FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

State the entries in the

2020.

Enter the amounts including a +/- sign to note whether each balance increases/ decreases into

the following template on Moodle.

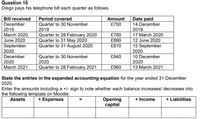

Transcribed Image Text:Question 10

Diego pays his telephone bill each quarter as follows:

Period covered

Date paid

14 December

Bill received

Amount

December

£750

Quarter to 30 November

2019

2019

March 2020

2019

Quarter to 29 February 2020

Quarter to 31 May 2020

Quarter to 31 August 2020

£780

17 March 2020

June 2020

£890

12 June 2020

September

2020

December

£810

15 September

2020

10 December

2020

Quarter to 30 November

£840

2020

2020

Quarter to 28 February 2021

March 2021

£960

13 March 2021

State the entries in the expanded accounting equation for the year ended 31 December

2020.

Enter the amounts including a +/- sign to note whether each balance increases/ decreases into

the following template on Moodle.

Assets

+ Expenses

Opening

capital

+ Liabilities

+ Income

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- . If the supplies account indicated a balance of $2,250 before adjustment on May 31 and supplies on hand at May 31 totaled $950, the adjustment would be: DATE DESCRIPTION DEBIT CREDITarrow_forwardInstructions X Income Statement Balance Sheet Journal spreadsheet, a part of which follows: 1. Prepare an income statement for the year ended June 30, 20Y3. Be sure to complete the 1. Prepare a balance sheet as of June 30, 20Y3. Fixed assets must be entered in order according to account number. Be sure 2. Based upon the end-of-period spreadsheet, joumalize the closing entries. Refer to the chart of accounts for the exact wording of the account titles. Finders Investigative Services statement heading. Refer to the Chart of Accounts and the list of Labels and Amount to complete the statement heading. Refer to the Chart of Accounts and the list of Labels and Amount Descriptions for the exact CNOW joumals do not use lines for joumal explanations. Every line on a joumal page used for debit or credit entries. CNOW joumals will automatically Descriptions for the exact wording of the answer choices for text entries. Enter amounts as wording of the answer choices for text entries. You will not…arrow_forwardUse the May 31 fiscal year-end information from the following ledger accounts (assume that all accounts have normal balances). Retained Earnings Date May 31 Dividends Date May 31 Services Revenue Date May 31 Depreciation Expense Date May 31 Required A 03 0% 3% 3% View transaction liet G2 Required B Transaction 2 Debit B Debit Record entry Debit Note: Enter debits before credits. Debit Journal entry worksheet Complete this questions by entering your answers in the tabs below. Prepare closing journal entries from the above ledger accounts. Account Number 318 Credit Balance Date 81,000 May 31 Number 319 Insurance Expense Balance 47.000 Account Credit Record the entry to close experise accounts. General Ledger Clear entry May 31 Account Number 403 Rent Expense Balance Date 142, 722 May 31 Income Summary Account Number 603 Credit Balance 21,000 Salarics Expense General Journal Date Debit (a) Prepare closing journal entries from the above ledger accounts. (b) Post the entries from…arrow_forward

- Use the following account T-balances (assume normal balances) and correct balance information to make the December 31 adjusting journal entries. Unearned Service Revenue: $24,000 T-Account Balance, $10,500 Correct Balance. Supplies: $8,500 T-Account Balance, $2,600 Correct Balance. Interest Payable: $2,400 T-Account Balance, $2,000 Correct Balance.arrow_forwardplease provide complete and correct answer and show all work like explanation , computation , formula with steps answer in text million thanksarrow_forwardWhy are adjusting entries needed at the end of each accounting period (like at month-end or at year-end)?arrow_forward

- Please Answer In Excel Sheet....!arrow_forwardList the two primary types of accounts found in the income statement. Provide the following information for each of the two accounts: Norm (normal) balance – debit or credit Balance at the beginning of the year Balance at the end of the year after the accounts are closedarrow_forwardThe following selected accounts and their current balances appear in the ledger of Maroon Co. for the fiscal year ended December 31, 2019. Accounts Payable 32,480 LT Note Payable 44,800 Misc. Administrative Accounts Receivable 96,800 1,280 Expense Misc. Selling Expense Office Equipment Office Salaries Expense Office Supplies Office Supplies Expense Paid-in Capital Prepaid Insurance Rent Expense Retained Earnings Accum Depr - Office Equip Accum Depr- Store Equip Advertising Expense 10,240 1,280 27,360 68,000 35,040 67,320 Cash 123,000 4,480 Common Stock 75,000 1,040 Cost of Goods Sold 620,000 52,000 Customer refunds Payable Depr Expense - Office Equip Depr Expense - Store Equip 12,000 2,720 25,080 301,600 1,920 992,000 10,160 5,120 Dividends 28,000 Salaries Payable Insurance Expense 3,120 Sales Sales salaries Expense 138,560 Interest Expense Inventory 4,000 140,000 Store Equipment 122,400 Maroon Co. has 10,000 shares of common stock authorized and 7,500 shares issued and outstanding…arrow_forward

- Can you please show me how to do the worksheet including the trial balance, adjustments, adjusted trial balance, income statement, and balance sheet. with the figures below the unadjusted trial balance should come equal $47,094. Adjustment column should be $4,040, and adjusted trial balance should equal $48,439. Please guide me in right direction. arrow_forwardPerformance Plastics Company (PPC) has been operating for three years. The beginning account balances are: $ 44, 500 9,050 61,500 7,900 5,650 82, 000 152,000 32,750 47,500 100,000 150,000 97,850 Cash Accounts Receivable Inventory Supplies Notes Receivable (due in three years) Equipment Buildings Land Accounts Payable Notes Payable (due in three years) Common Stock Retained Earnings During the year, the company had the following summarized activities: a. Purchased equipment that cost $25,350, paid $9,450 cash and signed a two-year note for the balance. b. Issued an additional 2,600 shares of common stock for $26,000 cash. c. Borrowed $61,000 cash from a local bank, payable June 30, in two years. d. Purchased supplies for $6,200 cash. e. Built an addition to the factory buildings for $69,750; paid $33,250 in cash and signed a three-year note for the balance. f. Hired a new president to start January 1 of next year. The contract was for $95,000 for each full year worked.arrow_forwardASAParrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education