings (1/1/19)

17 Dividends

18 Sales Revenue

19 | Rent Revenue

20

600

25,140

550

9,050

2,750

Cost of Goods Sold

21 Salaries Expense

22 Delivery Expense

23 Heat and Light Expense

Other Expenses

720

820

24

540

25

Totals

53,680

53,680

26

The following additional information is available: (a) salaries accrued but unpaid total $250; (b) the $80

heat and light bill for December has not been recorded or paid; (c) depreciation expense totals $810 on the

buildings and equipment; (d) interest accrued on the note payable totals $380 (this will be paid when the note

is repaid); (e) the company leases a portion of its floor space to KT & Daniel Specialty Company for $50 per

month, and KT & Daniel has not yet paid its December rent; (f) interest accrued on the note receivable totals

$80; (g) bad debts expense is $70; and (h) the income tax rate is 30% on current income and is payable in the

first quarter of 2017.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 6 steps with 7 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- On September 18, 2019, Afton Company purchased $2,475 of supplies on account. In Afton Company’s chart of accounts, the supplies account is No. 15, and the accounts payable account is No. 21.a. Journalize the September 18, 2019, transaction on page 87 of Afton Company’s twocolumn journal. Include an explanation of the entry.b. Prepare a four-column account for Supplies. Enter a debit balance of $840 as of September 1, 2019. Place a check mark (¸) in the Posting Reference column.c. Prepare a four-column account for Accounts Payable. Enter a credit balance of $10,900 as of September 1, 2019. Place a check mark (¸) in the Posting Reference column.d. Post the September 18, 2019, transaction to the accounts.e. Do the rules of debit and credit apply to all companies?arrow_forwardAssume TriTeal made the appropriate adjusting entries at the end of June. The events listed below occurred during the month of July. Please provide the journal entry(ies) TriTeal used (if any) to record each transaction. On July 15, TriTeal paid its sales staff $10,000 in commissions related to sales which were recognized in June.arrow_forwardBrokeback Towing Company is at the end of its accounting year, December 31, 2021. The following data that must be considered were developed from the company’s records and related documents: On July 1, 2021, a two-year insurance premium on equipment in the amount of $820 was paid and debited in full to Prepaid Insurance on that date. Coverage began on July 1. At the end of 2021, the unadjusted balance in the Supplies account was $1,220. A physical count of supplies on December 31, 2021, indicated supplies costing $410 were still on hand. On December 31, 2021, YY’s Garage completed repairs on one of Brokeback’s trucks at a cost of $910. The amount is not yet recorded. It will be paid during January 2022. On December 31, 2021, the company completed a contract for an out-of-state company for $8,060 payable by the customer within 30 days. No cash has been collected and no journal entry has been made for this transaction. On July 1, 2021, the company purchased a new hauling van.…arrow_forward

- Alert Security Services Co. offers security services to business clients. The trial balance for Alert Security Services Co. has been prepared on the following end-or- period spreadsheet for the year ended Octaber 31, 2019. In addition, the data for year-end adjustments are as follows: a. Fees earned, but not yet billed, $13. b. Supplies on hand, $4. C. Insurance premiums expired, $10. d. Depreciation expense, $3. e. Wages accrued, but not paid, $1. Enter the adjustment data, and place the balances in the Adjusted Trial Balance columns. If a box does not require an entry, leave it blank. Alert Security Services Co. End-of-Period Spreadsheet (Work Sheet) For the Year Ended October 31, 2019 Adjusted Trial Balance Credit Unadjusted Trial Unadjusted Trial Adjustments Adjustments Adjusted Trial Account Title Balance Debit Balance Credit Debit Credit Balance Debit Cash 12 Accounts 90 Receivable Supplies B paid Insurance 12 Land 190 Equipment 50 Accum. Depr.- Equiomentarrow_forwardOn December 31, 2019, $700of salaries has been accrued. (Salaries before accrued amount totaled $29,000.) The next payroll to be paid will be on February 3, 2020, for $7,500.Do the following: a. Journalize and post the adjusting entry (use T accounts). b. Journalize and post the reversing entry on January 1. c. Journalize and post the payment of the payroll. Cash has a balance of $16,000 before the payment of payroll on February 3, 2020. (Record debits first, then credits. Exclude explanations from journal entries.)arrow_forwardOn November 1, Year 1, a company borrows $49,000 cash from Community Savings and Loan. The company signs a three-month, 6% note payable. Interest is payable at maturity. The company's year-end is December 31. Required: 1.-3. Record the necessary entries in the Journal Entry Worksheet below. (If no entry is required for a particular transaction/event, select "No Journal Entry Required" in the first account field.) View transaction list Journal entry worksheet Record the repayment of the note at maturity. Note: Enter debits before credits. Date General Journal Debit Credit February 01arrow_forward

- Please see below. I need help with this asap please and thank you.arrow_forwardRecord the following in the adjustment journal template then post it to the T-accounts. additional information for adjustments for December 31, 2021. a. Unexpired prepaid rent is $1,000. b. The annual prepaid insurance was paid Nov. 1 $2,500. Record the expired portion. c. Cleaning supplies on hand, $3,200. d. Depreciation expense office equipment, $110. e. Cleaning Equipment original cost $12,000 with a residual value $800, useful life is 5 years. Record the annual depreciation expense. f. Record the vehicle depreciation expense $280. g. Accrued wages $ 950.arrow_forwardEdge Co., a toy manufacturer, is in the process of preparing its financial statements for the year ended December 31, Year 8. Edge expects to issue its Year 8 financial statements on March 1, Year 9. For each item, two responses are required. Select from the option lists provided the appropriate adjustment amount, if any, and whether additional disclosure is required, either on the face of or in the notes for each financial statement below. Each choice may be used once, more than once, or not at all. If no adjustment is necessary, select "No entry required" in the Adjusted amount column and continue to the Additional disclosure required column. Show Transcribed Text 5. On January 30, Year 9, Edge issued $10 million bonds at a premium of $500,000. 6. On February 4, Year 8, the IRS assessed Edge an additional $400,000 for the Year 4 tax year. Edge's tax attorneys and tax accountants have stated that it is likely that the IRS will agree to a $100,000 settlement. C !!!!arrow_forward

- The journal entry to close the Fees Earned, $750, and Rent Revenue, $175, accounts during the year-end closing process would involve:arrow_forwardA company begins 2022 (1/1/2022) with $0 of supplies. During the year the company purchases $5 of supplies. If the company reports $4 of supplies expense, what is the supplies inventory reported on the 2022 balance sheet at the end of the year (12/31/2022). (Hint make a T account and make the journal entries.)arrow_forwardThe Piper Ventura Illustrators presented the following information pertaining to accounts that will need adjustments for its Nov. 30, 2021, year-end financial statements.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education