FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

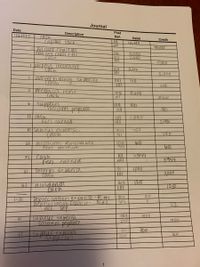

Can you please show me how to do the worksheet including the trial balance , adjustments, adjusted trial balance, income statement, and balance sheet . with the figures below the unadjusted trial balance should come equal $47,094. Adjustment column should be $4,040, and adjusted trial balance should equal $48,439. Please guide me in right direction.

Transcribed Image Text:Journal

Post

Date

Description

Uitiy expeN su

|-31

Ref.

Debit

Credit

sob

204

405

405

31

In Surcance

EXpense

SoS

215

215

Tnt expens

prepa la vent

502

105

700

700

Transcribed Image Text:Journal

Date

Description

Post

Ref.

Debit

Credit

capiral sack

y0,00 0

40,000

barper cha EL

Ear ber chaMI#2

110

12

3,000

2400

brepald INGrance

106

3,300

3,300

2 adver

110

101

T10

2 brepaia rent

Cach

8400

101

8400

supplres

acounts payaae

104.

201

410

2,880

Fers earnd

2,080

19aares

S0l

956

accounts Receiva lole

Fees earmed

21

102

60

cash

Fees carnid

31

40

3944

3p00

101

31

casn

3000

303

125

31

aiiaenas

125

101

SOy

20

-31

lation Ex pen se - BC #I

22

acc

501

202

900

salarces expense

salanes payakel

31

300

suppies.cxpenfe

suppices

50

300

104

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- The revenues and expenses of Paradise Travel Service for the year ended May 31, 2018, follow: Accounts (revenue and expense items) Fees earned $742,000 Office expense 309,000 Miscellaneous expense 12,000 Wages expense 461,000 Prepare an income statement for the year ended May 31, 2018. Refer to the lists of Accounts in the information given, Labels, and Amount Descriptions for the exact wording of the answer choices for text entries. Be sure to complete the statement heading. A colon (:) will automatically appear if it is required. If a net loss is incurred, enter that amount as a negative number using a minus sign. Labels and Amount Descriptions Labels Expenses For the Year Ended May 31, 2018 May 31, 2018 Amount Descriptions Net income Net loss Total expenses Income Statement Prepare an income statement for the year ended May 31, 2018. Refer to the lists of Accounts in the…arrow_forwardThe spreadsheet is O a. used to aid in preparing financial statements. O b. used to determine net income or loss. O c. used to summarize the effects of adjusting entries. O d. used to determine amounts recorded in the unadjusted trial balance.arrow_forwardplease answer within the format by providing formula the detailed workingPlease provide answer in text (Without image)Please provide answer in text (Without image)Please provide answer in text (Without image) ABC Consulting is a company that provides consulting services to clients in various industries. The following are the balances taken from the trial balance: ABC Trial Balance 31/12/2022 Account Debit (SAR) Credit (SAR) Cash 10,000 - Accounts Receivable 15,000 - Supplies 5,000 - Equipment 50,000 - Accumulated Depreciation - Equipment - 10,000 Accounts Payable - 8,000 Unearned Revenue - 12,000 Common Stock - 40,000 Dividends 5,000 - Service Revenue - 60,000 Salaries Expense 25,000 - Rent Expense 10,000 - Depreciation Expense 5,000 - Supplies Expense 3,000 - Interest Expense 2,000 - Total 130,000 130,000 Required: Prepare the income statement for the year ended 31 December 2022. Prepare the statement of retained earnings for the year…arrow_forward

- The transactions of Spade Company appear below. A. K. Spade, owner, invested $17,000 cash in the company in exchange for common stock. B. The company purchased supplies for $493 cash. C. The company purchased $ 9,401 of equipment on credit. D. The company received $2,006 cash for services provided to a customer. E. The company paid $9, 401 cash to settle the payable for the equipment purchased in transaction c. F. The company billed a customer $3,604 for services provided. G. The company paid $530 cash for the monthly rent. H. The company collected $1,514 cash as partial payment for the account receivable created in transaction f. I. The company paid a $900 cash dividend to the owner (sole shareholder). *fill out chart* HINT: Accounts must be listed in financial statement order: Assets first, followed by liabilities, equity, revenues, and expenses.arrow_forwardOn September 1, Cullumber Company has the following accounts and account balances: Cash $21,600, Accounts Receivable $2,480, Supplies $2,360, Accounts Payable $1,240, Unearned Revenue $1,980, Owner's Capital $19,880, Service Revenue $5,080, and Salaries Expense $1,740 During the month of September, the bookkeeper for Cullumber Company prepared the following journal entries: 1. 2. 3. 4. 5. Cash Service Revenue (To record cash received from services performed.) Salaries Expense Cash (Paid salaries to date.) Accounts Payable Cash (Paid creditors on account.) Cash Accounts Receivable (Received cash in payment of account.) Unearned Revenue Service Revenue (Provided services.) 6. Supplies Accounts Payable (To record supplies purchased on account.) 1,490 870 250 1,240 1,490 1.240 1,490 870 250 1,240 1,490 1,240 SUPPOarrow_forwardI need help with requirement one and two. however, I am only allowed to upload two images per question.  even though I already turned us and I want to learn how to do the calculations correctly for the future. arrow_forward

- In the blank space beside each account, enter the code for the financial statement column (IS or BS) where a normal account balance is extended. Use IS for the Income Statement column or BS for the Balance Sheet and Statement of Owner’s Equity column. a. Equipment b. Owner, Withdrawals c. Prepaid Rent d. Depreciation Expense e. Accounts Receivable f. Insurance Expense g. Supplies h. Rent Expense i. Casharrow_forwardPlease prepare a full trial balance – Trial Balance, Adjustments, Adjusted Trial Balance, Income Statement, Balance Sheet, and Statement of Owner’s Equity, as well the individual Balance Sheet, Income Statement, and Statement of Owners Equity. Include any journal entries necessary for this assignment. Use T accounts if you find them helpful.arrow_forwardThe trial balance section of the work sheet provides the information used in preparing the income statement. True or false?arrow_forward

- Use the information from the Adjusted Trial Balance and Financial Statement templates provided in the module under Test 2 information you completed to answer questions 36 - 50. (Also copied below.) For Question 36, how much revenue should be recorded on the Income Statement? Elliptical Consulting Adjusted Trial Balance For the Year Ended June 30, 2019 Account Title Debit Credit Cash 27,000 Accounts Receivable 53,500 Supplies 900 Office Equipment 30,500 Accumulated Depreciation – Office Equipment 6,000 Accounts Payable 3,300 Salaries Payable 375 Jayson Neese, Capital 82,200 Jayson Neese, Drawing 2,000 Fees Earned 60,000 Salary Expense 32,375 Supplies Expense 2,100 Depreciation Expense 1,500 Miscellaneous Expense 2,000 Totals 151,875 151,875 Notice that the accounts are listed in order of the accounting…arrow_forwardPlease see the picture below. This question utilizes excel. Please help with this.arrow_forwardThe balances for the accounts that follow appear in the Adjusted Trial Balance columns of the end-of-period spreadsheet. Indicate whether each account would flow into the income statement, statement of owner’s equity, or balance sheet.1. Accumulated Depreciation2. Cash3. Fees Earned4. Insurance Expense5. Prepaid Rent6. Supplies7. Tina Greer, Drawing8. Wages Expensearrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education